Shares of advanced nuclear energy firm Oklo Inc (NYSE:OKLO) are trading flat Thursday afternoon. The stock has pulled back 10% over the past five days, amid reports on Wednesday that Kazakhstan plans to increase uranium production. Here’s what investors need to know.

What To Know: The company earlier announced a partnership with automation leader ABB to launch a digital monitoring room. This facility is central to the company's forward-thinking operational strategy.

Oklo's Aurora powerhouses are designed to rely on automation and inherent safety features so the personnel can behave more like monitors than operators, a key component of Oklo’s commercial readiness.

This technological step forward builds directly on the momentum from last week’s announcement of Oklo’s selection for the U.S. Department of Energy’s Reactor Pilot Program.

“This shows that the DOE is ushering in a new era of building new nuclear in America by unleashing its unique capabilities to enable American nuclear innovators to build,” said Jacob DeWitte, co-founder and CEO of Oklo. He added that the program “provides a sweeping injection of urgency to meet the moment and unleash American nuclear innovation.”

This news followed the company’s second-quarter financial report on August 11, when Oklo reported a larger-than-expected loss of 18 cents per share. Multiple analysts raised their price targets following the earnings release.

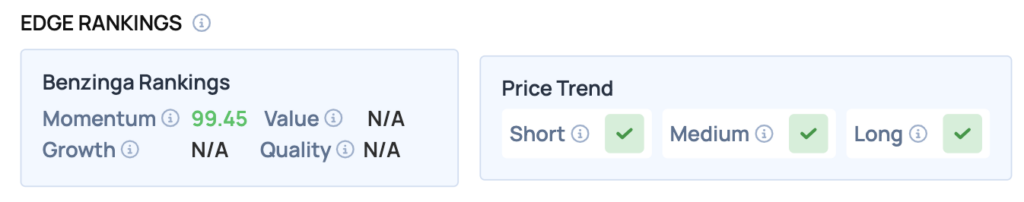

Price Action: According to data from Benzinga Pro, OKLO shares are trading flat at $66.73 Thursday afternoon. The stock remains up more than 200% year-to-date. The stock has a 52-week high of $85.35 and a 52-week low of $5.35.

Read Also: Nio Stock Is Moving Higher Thursday: What’s Driving The Action?

How To Buy OKLO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Oklo’s case, it is in the Utilities sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock