/Ralph%20Lauren%20Corp%20storefront%20by-%20Robert%20Way%20via%20iStock.jpg)

Valued at a market cap of $17.2 billion, Ralph Lauren Corporation (RL) is a globally renowned lifestyle and fashion brand. Headquartered in New York, it designs, markets, and distributes premium products across five core categories: apparel, footwear & accessories, home furnishings, fragrances, and hospitality, including luxury restaurants like Polo Bar and Ralph’s in Paris.

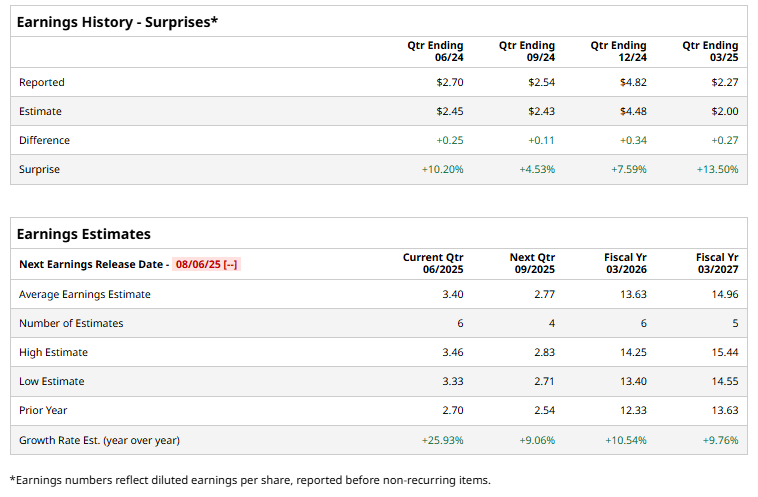

The luxury fashion behemoth is expected to release its Q1 earnings on Wednesday, Aug. 6. Ahead of this event, analysts expect RL to post adjusted earnings of $3.40 per share, representing a growth of 25.9% from $2.70 per share reported in the same quarter last year. The company has surpassed the Street's bottom-line estimates in the past four quarters.

For the current year, analysts forecast Ralph Lauren to report an adjusted EPS of $13.63, indicating a 10.5% increase from $12.33 reported in fiscal 2024.

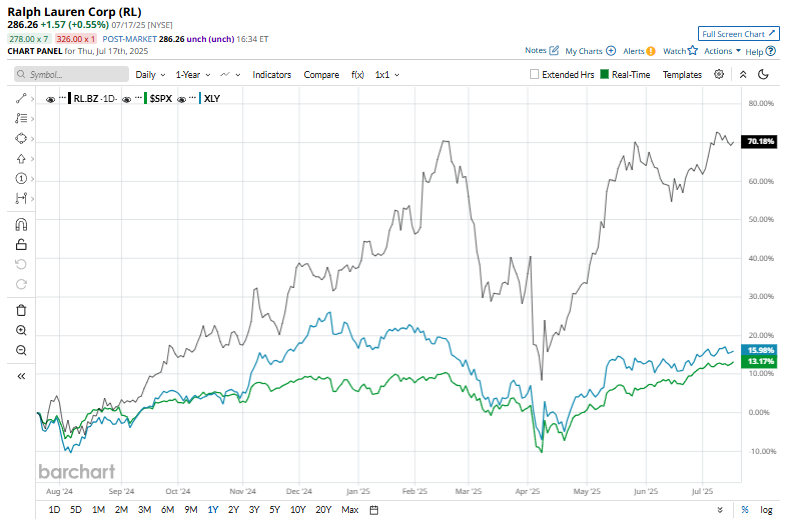

Shares of RL have gained 68.7% over the past 52 weeks, significantly outperforming the S&P 500 Index's ($SPX) 12.7% rise and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 15% return during the same time frame.

On May 22, Ralph Lauren released its fourth quarter earnings and its shares rose over 1%. It closed FY2025 on a high note, reporting a Q4 revenue of $1.70 billion, a solid 8% year-over-year gain. Its comparable direct-to-consumer sales jumped 13%, supported by effective pricing, leaner inventories, and reduced discounting. Its adjusted EPS of $2.27 beat Wall Street expectations of $2.

The company also announced a 10% dividend hike and a new $1.5 billion share repurchase program. Looking ahead, Ralph Lauren expects low-single-digit revenue growth for FY 2026, with stronger gains in the first half.

Analysts' consensus view on RL is fairly bullish, with a "Moderate Buy" rating overall. Among 18 analysts covering the stock, 13 suggest a "Strong Buy," one gives a "Moderate Buy," two recommend a "Hold,” one “Moderate Sell,” and the remaining analyst gives a “Strong Sell.” Its mean price target of $308.35 represents a 7.7% premium to current price levels.