Shares of database technology giant Oracle fell in Tuesday trading, pushing Oracle stock firmly below its 21-day moving average. Oracle shares appear to be taking a breather after a nearly 50% rally in June and July.

Oracle stock was down more than 4% at 238.46 in recent action on the stock market today. Since reaching a high of 260.87 on July 31, Oracle stock has edged lower. The stock is off about 5% for the month of August. That includes a decline last week that followed a report that Oracle is cutting jobs within its fast-growing cloud infrastructure business.

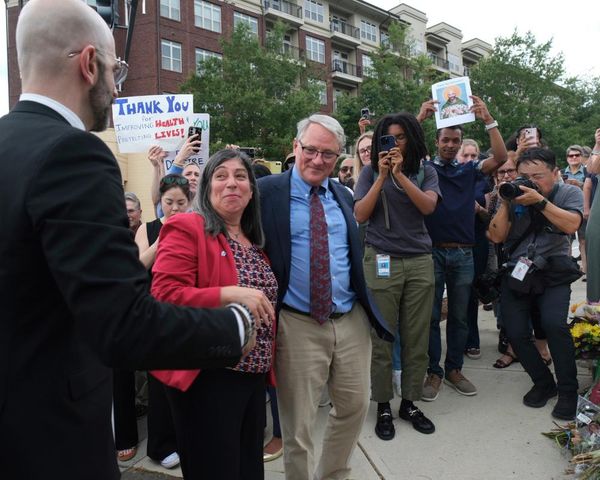

The catalyst for Tuesday's move is less clear. One factor could be that Bloomberg reported Monday that Oracle's longtime Chief Security Officer, Mary Ann Davidson, is leaving the company as part of its reorganization.

Investors are also grappling with questions about the sustainability of AI-fueled stock rallies. AI stock Palantir Technologies was also lower Tuesday. Shares of chipmaker and AI leader Nvidia were down about 2% in recent action.

OpenAI Chief Executive Sam Altman reportedly cautioned that investors may be "overexcited" about AI. And the lukewarm reception for OpenAI's latest GPT-5 models is sparking concern that AI progress could be slowing.

Oracle's AI Rally

Oracle's rally has been fueled by optimism it will harness AI demand to further grow its Oracle Cloud Infrastructure offering. OCI is a smaller but fast-growing challenger to Amazon and Microsoft in the market for renting cloud computing services to enterprises. Oracle got a big boost last month when it announced it will develop 4.5 gigawatts of data center capacity for OpenAI.

But Oracle is investing significantly to build up the data center infrastructure required for AI-related demand. Analysts are watching the expenditures.

The next test for Oracle will come early next month when the company reports its fiscal first-quarter earnings. Its quarter wraps up Aug. 31.

The results will offer Oracle's first chance to back up lofty targets it provided following its fiscal Q4 results in early June. Chief Executive Safra Catz said she expects Oracle's overall cloud revenue growth rate to increase to more than 40% for fiscal 2026 compared to 24% in the just-completed fiscal 2025. That includes a projection for cloud infrastructure revenue growth to exceed 70%, compared to 50% last fiscal year.

That strong forecast and overall AI bullishness have helped Oracle outperform a shaky market for software stocks. Oracle is the second-best 2025 performer in the iShares Expanded Tech-Software Sector ETF, behind only Palantir. The IGV ETF focuses on enterprise software stocks.

"The growing fear that AI will fundamentally change how enterprise software is traditionally built and used has weighed heavily on investor sentiment," Jefferies analyst Brent Thill wrote to clients Monday. "Although the IGV is still positive (+9% year-to-date), the performance is a mirage driven by three names — Palantir, Oracle and Microsoft — and the sector continues to underperform the rest of its tech peers."

Oracle Stock: Fiscal Q2 Results In September

With Tuesday's move, Oracle stock fell decisively below its 21-day line. Oracle stock found support at the short-term level last week, bouncing back to close trading last Friday slightly above the line. Shares remain about 3.5% above Oracle's 50-day moving average.

Overall, Oracle stock is up 44% year to date. Last year, Oracle surged 60% to post the company's best share-price-growth performance since 1999.

Meanwhile, Oracle stock has an IBD Composite Rating of 92 out of 99, according to IBD Stock Checkup. The score combines five separate proprietary ratings into one rating. The best growth stocks have a Composite Rating of 90 or better.