/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

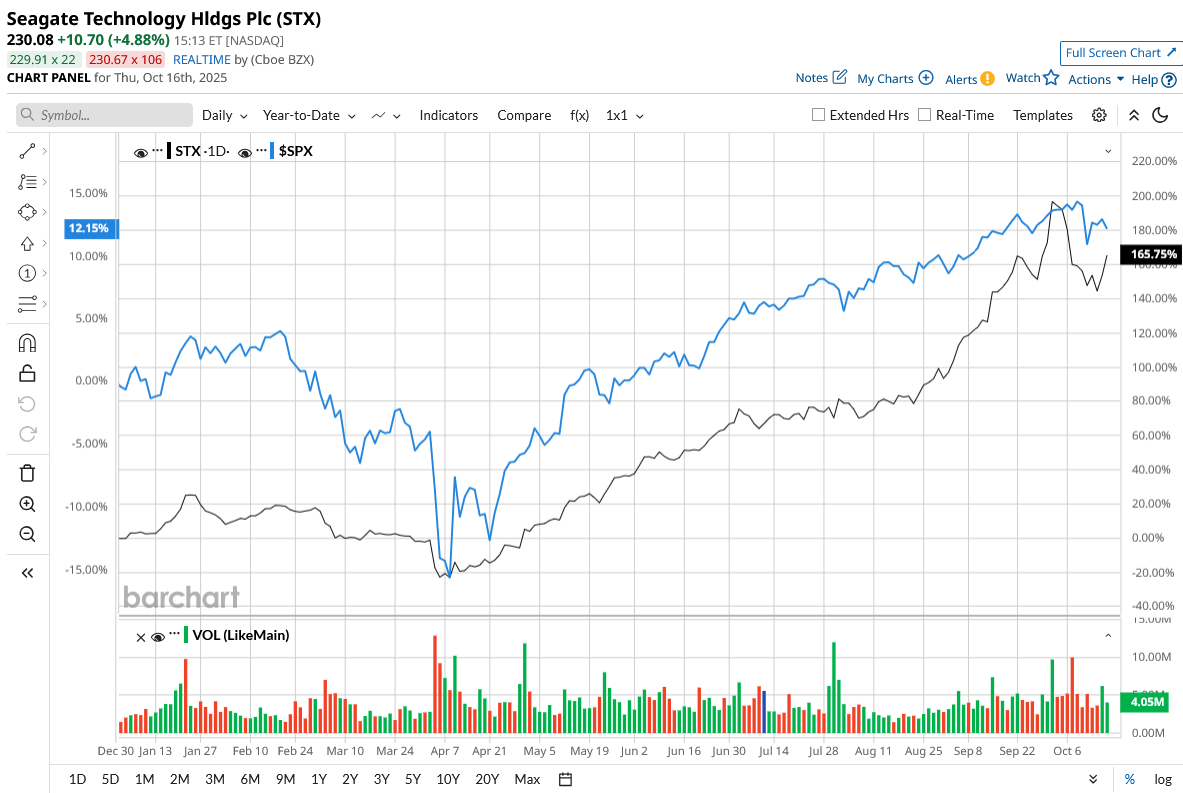

Seagate Technology (STX) has captured Wall Street’s attention, and for good reason. The stock is up a whopping 166% year-to-date (YTD), reflecting strong investor confidence in the company’s turnaround and long-term positioning in the data storage market.

Yet despite this rally, Wall Street sees more upside ahead. Let’s find out why.

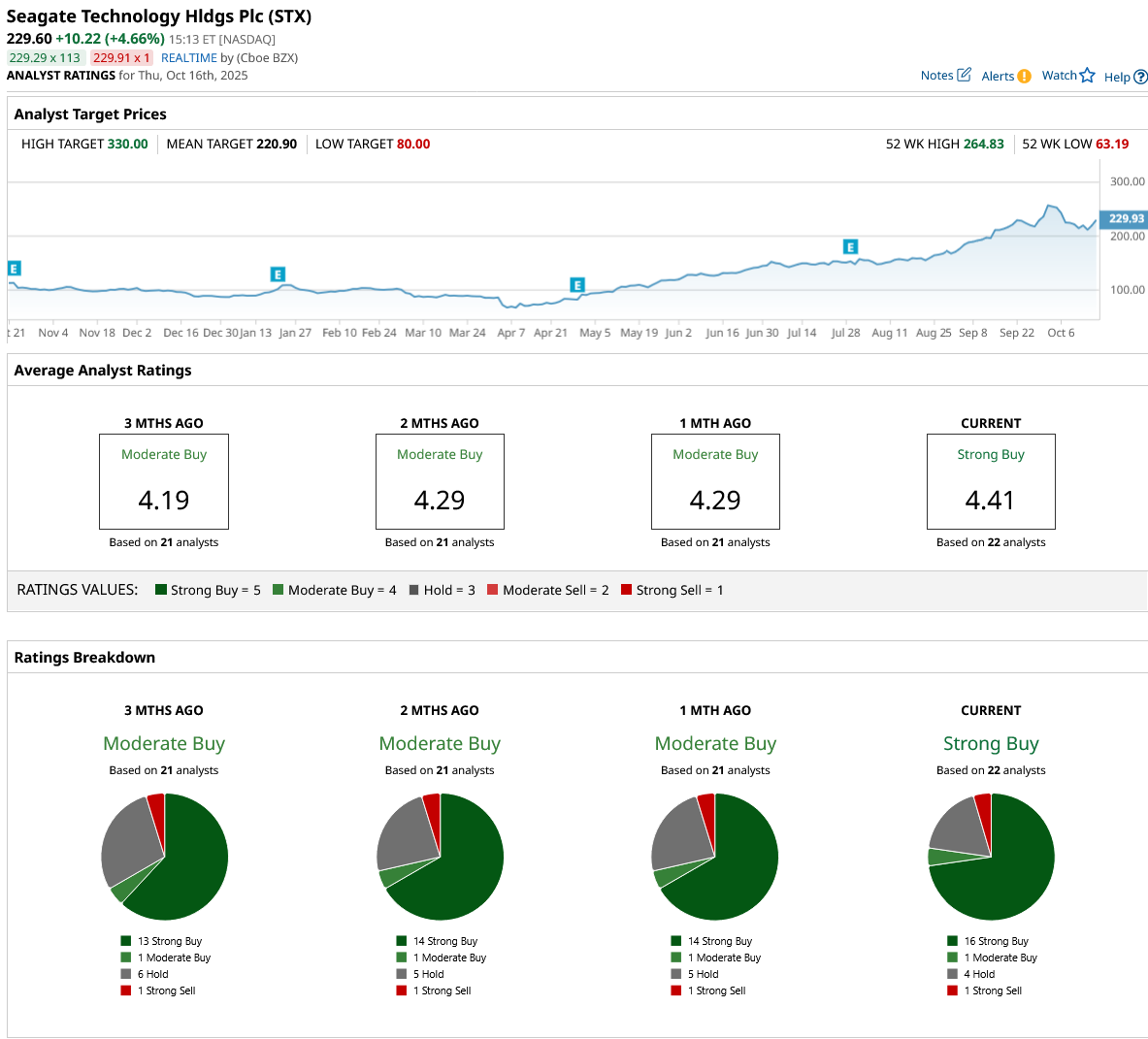

Analysts Raise Target Price for Seagate Stock

Valued at $46.7 billion, Seagate Technology is a data storage company that designs, manufactures, and distributes hard disk drives (HDDs), solid-state drives (SSDs), and data storage systems for use in computers, servers, and cloud infrastructure. The data storage company ended fiscal 2025 on a remarkably strong note, delivering its most profitable year. Following the outstanding performance, analysts at Citi, Wells Fargo, Goldman Sachs, Bernstein, Morgan Stanley, Bank of America Securities, and many others boosted their target prices for the stock, giving it a “Buy” rating.

Bernstein, in particular, feels that a cyclical resurgence in the HDD market and a structural shift toward cloud computing, artificial intelligence (AI), and edge processing place Seagate "in the sweet spot" to gain from both.

While Seagate's stock has already risen this year, Bernstein believes it "has more room to run" since valuation remains "undemanding" considering the company's growth prospects. The firm expects Seagate's earnings per share (EPS) to increase at a compound annual rate of more than 20% through fiscal 2027, which is outstanding for a hardware-focused company in a maturing market.

Notably, Evercore ISI has assigned STX stock a high price estimate of $330 and an “Outperform” rating. Evercore stated that Seagate's improved pricing discipline and technical advancements, such as Heat-Assisted Magnetic Recording (HAMR), are altering the competitive landscape and paving the way for a multi-year upcycle. Analysts at the firm say the HDD sector is now "on a path to transformation," with expanding margins, improved supply dynamics, and increased significance in the AI-driven data economy all likely contributing to a valuation re-rating and sustained financial performance gains for Seagate and its rivals.

These revisions indicate growing confidence that the company’s operational turnaround is real and sustainable.

A Financial Picture That Impressed the Street

Revenue in the June quarter increased 30% year-on-year (YoY) to $2.44 billion, while fiscal 2025 sales increased nearly 40% to $9.1 billion. Adjusted EPS for the fiscal year rose to $8.10, a near all-time high, up from $1.29 in fiscal 2024, exceeding Wall Street projections. The company also reported a record gross margin of 35.8%, up for the ninth consecutive quarter. Seagate anticipates this streak to continue into fiscal 2026 as emerging technologies like HAMR gain popularity.

CEO Dave Mosley credited this stellar performance to disciplined cost management, a well-balanced supply-demand strategy, and the successful implementation of next-generation hard drive technology. Wall Street’s bullish outlook probably stems from Seagate's HAMR-based Mozaic platform, which represents a significant step forward in data storage innovation. HAMR drives use laser-assisted recording to store substantially more data on each disk platter, making them both affordable and energy-efficient. They are designed to meet the rapidly growing data needs of cloud and AI applications, which increasingly rely on huge, long-term data storage solutions.

While the company didn’t specify, it emphasized that three major cloud service providers have already qualified Mozaic HAMR drives, with subsequent testing "progressing exceedingly well." This increased customer validation indicates that HAMR-based products are quickly transitioning from pilot to mainstream usage. AI adoption is fueling a tremendous need for high-capacity data storage. Seagate is positioning itself at the center of this structural shift. By 2029, the business anticipates global data center capacity to have more than doubled, thanks to AI workloads that generate and preserve massive amounts of data. Seagate’s improved profitability has also strengthened its balance sheet. The company ended the June quarter with $2.2 billion in liquidity and reduced its debt by roughly $150 million. It also doubled its free cash flow to $425 million.

Importantly, Seagate plans to resume share repurchases this quarter, a move likely to please investors. The company has a track record of returning a substantial portion of its cash flow to shareholders, distributing almost 75% of fiscal 2025 free cash flow through dividends and buybacks.

The company estimates revenue to be around $2.5 billion, plus or minus $150 million, reflecting a 15% rise YoY. Adjusted EPS is expected to be $2.30 (plus or minus $0.20), with margins expanding into the mid-to-high 20% range. With record-breaking margins, a healthy product pipeline, and a clear plan for capitalizing on AI-driven data growth, Seagate appears to be on track for another blockbuster year.

Analysts covering Seagate expect its revenue to climb by 16.7% in fiscal 2026 to $10.6 billion, along with a 31.8% increase in earnings. Trading at 20 times forward earnings, Seagate is still a reasonable buy.

What Does Wall Street Say About STX Stock?

Overall, Wall Street rates STX stock a consensus “Strong Buy.” Out of the 22 analysts who cover STX, 16 recommend a “Strong Buy,” one says it is a “Moderate Buy,” four recommend a “Hold,” and one rates it a “Strong Sell.” Seagate stock is trading close to its average analyst price target of $220.90. Furthermore, the high price estimate of $330 implies an upside potential of 44% over the next 12 months.