Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) shares are trading lower Monday afternoon following two financial announcements. Here’s what investors need to know.

What To Know: The company’s subsidiary, NCL Corporation Ltd., has initiated a cash tender offer to buy back all of its 5.875% Senior Secured Notes due in 2027 and its 5.875% Senior Notes due in 2026. To fund this, NCLC has launched a new offering of $2.05 billion in new senior unsecured notes. The tender offer is set to expire at 5:00 p.m. EDT time on September 12.

Concurrently, Norwegian Cruise Line Holdings announced a registered direct offering of ordinary shares. The cruise line intends to use the proceeds from this equity offering, along with a separate private offering of exchangeable senior notes, to repurchase a portion of its 1.125% Exchangeable Senior Notes due 2027 and 2.50% Exchangeable Senior Notes due 2027.

Offerings of new ordinary shares can cause a stock to fall because it dilutes the ownership stake and potential earnings per share for existing stockholders. Additionally, the issuance of $2.05 billion in new debt to restructure existing liabilities may heighten investor concerns about the company’s overall leverage.

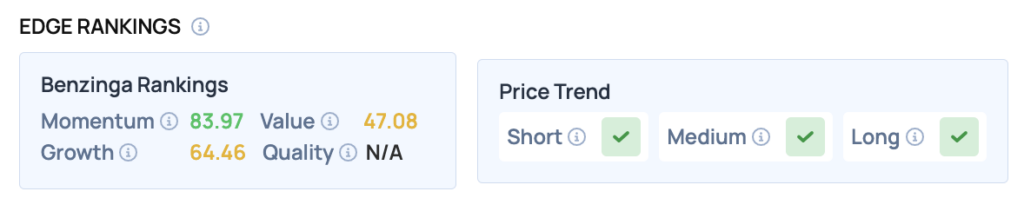

Benzinga Edge Rankings: Despite the day’s drop, Benzinga Edge Rankings highlight the stock’s very strong Momentum score of 83.97.

Price Action: According to data from Benzinga Pro, NCLH shares are trading lower by 2.57% to $25.00 Monday afternoon. The stock has a 52-week high of $29.29 and a 52-week low of $14.21.

Read Also: AppLovin Hits New Milestone With S&P 500 Debut Fueling Market Buzz

How To Buy NCLH Stock

By now you're likely curious about how to participate in the market for Norwegian Cruise Line – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock