A preliminary revision from the Bureau of Labor Statistics (BLS) has erased 911,000 previously reported U.S. jobs, sending shockwaves through economic circles and cementing expectations for a Federal Reserve interest rate cut next week.

The historic downward adjustment for the year through March 2025 has raised fresh doubts about the strength of the labor market, with analysts warning it could stall a record-setting market rally and introduce new fears of stagflation.

Is AI Automating Tech Jobs Away?

Drilling into the details, the data points to specific areas of weakness, particularly in the tech sector. Bill Adams, Chief Economist for Comerica Bank, observed that the information industry saw an outsized downward revision.

“The revised data show more clearly that AI is automating away tech jobs,” Adams stated, offering a stark explanation for the slowdown in a once-booming sector. The report also showed significant cuts in leisure and hospitality, retail, and professional services, indicating the weakness was broad-based and revealed an economy that “entered 2025 with less momentum than previously understood.”

Stagflation On Cards?

The revision, the largest in U.S. history, reveals a significantly weaker job market than previously understood. Experts immediately pointed to the dual-edged implications for the economy.

“The jobs picture keeps deteriorating and while that should make it easier for the Fed to cut rates this fall, it could also throw some cold water on the recent rally,” said Chris Zaccarelli, Chief Investment Officer for Northlight Asset Management.

He cautioned that if upcoming inflation data is high, “the market will begin worrying about stagflation”—a toxic combination of rising prices and slowing growth.

See Also: Nearly 1 Million Jobs Disappeared—And No One Noticed Until Now

BLS Revision Was ‘Outsized’ As Compared To Historical Average

This sentiment was echoed by others who see the data as a clear signal for policy action.

“A deteriorating labor market will allow the Fed to highlight the need to ease rates,” said Jeffrey Roach, Chief Economist for LPL Financial, noting the revision was an outsized -0.6% compared to the historical average of +/-0.2%.

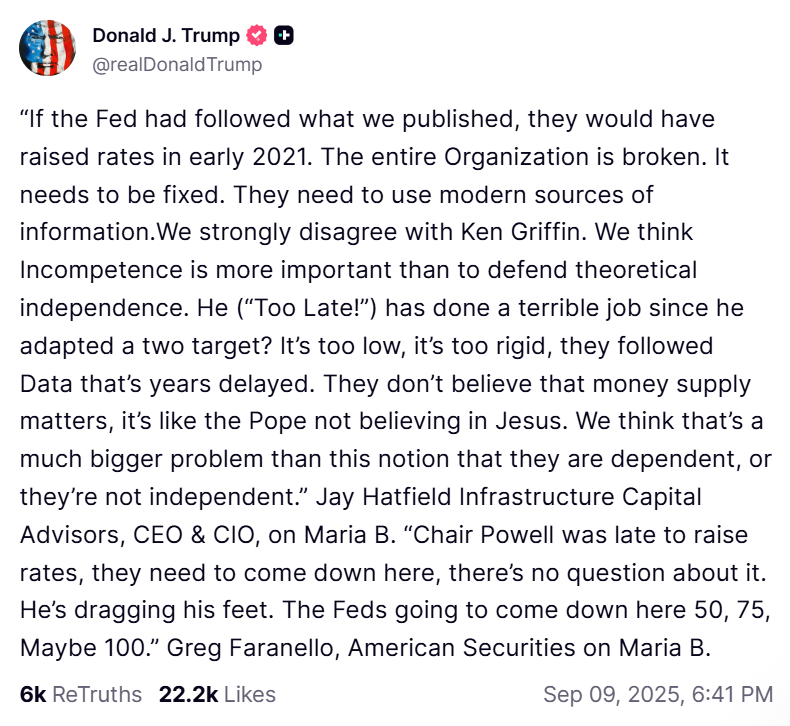

Trump Slams The Fed Again!

The political world also took notice, with President Donald Trump using the revision to slam the Fed for being “dangerously behind the curve.”

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 0.20% at $651.62, while the QQQ advanced 0.14% to $651.62, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzing

Image via Shutterstock