Throughout the post-pandemic period, the concept of "revenge travel" — a phenomenon where people sought to make up for lost time and experiences due to COVID-related restrictions — has been a powerful fundamental catalyst for businesses like Norwegian Cruise Line Holdings Ltd (NYSE:NCLH). Unfortunately, as economic difficulties continue to pile up, the idea that NCLH stock can continue to rise above a wall of worries is suspect. As such, there may be opportunities for the bearish side of the trade.

On paper, Norwegian doesn't necessarily appear as a candidate for downside speculation. In the cruise ship operator's second-quarter disclosure, the company posted earnings per share of 51 cents, meeting analysts' consensus estimate. What's more, it was a notable improvement over the year-ago quarter's print of 40 cents. On the top line, Norwegian's $2.52 billion admittedly missed the consensus estimate of $2.55 billion. However, the figure represented an improvement over last year's $2.37 billion.

Still, the devil may be in the details. The cruise ship operator has massive long-term debt to the tune of $12.63 billion, per its second-quarter press release. After paying net interest expense of nearly $237 million, the company was left with net income of only $30 million. That's a razor-thin margin amid a macro environment that isn't conducive to enterprises serving the consumer discretionary market.

Adding to concerns, the latest earnings results from big-box retailers don't provide much confidence. For example, Walmart Inc. (NYSE:WMT) produced a mixed earnings report, missing on the bottom line. During the conference call, management noted that the company has witnessed cost increases on a weekly basis as it replenishes inventory at post-tariff price levels.

Rival Target Corp (NYSE:TGT) didn't do any better. Although the retailer beat earnings and revenue expectations, it suffered from same-store contractions, along with a decrease in foot traffic. With consumers closing their pocketbooks, it's going to be increasingly difficult to justify bidding up NCLH stock.

A Cloudy Forecast Likely Awaits NCLH Stock

Ultimately, that's arguably the biggest concern for Norwegian in the short term. Since early April, NCLH stock has enjoyed a strong run. But since the end of July — which coincides with the cruise ship operator's second-quarter release — NCLH has noticeably struggled. This might not be a coincidence.

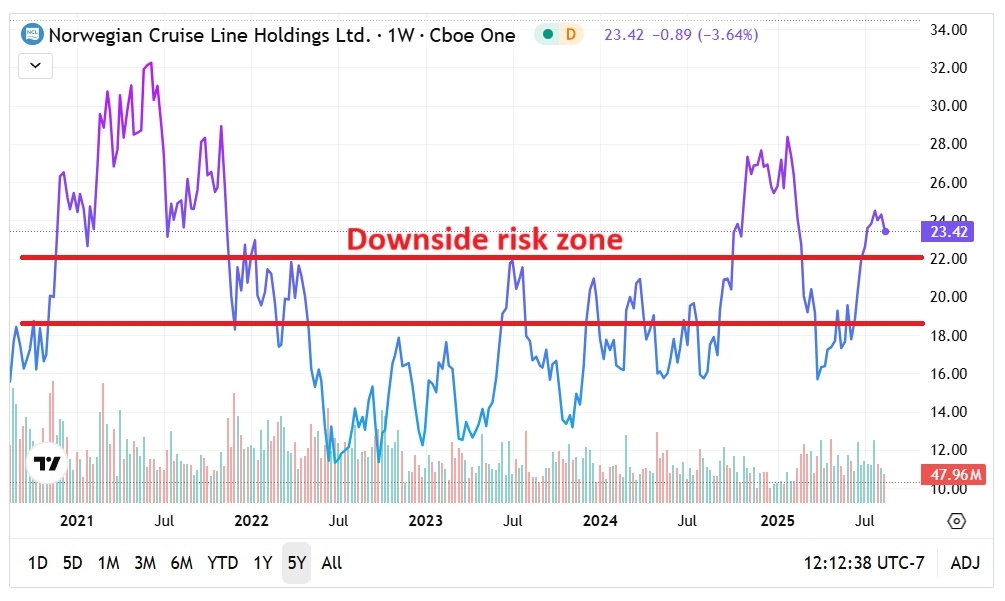

Looking at the technical chart, the risk for the security is that it's extremely peaky, which isn't all that surprising. After all, the sustained viability of consumer spending has long been a pressing concern for NCLH stock throughout the post-pandemic period. With major retailers delivering a not-so-pleasant read of the macro picture, the bearish proposition carries weight.

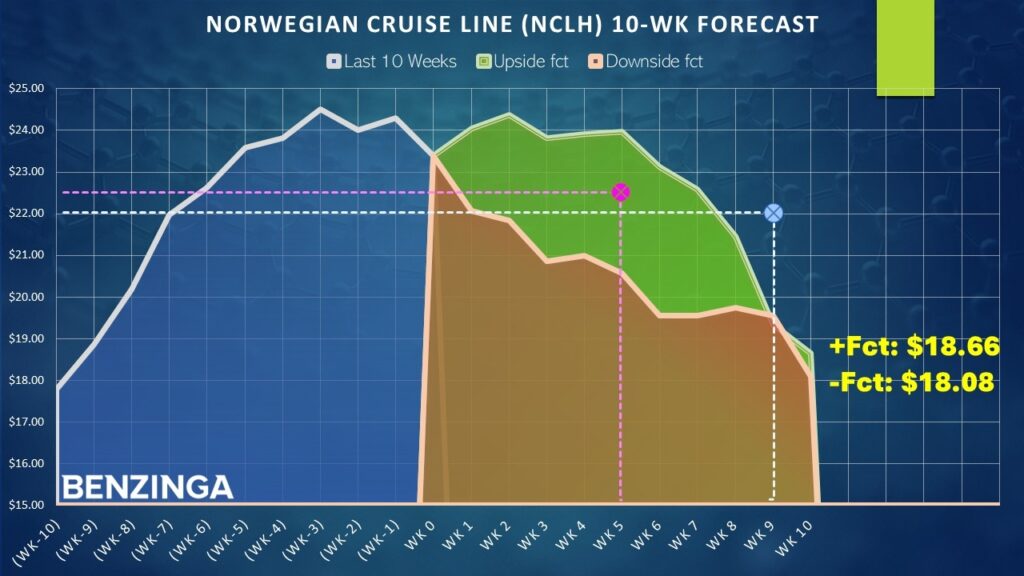

But the strongest argument may be the statistical case working against NCLH stock. Since January 2019, it has been extremely rare to see NCLH string together a long series of acquisitive weeks. Notably, in the trailing 10 weeks (including the current one), the market has essentially voted to buy shares eight times and sell only two times. During this period, NCLH enjoyed an upward trajectory. For convenience, this sequence can be labeled 8-2-U.

Again, it's a rare signal, having only occurred 11 times on a rolling basis. Interestingly, whenever the 8-2-U sequence flashes, there's a 45.45% chance that the following week's price action will result in upside. That's worse than the baseline probability or the chance that a long position will rise on any given week, which currently stands at 53.03%.

However, what's more problematic are the behavioral state transitions. Generally, extended series of positive weeks tend to resolve negatively. Further, based on past analogs, even positive responses to the 8-2-U sequence eventually have a tendency of rolling over and entering a downward spiral — unless some exceptionally bullish exogenous factor reverses the trend.

Outside of such bullish intervention? It's going to be difficult to justify investing in NCLH stock given so many headwinds. On the other hand, it does open the door to bearish speculation.

Two Bearish Tickets To Consider

Using the market intelligence above, the one trade that arguably stands out the most is the 23/22 bear put spread expiring Oct. 17. This transaction involves buying the $23 put and simultaneously selling the $22 put, for a net debit paid of $41 (the most that can be lost in the trade). Should NCLH stock fall through the short strike price ($22) at expiration, the maximum profit is $59, a payout of nearly 144%.

The language of puts can be confusing. When you're buying puts, you hold a long position in a bearish trade. When you're selling puts, you hold a short position in a neutral-to-bullish trade. With the above transaction, you're using the income generated from the short put position to offset some of the debit required to buy the long put. However, the short put doesn't expose you to unlimited losses because you own a put at a higher strike price, thus offsetting any potential liability.

Another trade — which is a lot riskier to consider — is the 23.00/22.50 bear put spread expiring Sept. 19. This trade requires only a $22 net debit for the chance to earn a max profit of $28 or a payout of over 127%. What makes this more treacherous is that NCLH stock could still stubbornly trade sideways, which would likely render the spread a complete money pit.

The other risk is that because the 8-2-U sequence is so rare, it's difficult to state that it has empirical reliability. From a purely mathematical perspective, the statistics would be considered naïve. That said, in combination with other factors, the narratives seem to align. In the short-to-intermediate term, NCLH stock is likelier to face downside pressure than an upsized rally.

So, you can either watch or take a gamble with these relatively low-cost bear put spreads.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock