QMMM Holdings (NASDAQ:QMMM), a Cayman Islands holding company, is facing serious allegations of stock manipulation, with financial research firm The Bear Cave warning of a “near-term, severe stock collapse.”

Check out QMMM’s stock price over here.

An Elaborate ‘Pump And Dump’ Scheme Behind QMMM’s Surge?

In a recent report, Edwin Dorsey of The Bear Cave asserted that QMMM’s stock, which has surged 118.45% in the last month, is being artificially inflated by “overseas stock manipulation groups” orchestrating an elaborate “pump and dump” scheme.

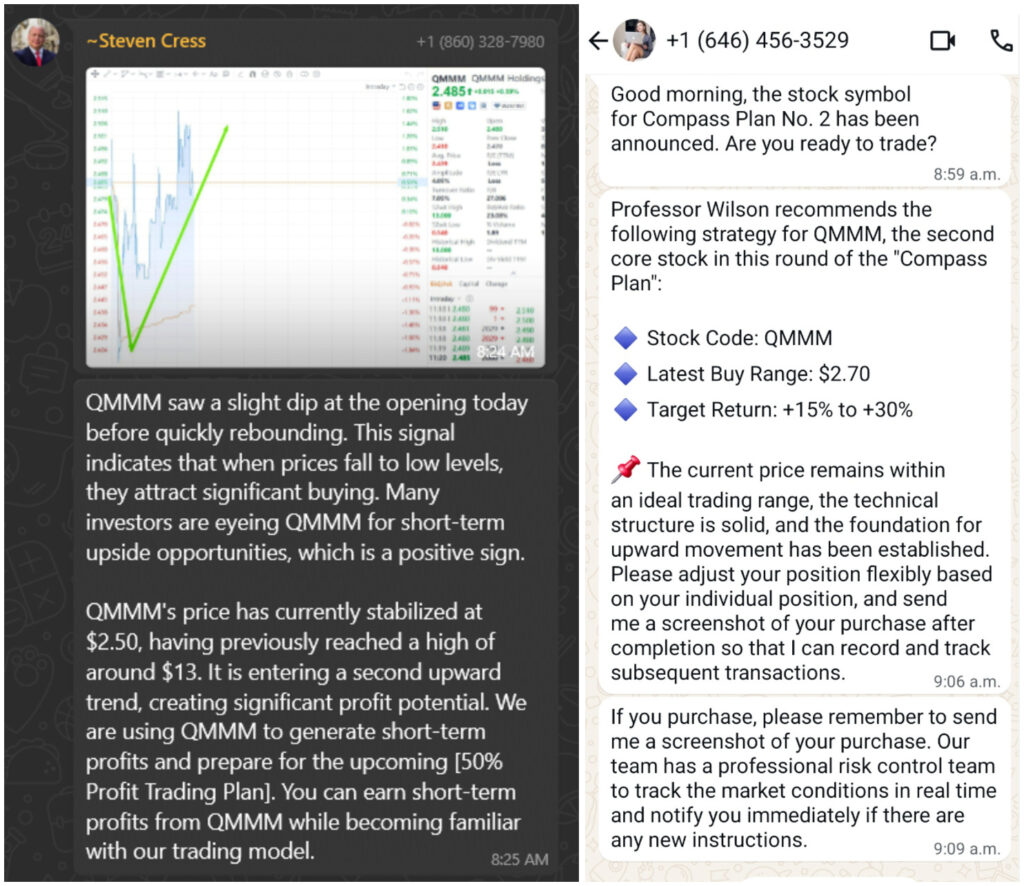

The report highlights a concerning pattern of promotion through private WhatsApp groups, where investors are allegedly being encouraged to buy QMMM shares.

Here’s an example of such a message:

Several Investors Flag The Ongoing Manipulation

According to The Bear Cave, StopNasdaqChinaFraud.com, a crowdsourced database, has received nine submissions since Aug. 3 detailing WhatsApp chats promoting QMMM.

Similarly, Reddit’s VampireStocks community, known for exposing U.S.-listed China stock manipulation scams, has also issued several warnings.

QMMM Has A History Of Coordinated Manipulation

QMMM Holdings, which owns a digital media advertising service in Hong Kong, has a history of declining revenues and posted a net loss of $1.58 million last year.

Its auditor, WWC P.C., expressed “substantial doubt as to [the company's] ability to continue as a going concern.” The stock previously saw a meteoric rise to $12.39 per share in November 2024, only to plummet by approximately 95% to $0.58 within weeks, without any corresponding company news – a potential hallmark of coordinated manipulation.

Recent Equity Issuance Under Scanner

The company’s recent issuance of 40 million shares at $0.20 each through Pacific Century Securities and Revere Securities is also under scrutiny, states The Bear Cave.

These underwriters have been associated with other micro-cap stocks that experienced severe declines shortly after offerings, further fueling concerns about QMMM’s current valuation and the potential for significant investor losses.

Price Action

QMMM Holdings’s shares closed 1.55% lower on Wednesday and fell 0.39% after hours. It was up 277.04% year-to-date and down 1.17% over the year.

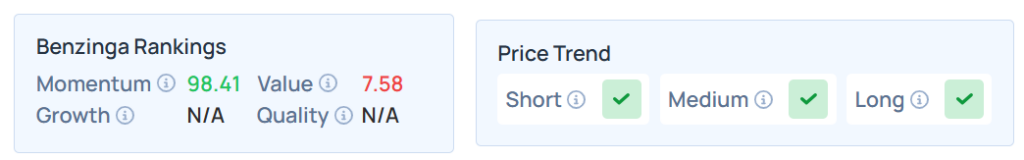

Benzinga’s Edge Stock Rankings indicate that QMMM maintains a stronger price trend in the short, medium, and long terms. However, the stock scores poorly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Wednesday. The SPY was up 0.23% at $646.63, while the QQQ also advanced 0.15% to $573.49, according to Benzinga Pro data.

On Thursday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading in a mixed manner.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock