Although several innovators tied to the explosive artificial-intelligence ecosystem swung higher on Thursday, Microchip Technology Inc (NASDAQ:MCHP) represented a conspicuous laggard. What appears to have dragged down the semiconductor firm — which specializes in microcontrollers used in industrial, automotive and embedded systems — is investor anxiety related to management's tepid outlook. Still, the red ink has arguably contributed to a counterintuitively bullish thesis for short-term speculators.

On surface level, Microchip should be humming. For the fiscal first quarter (released Aug. 7), the semiconductor specialist posted earnings of 27 cents per share, beating out Wall Street analysts' consensus target of 21 cents. On the top line, the company generated $1.08 billion, above the consensus view of $1.05 billion.

However, investors may have noticed the big drop-off from the year-ago quarter's results. At the time, earnings hit 53 cents per share on revenue of $1.24 billion. But what may have really triggered the subsequent volatility in MCHP stock was the conservative outlook for the second quarter. Management guided net sales to land between $1.11 billion to $1.15 billion or $1.13 billion at the midpoint.

The problem? In the third quarter last fiscal year, Microchip generated $1.16 billion. So, it's not really a good look.

This may also explain why Microchip hasn't broadly joined today's enthusiasm toward other AI-related names. For example, Pure Storage Inc (NYSE:PSTG) saw its shares pop 30% in the afternoon session. Other entities, such as Marvell Technology Inc (NASDAQ:MRVL) and Micron Technology Inc (NASDAQ:MU) also benefited from the broader tailwind.

Unfortunately for Microchip, its AI-related applications feature longer product cycles and less explosive growth compared to entities tied into hyperscaler contracts. Nevertheless, the disappointing performance could be a discounted prospect for market gamblers.

Taking Advantage Of A Short Window Of Opportunity In MCHP Stock

Ordinarily, when a security tumbles while its sector peers rise, the contrarian urge is to acquire shares in the open market. However, the options (or derivatives) market could be a more effective solution since not all publicly traded assets move in a predictably linear fashion.

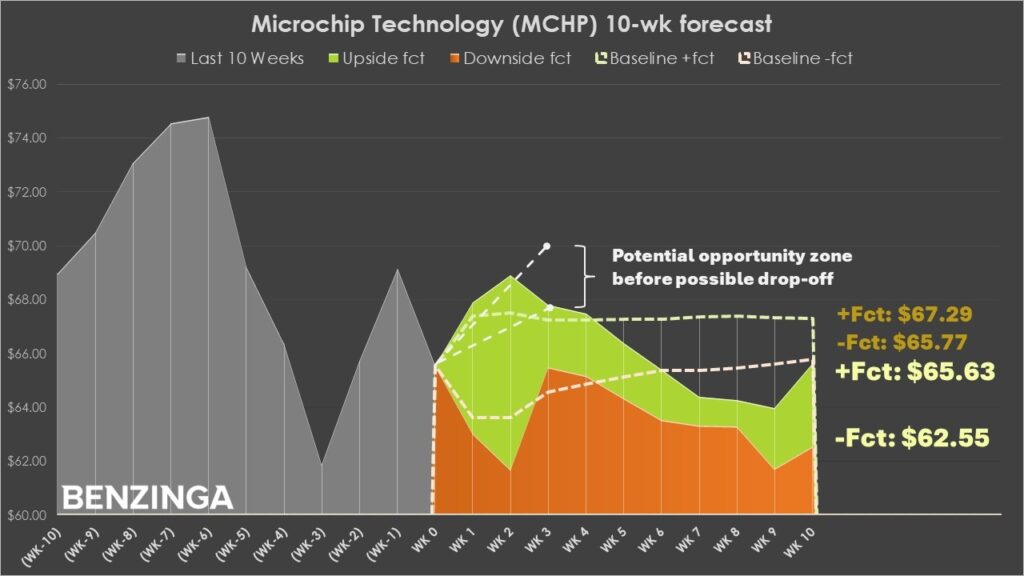

Case in point is MCHP stock. Using pathway-dependent analytics — which projects forward movement based on the target security's past pricing geometry — MCHP would be expected to have a drift that ranges from a lower median price of about $65.77 to an upper median price of about $67.29.

But right now, MCHP stock is flashing a rare quantitative signal. In the past 10 weeks, the security has printed six up weeks and four down weeks, yet the overall trajectory has been negative. For classification purposes, this sequence can be labeled 6-4-D.

On a rolling basis, this signal has only flashed 19 times. It's notable because in the following week, the chance of upside is 57.89%, a bit higher than the baseline probability of 52.01%. But what's intriguing is that after a potential pop over the next two weeks, the conditional drift of the 6-4-D sequence could see MCHP stock fade to a range between $62.55 and $65.63.

In other words, it's not clear that Microchip represents a solid investment over the next few months. Based on the conditional data, MCHP stock may only be viable for the next two to three weeks. That's why options may make sense, potentially allowing traders to profit in the near term and exit before the opportunity goes sour.

Adding to the speculation is unusual options activity that Benzinga identified on Aug. 13. Traders targeted the $70 call expiring Sept. 19 at the time, suggesting that this is a price level of interest for the bulls. Therefore, it wouldn't be unreasonable to consider taking a shot here since the target roughly aligns with what pathway-dependent analytics suggest would be possible.

A Splash-And-Dash Opportunity

Based on the market intelligence above, the trade that stands out is the 66/70 bull call spread expiring Sept. 19. This transaction involves buying the $66 call and simultaneously selling the $70 call, for a net debit paid of $170 (the most that can be lost in the transaction). Should MCHP stock rise through the short strike price ($70) at expiration, the maximum profit stands at $230, a profit of over 135%.

Breakeven for the above trade comes in at $67.70, about a 3.4% move from the current market price.

Given how the drift from the 6-4-D sequence is expected to pan out, targeting an options chain beyond Sept. 19 may not be prudent until market conditions change and justify a rethink. Otherwise, based on the current sentiment regime, MCHP stock may drift downward. In that scenario, a bear put spread expiring October may be in play.

For now, the opportunity appears to lean toward the bulls. If you're an impatient trader looking for a quick scalp, Microchip could be your answer.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Photo: Shutterstock