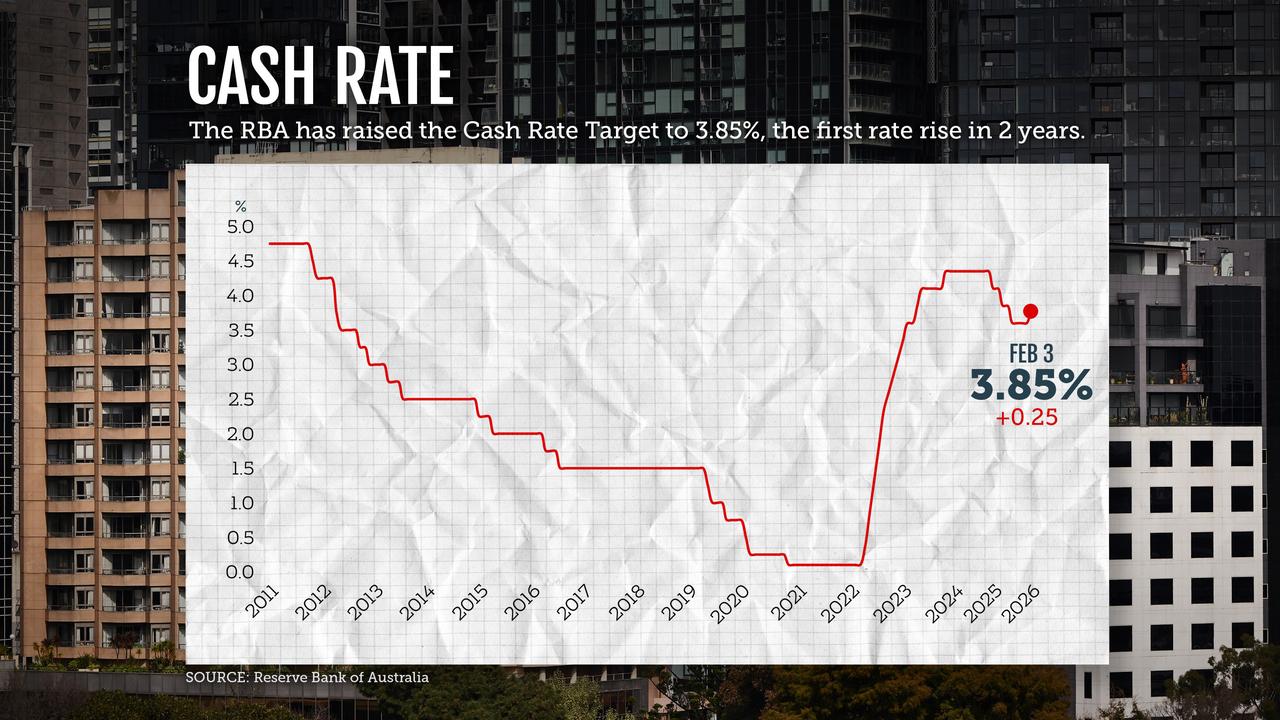

Borrowers have borne the brunt of a resurgence in inflation, with the Reserve Bank lifting interest rates and leaving the door open for more.

The RBA's monetary policy board lifted the cash rate by 25 basis points to 3.85 per cent in a unanimous decision on Tuesday.

The move was tipped by most economists and expected by financial markets after inflation surged back above the central bank's two to three per cent target band.

But that will do little to ease the blow for borrowers, who will have their monthly repayments increase by more than $90 on a $600,000 mortgage, assuming lenders pass on the increase in full.

As well as anxiety about a "material" pick-up in inflation, labour force data and consumer spending were above Reserve Bank forecasts, heightening fears the economy was running above capacity and contributing to inflationary pressures.

"The recent run of data gives the board a clear enough view that the underlying pulse of inflation is too strong," governor Michele Bullock said.

While part of the rise in inflation came down to temporary factors, there was enough to suggest capacity pressures were greater than previously assessed, the board said in its accompanying statement.

"The board judged that inflation is likely to remain above target for some time and it was appropriate to increase the cash rate target," it said.

But the decision was a difficult one for the Reserve Bank after cutting interest rates as recently as August.

After bucking the trend of peer economies by intentionally keeping rates lower for longer to prevent a spike in unemployment, the RBA becomes the first major central bank to return to interest rate rises since the pandemic.

Following the decision, the Aussie dollar jumped above US70c, while the ASX200 slumped 35 points lower.

Financial markets were pricing another rate hike by June.

In the bank's updated economic forecasts, RBA staff revised up their inflation assumptions, with core inflation expected to come in at 3.2 per cent by the end of 2026, up from a November prediction of 2.7 per cent.

With the RBA expecting higher inflation, lower GDP growth, higher medium-term unemployment and higher assumed interest rate path than previously thought, it all implies a high likelihood of an additional rate hike, ANZ Bank's head of Australian economics Adam Boyton said.

But NAB chief economist Sally Auld said given the increasing pressures on inflation, it was unlikely to be a "one-and-done" scenario for the RBA.

"We continue to forecast a follow-up 25bp hike in May, although risks are biased to an earlier hike and the possibility of more than just a modest 50bp recalibration," she said.

The board said it would use upcoming data about the global economy, domestic demand, inflation and the labour market to guide future decisions.

Treasurer Jim Chalmers said the decision was difficult news for millions of Australians with a mortgage and put additional pressure on families and businesses.

But he was quick to point out the board statement did not mention government spending as a driver of inflation.

"It makes it very clear the pressure on inflation is coming from private demand," Dr Chalmers said.

Shadow treasurer Ted O'Brien said spending blowouts in Dr Chalmers' mid-year budget update pushed more money into the economy, forcing the RBA to hike rates to get inflation under control.

Ms Bullock declined to point the finger at governments for contributing to the rise in inflation.

"Years of weak to no productivity growth is a big part of that story," she said.