Rare earth mineral stocks have been quietly gaining traction as global demand for electric vehicles (EVs), renewable energy, and advanced technologies accelerates. These elements are critical for producing permanent magnets, batteries, and other high-performance materials, making them a strategic necessity for industries and nations alike. Yet, only a handful of companies outside China are successfully developing supply chains that can compete on a global scale.

One of the leading stocks that has been catching headlines lately is Energy Fuels (UUUU). The U.S.-based miner just announced a breakthrough catalyst with its domestically produced rare earth oxides, which were successfully integrated into commercial-scale permanent magnets used in EVs. Shares jumped about 6% following the announcement. This validation not only cements Energy Fuels’ role in building a U.S.-based “mine-to-magnet” supply chain but also opens the door to long-term supply deals with global automakers.

For investors eyeing the future of clean energy and national security, here’s why UUUU stock deserves a closer look.

About UUUU Stock

Founded in 2006, Energy Fuels is a prominent player in the exploration, recovery, and sale of uranium and rare earth elements (REEs) within the United States. The company is recognized as the largest domestic producer of uranium in the U.S., with operations extending to vanadium pentoxide, heavy mineral sands, and rare earth elements like neodymium-praseodymium.

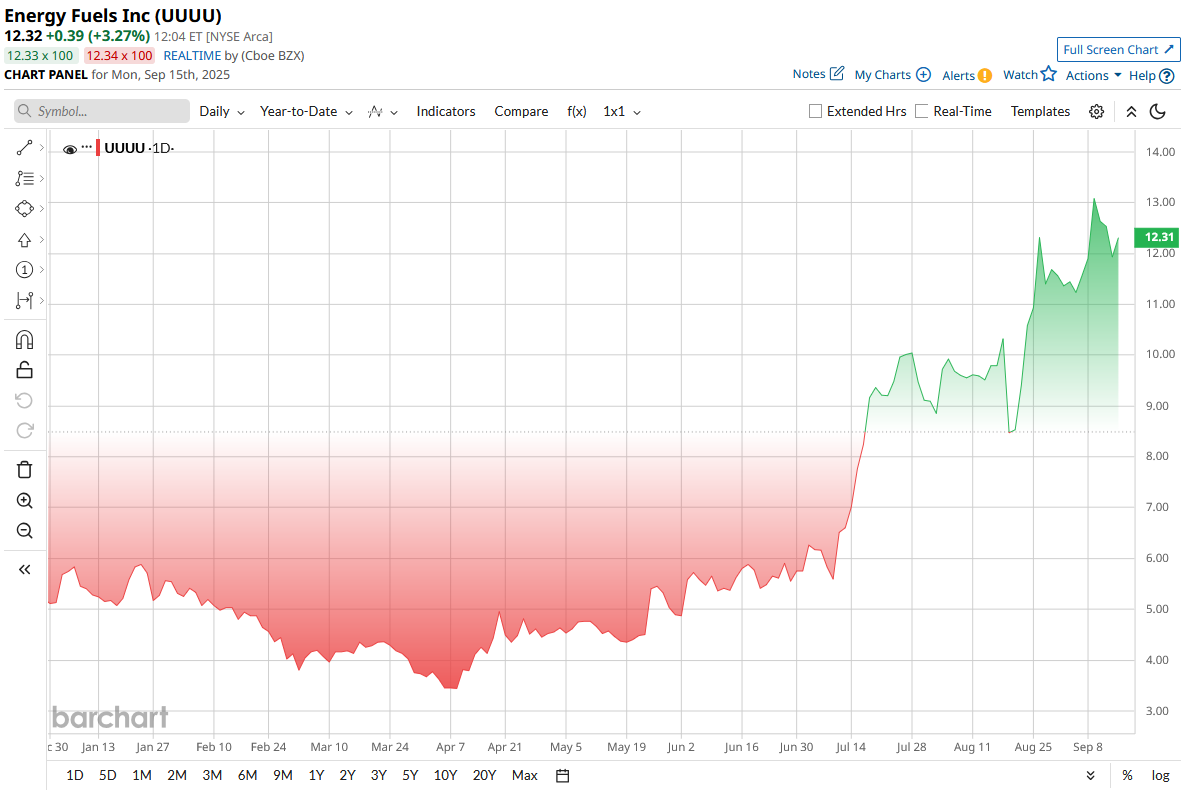

Energy Fuels carries a modest market cap of about $2.6 billion but has become one of 2025’s best-performing mining stocks. The share price is up 160% over the past year, far outpacing the S&P 500’s ($SPX) 17% gain during the same period.

Following its sharp rally, UUUU now trades at a challenging valuation, with a price-to-sales (P/S) ratio of 35 versus a sector median of 1. The gap suggests the stock may be trading well above its peers.

Energy Fuels' Strategic U.S. Supply Chain Partnerships

Energy Fuels has also been lining up U.S.-based partners to secure offtake and end markets for its rare-earth oxides. In late August 2025, it signed a memorandum of understanding with Vulcan Elements, an American magnet maker, to supply “ex-China” high-purity NdPr and dysprosium oxides refined at White Mesa Mill in Utah. Under this agreement, Energy Fuels will ship initial lots of its NdPr and Dy to Vulcan in Q4 2025. Vulcan will validate the materials for magnet production and then negotiate longer-term supply contracts for both oxides.

White Mesa Mill is currently the only U.S. plant capable of processing monazite into separated RE oxides, so this deal helps “onshore” a critical part of the magnet supply chain. These efforts build on earlier collaborations such as joint initiatives with POSCO International in Korea and Chemours aimed at integrating Energy Fuels’ NdPr and other REOs into EV motor and defense supply chains.

Financial Overview

In the most recent quarter, Energy Fuels posted $4.2 million in revenue and a net loss of $21.8 million, or a loss of $0.10 per share, and missed analysts' estimates. At first glance, those numbers don’t look great. Revenue fell sharply from Q1 as the company sold only about 50,000 pounds of uranium, generating roughly $3.85 million in sales. But that weak top line isn’t due to a lack of production.

In fact, Energy Fuels produced about 180,000 pounds of uranium in the quarter. It simply chose to hold back most of it in inventory rather than sell at current spot prices. That strategy has become a hallmark of management’s approach. Mine aggressively when grades are high, but wait to sell until pricing and contract structures are more favorable. It does mean the quarterly results look messy, but it also shows confidence in the uranium market’s longer-term upside.

The good news is the balance sheet gives Energy Fuels plenty of room to take this approach. At the end of the Q2 quarter, the company had more than $71 million in cash, another $126 million in marketable securities, and zero debt. That’s over $250 million in liquidity, a rare cushion for a company of its size. With that kind of financial flexibility, Energy Fuels can afford to stockpile uranium and ramp up its rare-earth processing capabilities without worrying about short-term losses.

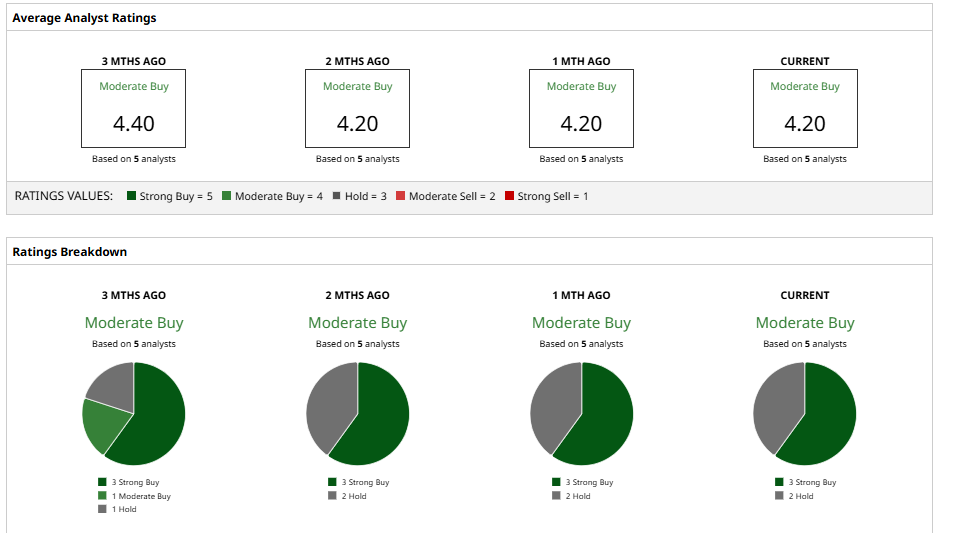

What Analysts Think About UUUU Stock

Wall Street analysts remain cautiously bullish on UUUU with a consensus “Moderate Buy” rating. Among five analysts tracked by Barchart, three rate the stock a “Strong Buy” while two recommend a “Hold.” However, shares have already surpassed the average price target of $10.19 and now trade near the Street high of $12, suggesting the stock may already be priced for perfection.