/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

It has been some time since Tesla (TSLA) CEO Elon Musk has teased an affordable model. In fact, perhaps the first recorded instance of Musk talking about a cheaper Tesla model was way back in 2006 when, in an official blog, he stated, “Build sports car. Use that money to build an affordable car. Use that money to build an even more affordable car.”

After years of missed deadlines, maybe 2025 is the year when we finally get to see an economical version of the world’s most popular EV, at least if a recent note from Deutsche Bank is to be believed. In an earlier note, the firm estimated the cost of the expectantly titled new Model Q or Model 2 to be less than $30,000, competing with cars such as the Volkswagen ID.3 and the BYD Dolphin.

What to Expect in the New Model

Tesla’s long-anticipated affordable model, unofficially referred to as either the Model Q or Model 2, is generating significant buzz, and for good reason. The model is expected to be built in accordance with the company’s proprietary manufacturing process. The idea here is to simplify and accelerate production, which could help lower costs. If current estimates hold, the car would be shorter than the Model 3 by roughly 15% and lighter by about 30%, suggesting a much more compact and efficient design.

The real differentiator, though, may be the battery choice. Tesla seems likely to opt for lithium iron phosphate (LFP) batteries for this model. These aren’t just cheaper to produce than the standard lithium-ion alternatives, they also tend to last longer, which makes them a logical pick for a cost-conscious EV. At this point, two battery configurations are being speculated: a 53 kWh pack with rear-wheel drive, estimated to offer around 310 miles of range, and a 75 kWh all-wheel drive variant, which might surprisingly come with slightly less range due to increased power demands.

Meanwhile, when plugged into one of Tesla’s V3 Superchargers, the battery could be pushed to 80% in just 20 to 25 minutes, a timeframe that makes long-distance travel feel less burdensome. At home, using a standard Level 2 charger, owners could expect to gain between 30 and 40 miles of range per hour, a rate that would comfortably cover daily driving needs.

On the performance side, early figures suggest the rear-wheel version might accelerate from zero to 60 miles per hour in about 6 to 7 seconds. The dual-motor all-wheel variant, by contrast, may complete that sprint in under five seconds, potentially making it one of the fastest vehicles in its anticipated price segment.

Tesla Is Here for the Long Haul

Tesla has had a rough 2025 so far, seeing its share price fall by 17.6% on a YTD basis, thanks to Musk’s political machinations and intense competitive pressure from Chinese EV companies. However, the company with a market cap of $1.1 trillion still has a compelling long-term story.

I had highlighted this in a recent piece, exploring how bulls expect autonomous vehicles and robotics to be the key drivers.

In terms of its vehicle division, Tesla has something few others can claim: a huge stream of real-world driving data. With over a million vehicles out there, each one constantly feeding back info, the company has built a rich foundation for its autonomous driving efforts. Combined with its own AI systems, that data could give Tesla a serious head start in the race toward self-driving services.

Then there’s the Optimus robot with a clear initial vision. The first goal is to use it in its own factories. If the plan works, and production ramps up at the expected price range of $20,000 to $30,000, there could be big demand, not just in industry, but eventually at home too.

Overall, what bodes well for Tesla is its ability to keep things in-house. From hardware to software, from cars to energy, the company runs a tightly controlled operation. That gives it room to move fast and experiment where others might stall. And with global support growing for green tech and looser regulations on the horizon, the timing may be on Tesla’s side.

Financials Not a Concern (Yet)

Tesla has had a few rough quarters financially, but it hasn’t lost its footing just yet.

The latest numbers released for Q1 2025 didn’t meet Wall Street’s expectations. That might be concerning on the surface, but it’s not entirely surprising, with heavy capex being done on the part of the company in various fields such as AI and robotics.

In the first quarter, the company reported $19.3 billion in total revenue, which is a 9% drop compared to the same time last year. The core automotive business saw a steeper fall, down 20% to $13.9 billion. Meanwhile, some of Tesla’s smaller divisions fared better. Revenue from energy generation jumped 67%, and the services segment rose 15%, hitting $2.7 billion and $2.6 billion, respectively.

Profit-wise, things got tighter. Earnings per share landed at $0.27, 40% lower than last year and well below the expected $0.41. This hit came from rising production costs and slower delivery rates.

Even so, Tesla made progress in generating cash. Operating cash flow reached $2.2 billion, a huge lift from just $242 million a year earlier. Free cash flow turned positive too, at $664 million, compared to the $2.5 billion outflow from the same quarter last year. Overall, the company also ended the period with $37 billion in cash and equivalents.

Tesla is set to report its Q2 earnings on July 23 after market close, with analysts expecting EPS of $0.29.

Analyst Opinions on TSLA Stock

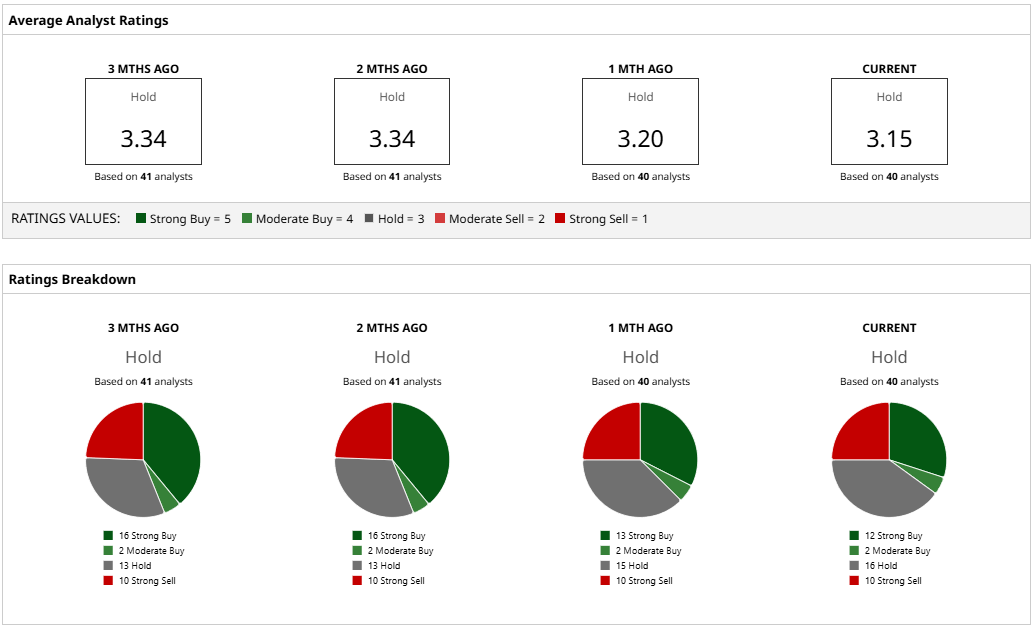

The analyst community has assigned a rating of “Hold” for Tesla stock, with a mean target price of $297.86, which has already been surpassed. However, the high target price of $500 implies upside potential of about 51% from current levels. Out of 40 analysts covering the stock, 12 have a “Strong Buy” rating, two have a “Moderate Buy” rating, 16 have a “Hold” rating, and 10 have a “Strong Sell” rating.