/Apple%20Inc%20Tim%20Cook-by%20John%20Gress%20Media%20Inc%20via%20Shutterstock.jpg)

Shares of Outsourced Semiconductor Assembly & Test (OSAT) provider Amkor Technology (AMKR) shot up when iPhone-maker Apple's (AAPL) CEO Tim Cook mentioned the company in a recent interview with CNBC's Mad Money. Highlighting Amkor's importance as a packaging partner of the company, Cook stated, “And then, you know, it goes to GlobalWafers, a company that’s in Texas, and they will serve companies like TSMC (TSM), which will do that, provide the fab for the product, for the chips, and then Amkor, another company that’s located in Arizona, will do packaging.”

About Amkor

Tracing its roots to Korea, Amkor was founded as the sales and marketing arm of ANAM Industrial in 1968. By being one of the leading OSAT providers, Amkor handles the “backend” of semiconductor manufacturing: packaging integrated circuits (ICs), testing them, and often providing advanced packaging and system-in-package (SiP) solutions. Its customers are chip foundries, electronics OEMs, etc.

Valued at a market cap of about $7 billion, the AMKR stock is up 16% on a year-to-date (YTD) basis but down 4% in the past year. The stock offers a dividend yield of 2.6%, which is much higher than the sector median of 0.572%. Moreover, the payout ratio of just 26.57% implies that the scope for further growth in dividends remains.

Thus, after muted returns, has the moment finally arrived for Amkor when its shares will finally embark on a sustained upward trajectory, or will investors be deceived again? Let's find out.

Financials Evoke Curiosity

Amkor's financial picture is a disparate one. On the one hand, while its sales and earnings have grown at steady compound annual growth rates (CAGR) of 7.23% and 12.06%, respectively, on the other hand, Amkor's earnings have reported year-over-year (YoY) declines in seven out of the past nine quarters. Then, staying true to its bipolar nature, the company's earnings have missed estimates just once in that period.

However, in the most recent quarter, Amkor's earnings and revenue both exceeded Street expectations. Total net sales of $1.51 billion represented an annual growth of 3.4%. Net sales of advanced products, which made up more than 81% of the overall revenues, grew by 4.1% from the previous year to $1.23 billion. However, earnings of $0.22 per share reflected a decline of 18.5% from the corresponding period a year ago, marking the fourth consecutive quarter of YoY earnings fall, despite coming in higher than the consensus estimate of an EPS of $0.16.

For the six months ended June 30, 2025, net cash from operating activities came in at $282.6 million. Although this was lower than the previous year's figure of $387.1 million, Amkor's overall cash balance of more than $1.5 billion was much higher than its short-term debt levels of about $400 million. Thus, short-term liquidity concerns are negligible.

Notably, for the third quarter of 2025, Amkor expects revenue to be in the range of $1.875 billion to $1.975 billion, the midpoint of which would denote an annual growth rate of 31.8%.

Why Does Apple Prefer Amkor?

Amkor offers a broad array of highly advanced packaging technologies: wafer-level packaging (including fan-out, chip scale, etc.), System-in-Package (SiP), flip chip, Through-Silicon Via (TSV), and 3D/stacked die packages. This matches Apple’s need for high performance, small form factor, efficient interconnects, and integration of sensors/components (e.g., in iPhones, iPads, and Macs). The ability to pack more functionality into smaller packages with better thermal/electrical performance is critical to Apple. Also, Apple’s chips are manufactured by TSMC; Amkor’s planned facility in Peoria, AZ, is designed to be very close to a TSMC fab in the Phoenix (Arizona) area. Having wafer fabrication (front-end) and packaging/test (back-end) located in close geographical proximity reduces logistical delays, risk in shipping, supply chain complexity, and lead times. This helps with faster time-to-market, better control over the process, and potentially lower costs.

But what else does Amkor have to offer? Well, for starters, Amkor is the second-largest player in a market that is projected to reach about $80 billion by the end of this decade, almost double from 2023. And Amkor has a solid advantage of offering a wide range of packaging technologies, such as wafer-level packaging, fan-out-wafer-level packaging, system-in-package, and flip chip, among others. Competitors like ASE, JCET, or SPIL may specialize more in certain segments, but Amkor covers almost all advanced packaging technologies for high-performance chips.

Also, Amkor works closely with TSMC, Samsung (SMSN.L.EB) and Intel (INTC), as well as major end customers like Apple and Qualcomm (QCOM), which provides design-for-packaging support, including design kits (PADKs), early collaboration on packaging constraints, and reliability verification. This integration reduces iteration cycles and improves time-to-market for high-value customers. Overall, its technology roadmap includes high-density interconnects, fine-pitch flip-chip, and embedded die solutions.

However, Amkor's almost “full-stack” position as a solutions provider in the semiconductor packaging space comes with its disadvantages too. For instance, some competitors specialize deeply in memory packaging or automotive-grade packages and can outperform Amkor in these very narrow segments, which means that Amkor has limited specialization in certain niche areas. This can make it vulnerable to losing business from customers who are seeking customized solutions. Then, Amkor’s advanced capabilities and U.S./high-tech facilities sometimes make its services more expensive than lower-cost competitors in China or Southeast Asia.

Analyst Opinion on AMKR Stock

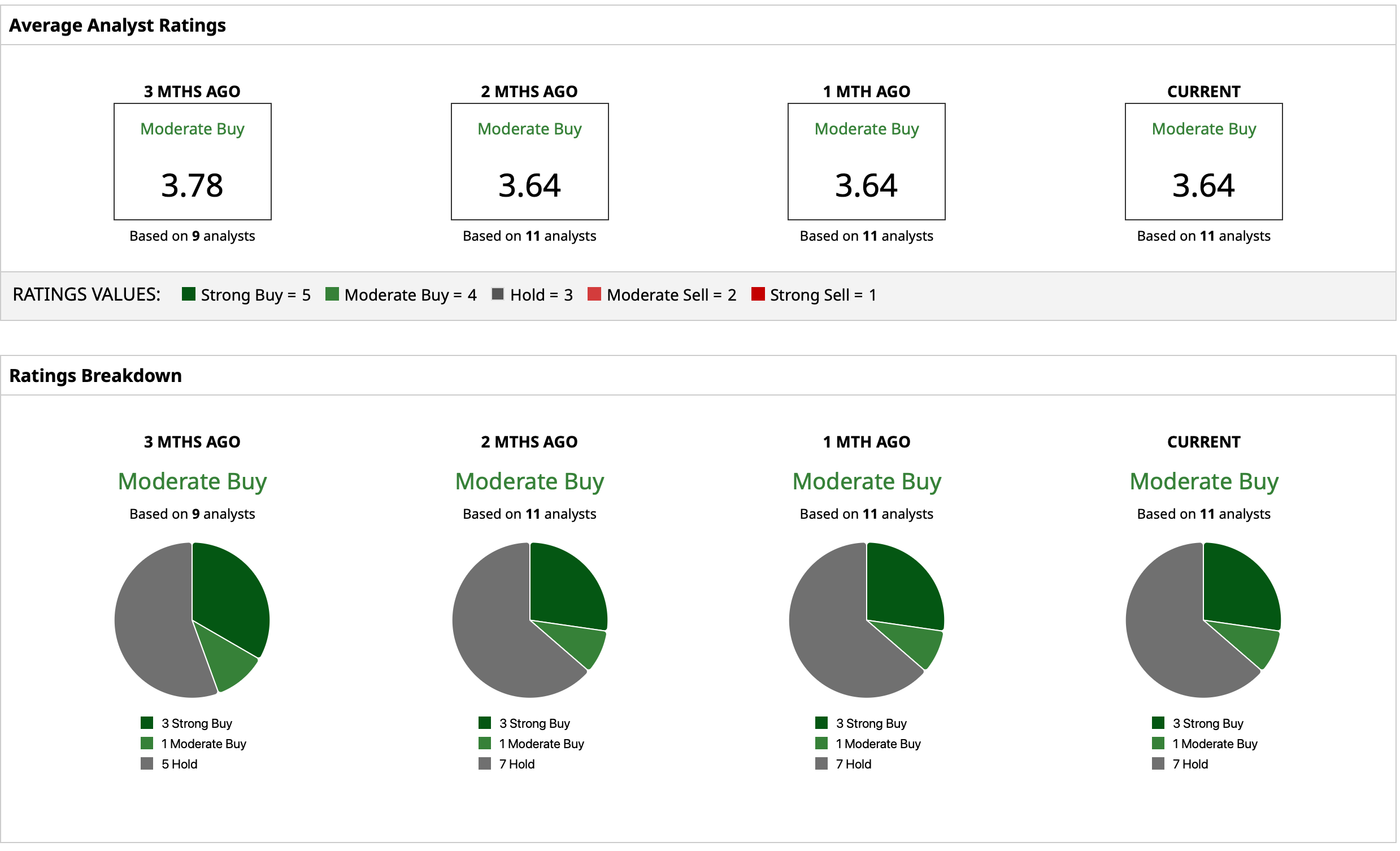

Considering all these factors, analysts remain cautiously optimistic about the AMKR stock, attributing to it a rating of “Moderate Buy,” with a mean target price of $24.75. This target has already been surpassed, and the high target price of $30 is only a few cents away from current levels. Out of 11 analysts covering the stock, three have a “Strong Buy” rating, one has a “Moderate Buy” rating, and seven have a “Hold” rating.