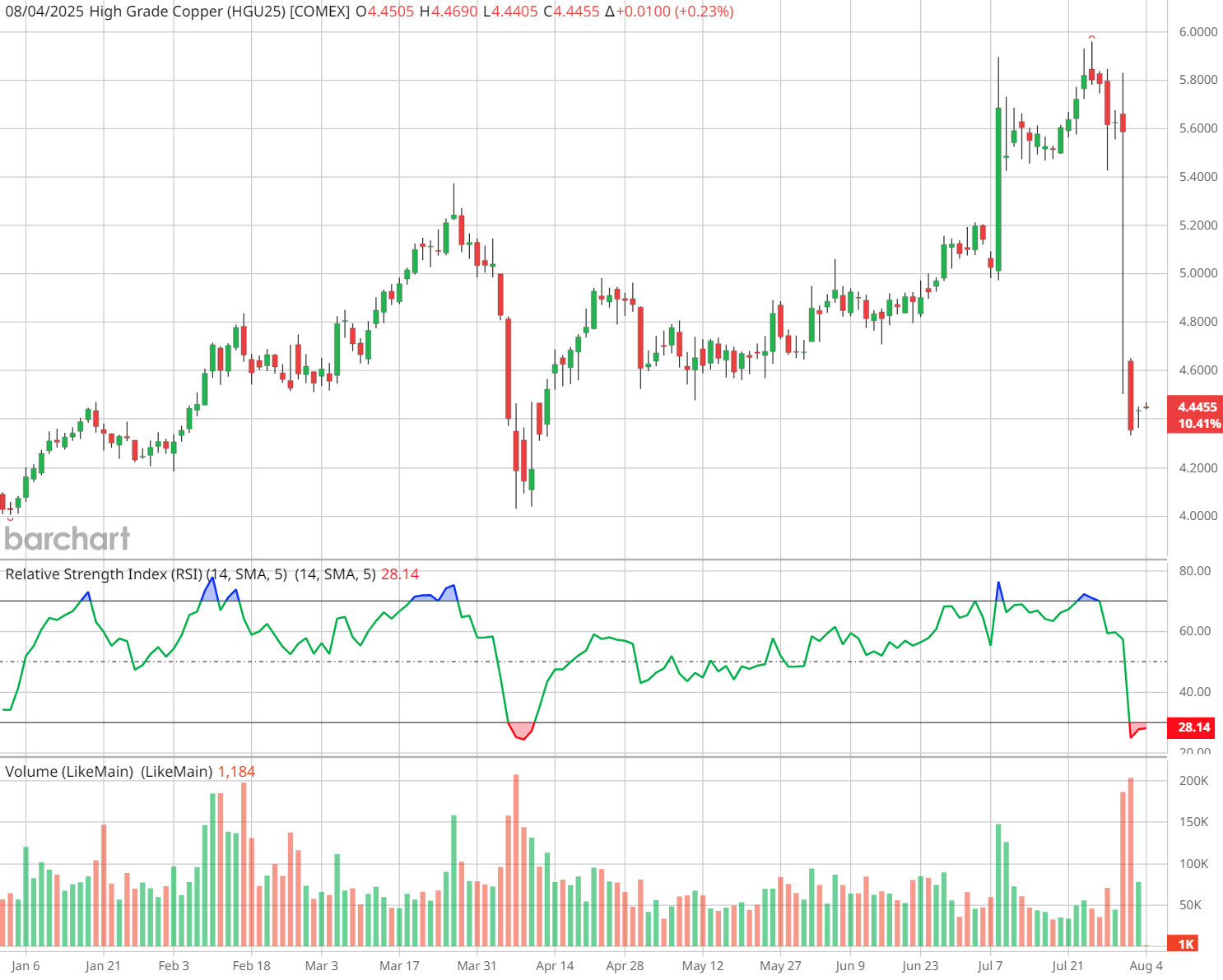

The surprise news last week that President Trump signed an immediate 50% tariff on only some copper imports into the U.S. caused the most-active September COMEX copper futures (HGU25) price to plunge to a weekly low of $4.3325 — down around 25% from the record peak scored just a week earlier. The U.S. copper tariffs were only on semi-finished products such as wires and pipes, and spared key inputs like ore, cathodes, and concentrates, which are the most commonly imported forms of copper.

The marketplace did not expect that, at all.

Supplies of copper had been previously rushed into the U.S. to frontload ahead of what were expected to be much wider-encompassing Trump copper tariffs. Analysts now warn that the U.S. may face a glut of copper, with excess inventory potentially being re-exported and adding further pressure to global prices.

The huge sell-off in copper futures last week spilled over into price pressure on other metals futures markets, including silver (SIU25), platinum (PLV25), palladium (PAU25), and even gold (GCQ25). That's because panic selling in copper futures spooked the traders of other metals, prompting very degrees of selling pressure, including sharp losses in silver.

There’s an old trader adage that says when markets turn very anxious, “If you can’t sell what you want, you sell what you can.” Such was likely the case for at least some copper traders last week.

LME, COMEX Warehouse Stocks Told a Telling Tale

Also, in anticipation of U.S. copper tariffs, reports said copper was transferred from the London Metals Exchange (LME) warehouses to COMEX warehouses. At the end of 2024, LME copper stocks were 271,400 metric tons (MT), and then fell two-thirds to 90,625 MT, at the end of June.

In the meantime, COMEX copper warehouse inventories rose by around 125%, from 93,161 MT to 211,209 MT. In late July, LME stocks were 136,850 MT, with COMEX stocks at 250,819 MT.

“The bottom line is that copper that flowed from abroad to the U.S. had distorted the supply and demand fundamentals, leading to a significant price divergence. The divergence corrected with the price carnage on July 30 and 31,” reported Andy Hecht.

Takeaways for Traders of All Markets

Those of us who have been in the marketplace for many years have seen a few of them. They don’t come often, but when they do, they are dreaded. When unexpected market shocks like last week’s copper debacle occur, all hell can break loose in the marketplace, or at least within a market sector. Those unexpected shocks to the markets blindside all traders and can propel price volatility into the stratosphere.

The assassination attempt on President Reagan, the Chernobyl nuclear disaster, the stock market crash of 1987, the failed coup attempt in the former Soviet Union, the 9/11 terrorist attacks on the U.S, the COVID-19 eruption, and now the copper debacle. These are a few of history’s fundamental general marketplace, or market sector, shocks that I have experienced as a market watcher over the past 40-plus years.

Fortunately, I have never been caught in a real bad way on the wrong side of markets when prices have reacted violently to unexpected shocks. However, I have occasionally pondered the risk of being in the middle of a trade when a shock does occur. I have heard horror stories of traders getting wiped out in a single day and never recovering.

Of course, there are always a few who happen to be on the right side of a market when an unexpected shock occurs, and they might make a quick and unexpected fortune. However, more times than not, a market shock will initially cause price volatility both on the upside and on the downside, as markets react and then overreact to early reports and rumors of a major shock event. That kind of volatility is detrimental to both bulls and bears.

What to Do?

What can a trader do to prepare for these rare market shocks? Frankly, not much can be done, effectively. Of a bigger danger to most traders are what I call the mini-shocks in markets, such as the “Mad Cow” disease scare in cattle futures, or the “irrational exuberance” phrase famously uttered in a speech by Federal Reserve Chairman Alan Greenspan, which rattled the financial markets. I would categorize the copper debacle as a mini-shock because it impacted only a few markets.

One way to try to prevent being on the wrong side of a major or mini market shock would be to purchase well out-of-the money put or call options on futures that are “on the other side” of a bigger trading position you have in place. For example, if a trader has a big long position on in grains heading into a summertime weekend — when weather patterns can be less predictable —they may choose to purchase cheaper out-of-the money put options to somewhat hedge that long grain futures position.

But this particular type of hedge with options is usually less-than-ideal, and does cut into any already-accrued profits. Putting on this type of hedge on a regular basis would be akin to driving down the street in your passenger car not only wearing your safety belts, but also wearing a crash helmet.

More often than not, these rare shocks to markets are just a slight risk that all traders have to accept to be in the business of trading. Worrying too much about the phenomenon is a psychological negative that can, by itself, be damaging to a trader.

Tell me what you think. I really enjoy getting email from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.