/Applied%20Materials%20Inc_%20campus%20sign-by%20Sundry%20Photography%20via%20iStock.jpg)

Applied Materials (AMAT) announced a 4% workforce reduction despite shares climbing over 40% year-to-date (YTD). The chip equipment maker will eliminate approximately 1,444 positions from its 36,100-person global workforce, incurring charges of $160 million to $180 million, primarily for severance payments.

CEO Gary Dickerson cited automation, digitalization, and geographic shifts as drivers reshaping workforce requirements. The company aims to build higher-velocity teams while simplifying organizational structures.

Notably, Applied Materials recently projected a $600 million revenue hit for fiscal 2026 after the U.S. expanded export restrictions, sending AMAT stock down 3% earlier this month.

Applied Materials' Contradictions

Applied Materials faces a puzzling contradiction as the chip equipment maker announced workforce cuts despite achieving record third-quarter performance. In fiscal Q3 of 2025, AMAT reported record revenue of $7.3 billion, up 8% year-over-year (YoY), and record adjusted earnings of $2.48 per share.

However, the company guided fourth-quarter revenue and earnings sequentially lower, primarily due to three factors:

- First, capacity digestion in China, where tremendous spending occurred in 2023 and 2024.

- Second, a large backlog of pending export licenses, where management conservatively assumes none will be issued next quarter.

- Third, nonlinear demand from leading-edge customers is linked to market concentration and factory timing.

Due to the ongoing trade war, AMAT’s China business remains below 2024 levels, though it remains meaningful to overall results. The ICAPS segment, which covers mature logic nodes for industrial, communications, automotive, and power applications, continues to face headwinds as utilization remains depressed.

Despite near-term turbulence, management maintains confidence in long-term prospects. Applied expects to achieve its sixth consecutive year of revenue growth in fiscal 2025 at mid-single-digit rates.

The company holds leadership positions in critical areas like gate-all-around transistors and backside power delivery, with opportunities to gain multiple points of market share as these technologies ramp in 2026 and 2027.

The service business has grown for 24 consecutive quarters, with over two-thirds of that growth driven by recurring subscription revenue. Investors must weigh whether workforce reductions signal proactive cost management or defensive positioning against deteriorating fundamentals.

The Bull Case for AMAT Stock

Applied Materials is uniquely positioned across five critical AI semiconductor innovation areas that management believes will drive industry growth through 2030. The semiconductor equipment market is expected to reach $1 trillion by the decade's end, with Applied holding leadership in leading-edge foundry logic, high-performance DRAM, high-bandwidth memory stacking, advanced packaging, and power electronics.

The company's advanced packaging business alone is projected to more than double to over $3 billion within the next few years. Applied has secured over 50% market share in gate-all-around and backside power technologies, positioning it to capture additional market share as these architectures ramp up in late 2026 and 2027.

The transition from FinFET to gate-all-around transistors with backside power delivery expands Applied's revenue opportunity by 30 percent for equivalent fab capacity. High-bandwidth memory represents a powerful growth driver, expanding at a 30-40% compound annual growth rate.

Currently, about 15 percent of DRAM capacity is dedicated to HBM, requiring three times as many wafer starts due to larger die sizes and lower yields. Applied has already gained 10 points of market share in this segment.

The company plans to invest over $200 million in Arizona manufacturing facilities as part of Apple's (AAPL) American Manufacturing Program, building on the $400 million it has invested over the past five years in U.S. infrastructure.

Is AMAT Stock Undervalued Right Now?

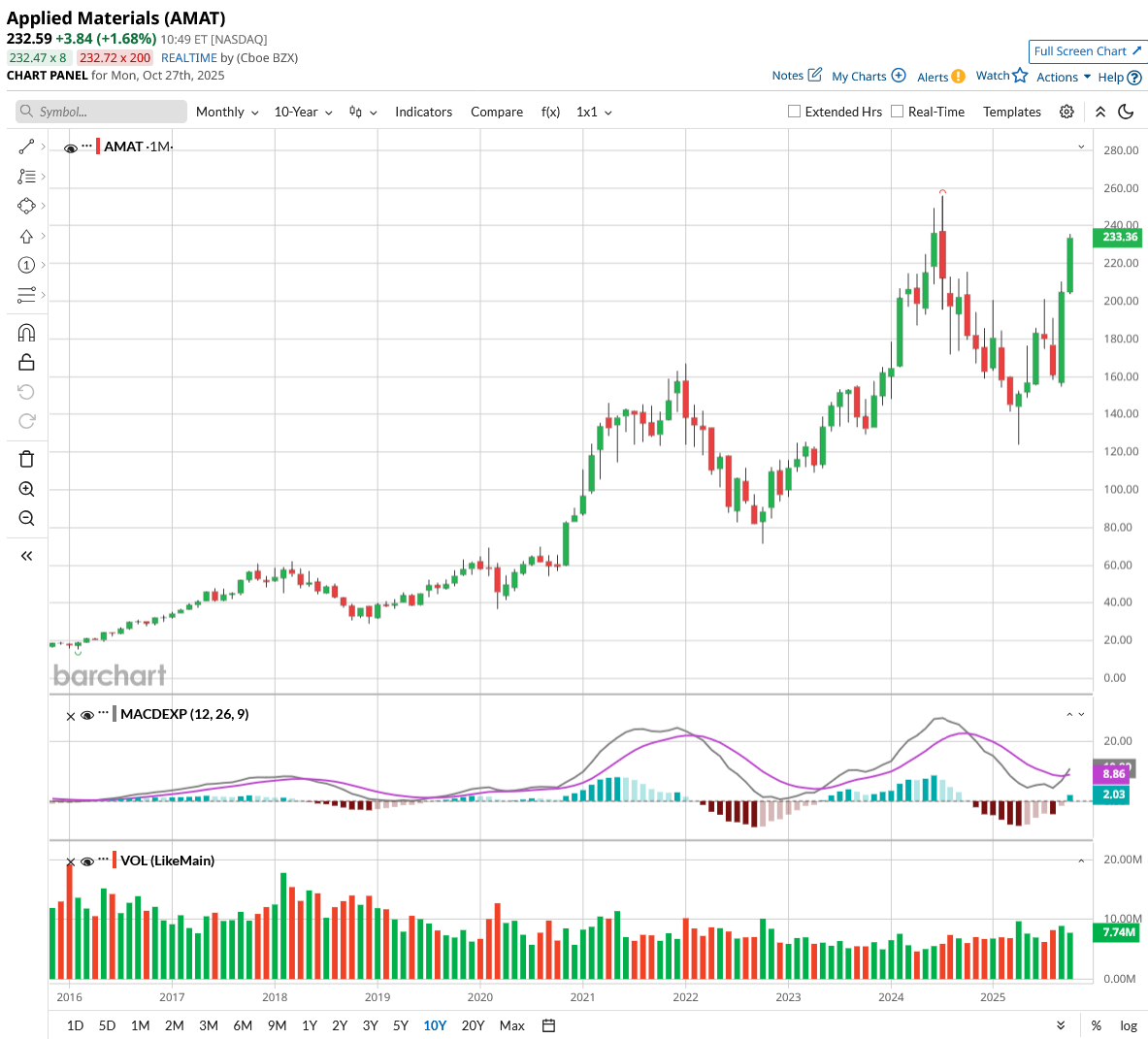

Analysts tracking AMAT stock forecast revenue to increase from $27.2 billion in fiscal 2024 (ended in October) to $38.1 billion in fiscal 2029. In this period, adjusted earnings are forecast to expand from $8.65 per share to $13.82 per share.

Today, AMAT stock trades at 25.5x forward earnings, above its 10-year average of 16x. If AMAT stock is priced at 20x earnings, it should trade around $276, indicating an upside potential of 19% over the next three years.

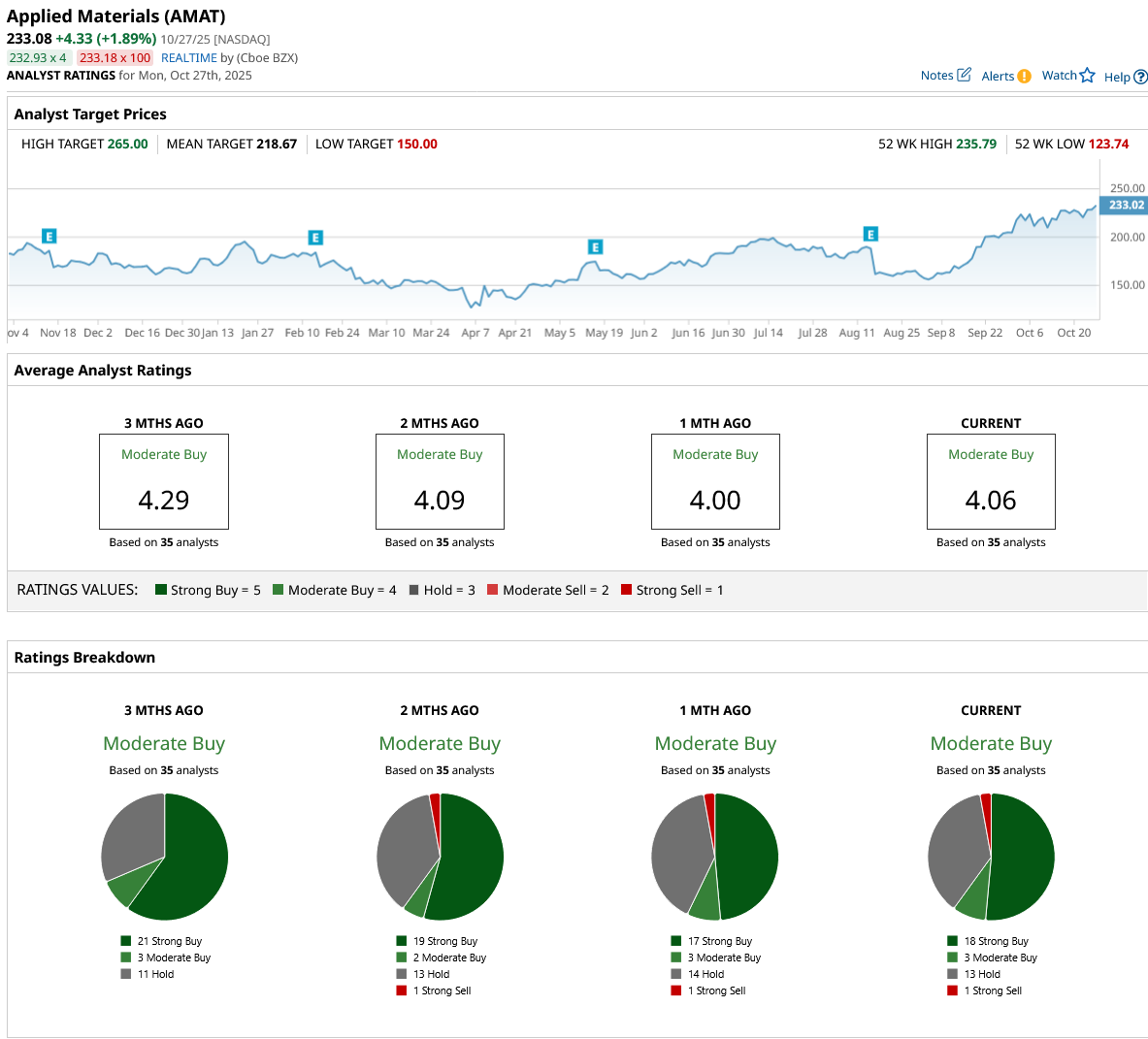

Out of the 35 analysts covering AMAT stock, 18 recommend “Strong Buy,” three recommend “Moderate Buy,” 13 recommend “Hold,” and one recommends “Strong Sell.” The average AMAT stock price target is about $219, below the current price of $233.