/Pfizer%20Inc_%20NY%20HQ-by%20JHVEPhoto%20via%20iStock.jpg)

Pfizer, Inc. (PFE) stock still looks cheap ahead of its upcoming Aug. 5 Q2 earnings release. Moreover, investors can make extra income by selling out-of-the-money (OTM) put options.

This article updates my July 2 Barchart piece, “Huge Unusual Volume in Pfizer Put Options Signals Investors Bullish Outlook.”

PFE stock is at $24.23 in midday trading on Tuesday, July 29. That's down from its March 7 high of $26.73. It could be worth substantially more, as this article will show.

Statistically Cheap

I demonstrated in my last article that PFE stock appears to be undervalued based on its historical price-to-earnings (P/E) ratio and analysts' earnings per share (EPS) forecasts. Additionally, based on its average historical dividend yield, PFE could rebound if it were to revert to its historical mean yield.

Price-Earnings Target

For example, analysts project $3.01 EPS this year and $3.08 in 2026. Barchart's analyst survey says the range is between $3.07 this year and $3.06 in 2026 - i.e., a slight decline in EPS.

However, Yahoo! Finance reports a $3.01 EPS estimate for 2025 and $3.08 next year, and Stock Analysis says the analyst range is between $3.03 and $3.13.

So, on average, these surveys range between $3.03 EPS this year and $3.09 next year.

That means PFE stock is trading on a forward P/E multiple of between 8.0x (i.e., $24.23/$3.03) for 2025 and 7.84x ($24.23/$3.09).

This is well below its historical valuation average. For example, Seeking Alpha reports that Pfizer stock has had an average 10.79x forward P/E multiple in the last 5 years. In addition, Morningstar says the 5-year average forward multiple has been 10.16x.

So, using a 10.5x average forward multiple, we can forecast where PFE would trade if it reverts to its mean valuation:

$3.03 EPS x 10.5 = $31.82 2025 target

$3.09 EPS x 10.5 = $32.45 2026 target

So, on average, the price target is $32.13 if PFE were to rise to its average multiple. That presents a potential upside of +32.6% from today.

Dividend Yield Target

The same thing is evident with PFE's average dividend yield. Its yield today is 7.09% (i.e., $1.72/$24.23). But, historically, it's been 4.25% (Morningstar), or 4.58% (Yahoo! Finance).

So, using an average yield of 4.415%, PFE should be worth +71 % more:

$1.72 / 0.0415 = $41.45 or +71.0% more

The bottom line is that if PFE were to trade at its historical mean P/E multiple or dividend yield the stock is deeply undervalued.

In addition, analysts see the stock as too cheap.

Analysts' Target Prices

For example, Yahoo! Finance reports that 24 analysts have an average price target of $28.67, or +18% higher. Barchart's mean survey target is $27.81, and Stock Analysis says 14 analysts have an average price target of $29.92, or +23% higher.

Moreover, AnaChart.com, which tracks recent analyst recommendations and write-ups, reports that 17 analysts have an average $32.21 price target.

So, on average, these surveys show that analysts believe PFE stock is worth $29.65. That is potentially +22.3% higher than today.

Summary Valuation

As a result, using these three metrics, PFE stock looks deeply undervalued:

P/E based target ……. $32.13

Div Yield target ……… $41.45

Analysts' targets ……. $29.65

Average Target Price … $34.41, or over $10 higher, and a potential upside of +42%.

However, there is no guarantee this will happen over the next 12 months.

As a result, it makes sense to set a lower buy-in price and get paid while waiting for this to occur. That's what happens when an investor sells short out-of-the-money (OTM) puts in nearby expiry periods.

Shorting OTM PFE Put Options for Income

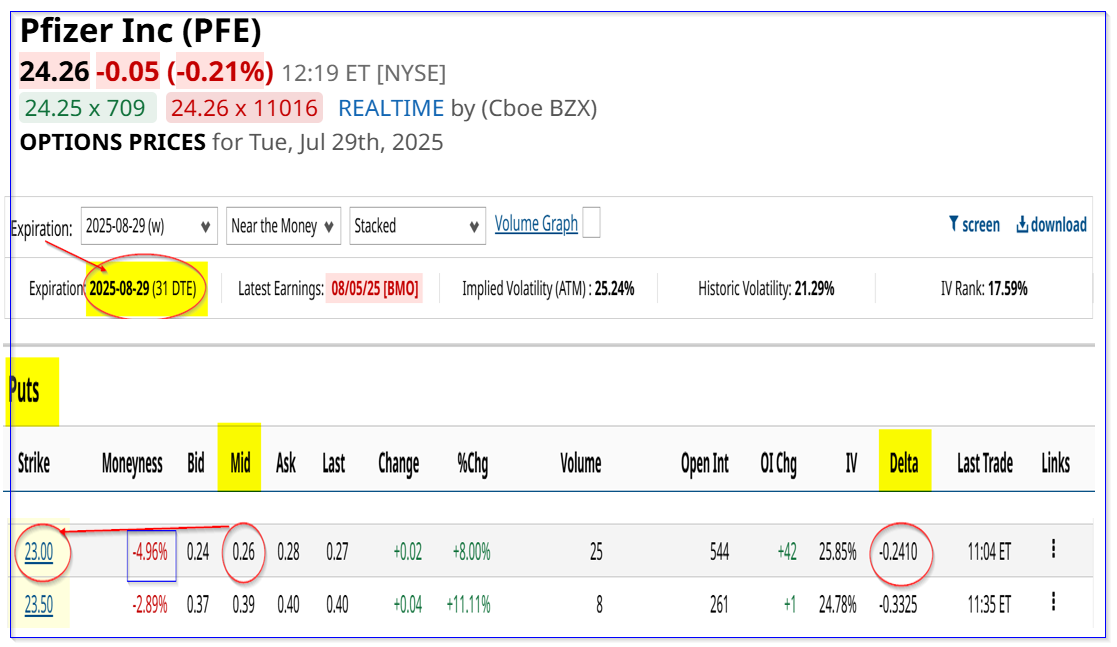

For example, look at the Aug. 29 expiration period, which is one month from today. It shows that the $23.00 put option exercise price, which is 5% below today's trading price (i.e., out-of-the-money), has an attractive yield.

Since the midpoing premium is 26 cents, that offers a short-seller (i.e., an investor who enters a trade to “Sell to Open”) an immediate 1.13% yield (i.e., $0.26/$23.00 = 0.0113).

This also means that even if PFE stock falls to $23.00, the investor has a breakeven point of $23.00-$0.26, or $22.74. That is 6.3% below today's price, providing good downside protection.

Moreover, the delta ratio is low at just 24%, implying a low probability that the stock will fall to this strike price over the next month.

That implies an investor stands to make an expected return of over 3.3% over the next 3 months if this trade can be repeated. In effect, it allows investors at today's undervalued price to make extra income.

In addition, even if PFE falls to $23.00, the investor's potential upside is quite attractive, over +50%:

$34.41 target price / $22.74 breakeven point = 1.513 - 1 = +51.3% upside

The bottom line here is that PFE stock looks deeply undervalued on a statistical basis. One way to play it is to short OTM puts to generate extra income.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.