NEW DELHI: The unprecedented economic crisis in Sri Lanka has intensified in the past few days.

Sri Lankan Prime Minister Mahinda Rajapaksa resigned on Monday after weeks of protests by people demanding the Rajapaksa brothers to step down.

Rajapaksa's spokesman Rohan Weliwita said the 76-year-old sent his letter of resignation to his younger brother, President Gotabaya Rajapaksa, clearing the way for a "new unity government".

Facing escalating anti-government protests, Rajapaksa's government last week declared a state of emergency for the second time in five weeks, but public discontent has steadily simmered.

Worst economic crisis since 1948

The Sri Lankan economy has been facing one of its worst ever economic crisis since its independence from Britain in 1948, resulting from mismanaged government finances and ill-timed tax cuts, besides the impact of the Covid-19 pandemic.

A severe shortage of foreign currency had left Rajapaksa's government unable to pay for essential imports, including fuel, leading to debilitating power cuts lasting up to 13 hours.

Huge piles of foreign debt, series of lockdowns, soaring inflation, shortage in fuel supply, fall in foreign currency reserves and devaluation of currency has adversely impacted the country's economic growth.

The nation is now on the brim of bankruptcy. Last week, finance minister Ali Sabry had said that Sri Lanka has as little as $50 million of useable foreign reserves.

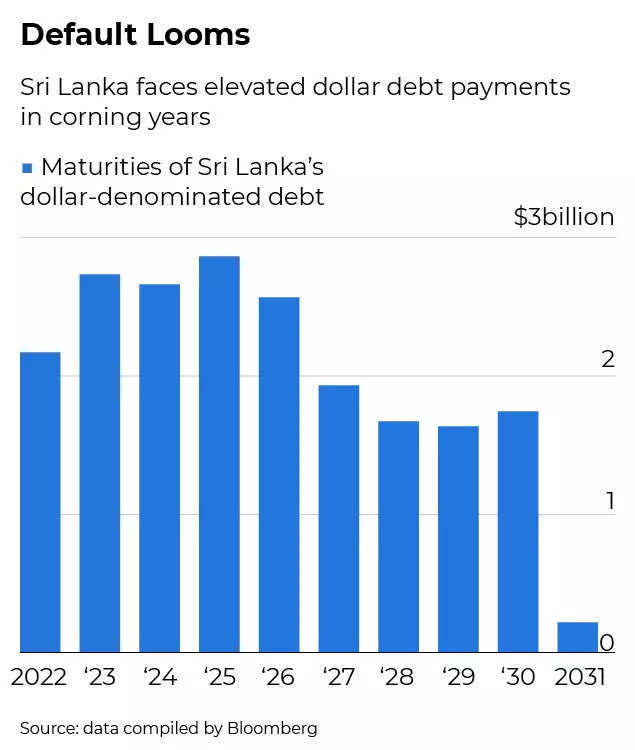

Sri Lanka was due to pay $7 billion of its foreign debt this year out of nearly $25 billion it must pay by 2026. Its total foreign debt is $51 billion.

The government has approached the International Monetary Fund (IMF) for a bailout, and will begin a virtual summit on Monday with IMF officials aimed at securing emergency assistance.

What led to this crisis

Sri Lanka's economy was in trouble even before the Covid pandemic struck. The lockdowns further added to its woes and impacted the informal sector hard, which accounts for nearly 60 per cent of the country's workforce.

The country's foreign exchange reserves have fallen 70 per cent in the past two years to about $2.31 billion, leaving it struggling to pay for essential imports, including food and fuel.

The financial crisis also stemmed from a critical shortfall in foreign currency, leaving traders unable to finance imports.

Tourism, one of the key source of foreign exchange for the country, was badly hit due to the Covid pandemic. Besides, remittances from Sri Lankans working overseas also declined sharply.

The country is left with foreign reserves of only around $2.31 billion as of February, even as it faces debt payments of about $4 billion through the rest of the year.

"The reason for the shortages is not a shortage of any commodity but the shortage of dollars," said Dhananath Fernando, chief operating officer of Colombo think-tank Advocate Institute told news agency Reuters.

The $4 billion debt includes a $1 billion international sovereign bond that matures in July.

Job losses, power shortages disrupt life

Job losses have become a common phenomenon in almost every household. Besides, fall in earning has led to rise in poverty rates.

According to World Bank data, the share of the poor based on a daily income of $3.20 was estimated to have grown to 11.7 per cent in 2020 - or by more than half a million people - from 9.2 per cent a year before.

The government had identified 5 million families with "fragile financial status of low-income households" and provided them a Rs 5,000 allowance during the Covid-19 lockdowns.

But that helped only briefly, with the latest economic crash - compounded by the Russia-Ukraine conflict that has led to a steep hike in oil prices - serving another gut punch, and making scenes of desperation and panic more and more common.

(People took to the streets to protest against the challenges being faced due to shortages of essential items)

Shortages have scaled to such heights that examinations for millions of students in the country had to be postponed due to lack of paper and ink.

As oil prices soared during the Russia-Ukraine conflict, Sri Lanka’s fuel stocks are running out. Authorities have announced countrywide power cuts will increase to about four a day because they can’t supply enough fuel to power generating stations.

Fuel shortages have led to long lines at petrol stations and rolling power cuts across much of the country. A serious shortage of diesel has shut multiple thermal power plants causing rolling power cuts across the nation.

Fuel prices have also been increased frequently with petrol up by 92 per cent and diesel by 76 per cent since the beginning of the year.

People in the country are also dealing with shortages and soaring inflation, after the country steeply devalued its currency in March.

Soaring inflation

The crisis caused in part by a lack of foreign currency, meant that the country cannot afford to pay for imports of staple foods and fuel, leading to acute shortages and very high prices.

The government ran out of money for vital imports; prices of essential commodities skyrocketed, leading to acute shortages in fuel, medicines and electricity supply.

In March, the central bank of the country raised interest rates to staunch growing inflationary pressures and urged the government to consider measures including curbing non-essential imports and raising fuel prices to reduce pressure on the ailing economy.

Retail inflation in February reached 15.1 per cent while food inflation hit 25.7 per cent - the highest in a decade. The Central Bank of Sri Lanka (CBSL) targets to hold inflation in a 4-6 per cent range over the medium term.

The sudden rise in prices of key commodities has left many people at the mercy of subsidies as all essential items are in short supply due to import restrictions forced by the forex crisis.

Currency depreciation

Sri Lankan rupee depreciated against the US dollar by 33 per cent during the year up to April 1, 2022.

Given the cross currency exchange rate movements, the Sri Lankan rupee depreciated against the Indian rupee by 31.6 per cent, the euro by 31.5 per cent, the pound sterling by 31.1 per cent and the Japanese yen by 28.7 per cent during this period.

The Central Bank of Sri Lanka, with immediate effect, set an exchange rate limit of 230 rupees per dollar compared to a limit of 200-203 that had prevailed since October.

In December, CBSL announced a host of measures including giving an additional 10 rupees per dollar as an incentive but this had limited impact with remittances dropping 61.6 per cent in January to $259 million from $675 million a year earlier.

(With inputs from agencies)