Robinhood Markets Inc (NASDAQ:HOOD) shares are trading higher Monday as tech rebounds on hopes the Federal Reserve will cut rates in December. The stock is rebounding after a roughly 18% slide over the past month.

- HOOD is charging ahead. Find out why here.

What To Know: The move comes after Goldman Sachs reiterated its call for a 25-basis-point cut at the December FOMC meeting, citing a softer labor market and inflation near 2%.

The Invesco QQQ Trust climbed 2% to around $602 as investors rotated into large-cap tech. November's 5%-plus drop in the Nasdaq-100 has historically set up 12-month rebounds averaging about 27%.

Lower rates are particularly bullish for Robinhood's business model. A Fed pivot boosts valuations for long-duration growth and tech stocks, which dominate trading on the platform.

Rising equity and crypto prices lift assets under custody, expand margin capacity and drive higher options and equity-trading volumes, Robinhood's key revenue stream. A lower risk-free rate makes cash and Treasuries less competitive, nudging investors toward risk assets and short-dated options on the platform.

While cuts may trim the yield Robinhood earns on idle cash, investors expect stronger trading and asset-price gains to offset that drag, positioning Robinhood as a high-beta play on a renewed tech rally.

What Else: Robinhood reported strong third-quarter results on Nov. 5, with EPS of 61 cents topping estimates of 48 cents, and revenue of $1.27 billion beating expectations of $1.19 billion.

In response, several analysts maintained bullish or neutral ratings on the stock while raising their price targets, now ranging from $135 to $172.

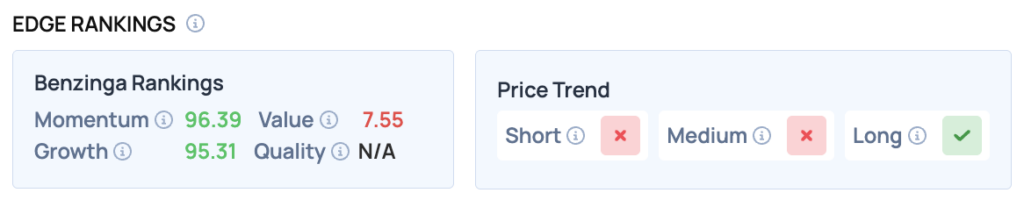

Benzinga Edge Rankings: Benzinga Edge stock rankings, which give you four critical scores to help identify the strongest and weakest stocks to buy and sell, show Robinhood with standout Momentum and Growth scores of 96.39 and 95.31, respectively, alongside a bullish long-term price trend.

HOOD Price Action: Robinhood Markets shares were up 5.41% at $113.11 at the time of publication on Monday, according to Benzinga Pro data.

Read Also: Alibaba Q2 Preview: Qwen’s 10 Million Milestone Highlights ‘Historic Opportunities’ In AI, Cloud

How To Buy HOOD Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Robinhood Markets’ case, it is in the Financials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock