Fresh off its initial public offering (IPO), fintech company Klarna Group (KLAR) seems to be at the crux of another growth boom. The company’s newly launched Klarna card is gaining significant traction among consumers.

The card was launched in July and quickly became a customer favorite. In the second quarter, the company initiated the U.S. rollout to deliver a smarter wallet experience, introducing features such as real-time transfers and deposits. By the end of the quarter, the card had an acceptance rate of over 150 million merchants globally.

It was also reported that Americans are signing up for the card at a rate of 13,000 per day, reaching a peak of 50,000 sign-ups on Sept. 23. The company reported that, in just 11 weeks, over 1 million Americans signed up for the Klarna card.

With this significant adoption, let's take a closer look at Klarna.

About Klarna Stock

Klarna is a leading financial technology company that revolutionizes online shopping through its buy now, pay later (BNPL) services. It offers consumers flexible payment options, including installment plans and post-delivery payments, making purchasing easier and more accessible.

Klarna partners with numerous merchants to provide smooth, secure payment solutions integrated within the shopping experience. The company evolved beyond just payments by adding personalized marketing, banking features, and consumer financial tools. The company currently has a market capitalization of $29.7 billion.

Klarna's recent entry into the stock market with its IPO highlights its continued ambition to grow and innovate in the fintech space, positioning itself as a major player in global digital commerce. This move supports its strategy to expand its influence and service offerings worldwide.

KLAR stock began trading last month, with its IPO priced at $40 per share and opening at $52 per share. Klarna was one of the most successful IPOs of the year. Needless to say, this financial services IPO grabbed a lot of investor attention.

However, the stock is currently facing a down period. Over the past five days, KLAR stock has declined by 13%. It hit a five-day trading low of $37.50 on Oct. 2, but is up 12% from this low.

Klarna’s Financials Are Holding Strong

Klarna’s IPO year also coincided with its 20th year as a company. For its 20th anniversary, the company made notable strides. For the second quarter of fiscal 2025, Klarna reported having 790,000 merchants on its platform, representing a 34% year-over-year (YOY) increase. Its active consumer count increased by 31% annually to 111 million.

Gross merchandise volume (GMV) jumped by 19% from the prior year’s period to $31.2 billion. The company reported a total revenue of $823 million, up 24% YOY. The majority of Klarna's topline came from transactions and services. Klarna’s revenue take rate, which essentially reflects how much money a business makes from a transaction, was at 2.64% during the period.

On the other hand, Klarna’s provision for credit losses (which reflects provision for possible future losses and realized losses for all lending activities during the period) increased from 0.42% in Q2 2024 to 0.56% in Q2 2025. Contrarily, Klarna’s delinquency rates continue to fall. Net loss also climbed from $18 million to $53 million over the same period.

Klarna continues to expect to branch out into new territories that have long been dominated by traditional banks, which has been the company’s vision. With the rollout of the Klarna card and its widespread acceptance, the company appears to have bolstered its growth opportunities by becoming an everyday part of many consumers’ lives.

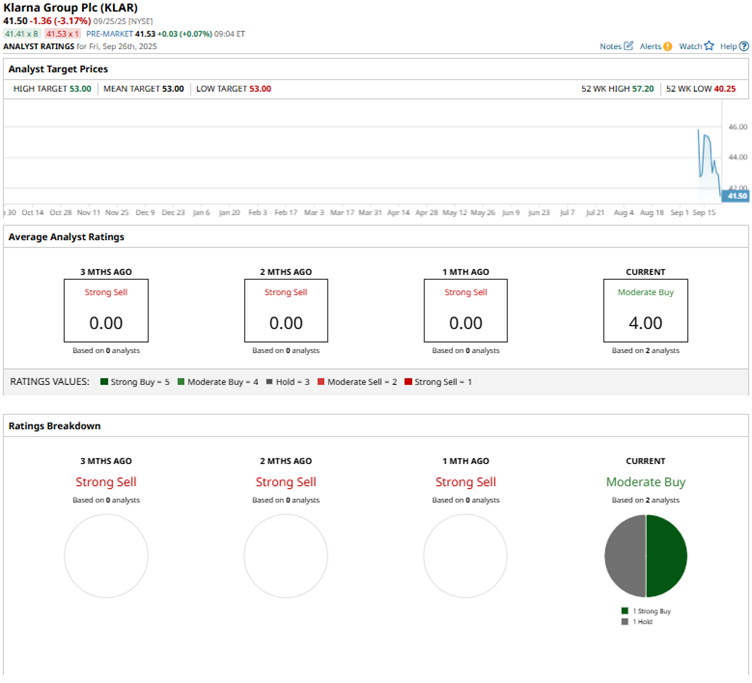

What Do Analysts Think About Klarna Stock?

Wall Street analysts have started giving their opinions on KLAR stock. Recently, Needham initiated coverage of the stock with a “Hold” rating. Needham analysts acknowledged the company’s leadership in the BNPL sector, but also expressed concern about its valuation and possible expense pressure.

On the other hand, analysts at Compass Point initiated coverage of the stock with a “Buy” rating and a price target of $53. Compass Point believes that Klarna can expand its market share and improve its profitability by continuing to grow in the U.S. market. Analysts also added that Klarna’s deposit funding base gives it an advantage over peers.

Klarna has a consensus rating of “Moderate Buy" currently. Of 14 analysts with coverage, the stock has nine “Strong Buy” ratings, one “Moderate Buy" rating, and one “Hold” rating. The mean target of $49.80 represents 18% potential upside from current levels. Meanwhile, the Street-high price target of $53 reflects 26% potential upside from here.