/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)

Ever since the artificial intelligence (AI) mania first gripped markets in 2023, Apple (AAPL) has been trying to convince Wall Street that it is very much in the race and not slacking off in its efforts, as many believe.

At times, the iPhone maker has been able to prove its point, particularly with the initial “Apple Intelligence” features that it revealed at its 2024 Worldwide Developer Conference (WWDC). However, this year’s WWDC was quite a lackluster event where the company did not reveal any groundbreaking features, and at best, seemed to play catch-up with other players.

Last week, Apple released its earnings for the June quarter, where it faced several questions about its AI strategy, as expected. Separately, at an all-hands meeting, CEO Tim Cook reportedly termed AI an opportunity as big as the internet and emphasized, “Apple must do this. Apple will do this. This is sort of ours to grab.”

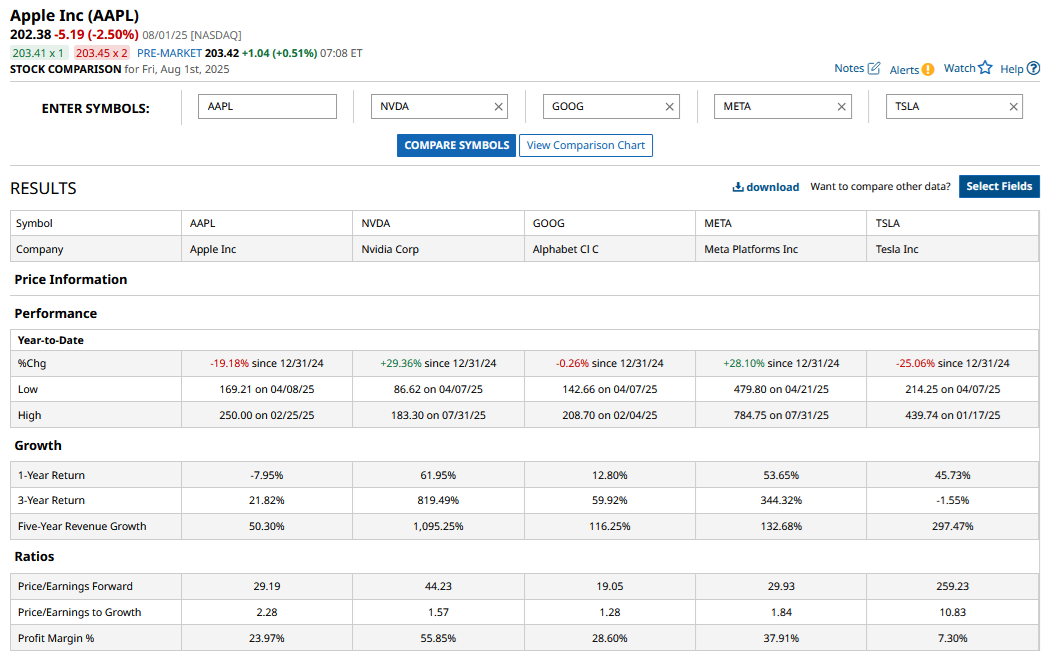

In this article, we’ll examine whether Apple – which is down 19.2% for the year, in part due to apprehensions about it losing out in the AI race – is a “buy” now, as the company plans to accelerate its AI endeavors.

Apple Had a Remarkable Quarter

To begin with, let’s look at a snapshot of Apple’s fiscal Q3 2025 earnings, which were even stronger than what I had anticipated in the pre-earnings analysis. The company’s revenues rose 10% in the quarter to $94.04 billion – the highest growth since December 2021 – and a June quarter record. The sales were also well ahead of the $89.53 billion that analysts were expecting.

iPhone revenues rose 13% to $44.58 billion, easily surpassing the $40.22 billion that analysts were modeling. Services revenues also topped Street estimates and so did the gross margin, which came in at 46.5% (analysts were expecting the metric at 45.9%).

While usually you might expect a massive jump in AAPL stock following such stellar numbers, the stock closed in the red on Friday, Aug. 1, in part due to the broader market sell-off on soft employment data and tariff uncertainty. Moreover, Apple attributed part of its growth in the quarter to demand pull forward in the U.S. amid the tariff uncertainty.

Apple Steps On the Gas in AI

While AI was pretty much the theme for tech companies’ earnings calls over the last few quarters, there hasn’t been much discussion on the topic during Apple’s earnings calls. The fiscal Q3 earnings call was different, though, and quite early in his commentary, CEO Tim Cook said he is “excited to share some updates across our AI work,” terming AI “one of the most profound technologies of our lifetime.”

Here are some of the key takeaways on Apple’s AI Strategy:

- Apple has released 20 Apple Intelligence features until now and is making “good progress on a more personalized Siri,” which it expects to release next year.

- Apple has increased its capex towards AI and is “reallocating a fair number of people to focus on AI features within the company.” Without providing specifics, Cook alluded to an “exciting road map ahead” for new AI products.

- The company continues to highlight privacy as the USP of its AI features and said that it is investing in private cloud compute, including in its own data centers.

- Apple alluded to possible M&A in the AI space, with Cook saying, “We're very open to M&A that accelerates our road map.” He even touted the possibility of a major acquisition – something not very common for Apple – and said, “We are not stuck on a certain size.”

Apple Stock Forecast After Q2 Earnings

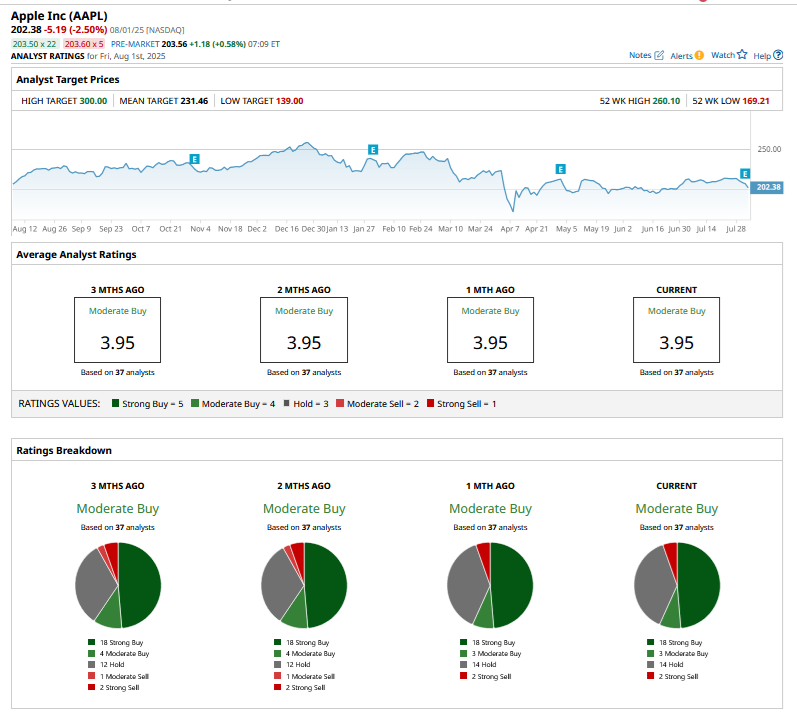

Several brokerages, including UBS, Citigroup, Bank of America, Barclays, and Morgan Stanley, all raised Apple’s target price following the company’s earnings. The stock’s mean target price of $231.46 is 14.4% higher than the Aug. 1 closing price, while the Street-high target price of $300 is 48.2% higher.

After the last few quarters of tepid top-line growth, Apple is now seeing a revival and, after strong growth in the June quarter, management has forecast revenues to rise by “mid- to high single digits" in the September quarter, as well. The company has managed to grow its margins despite all of these headwinds and expects its gross margins to be between 46%-47% in the September quarter after accounting for $1.1 billion impact from tariffs.

Should You Buy Apple Stock Now?

The tariff uncertainty remains a hanging sword for Apple, and any adverse actions from President Trump could put pressure on AAPL stock. However, I believe the Cupertino-based company has put the worst behind it, and after the massive underperformance in the first seven months of the year, AAPL looks set to outperform the broader markets in the remaining months this year as it steps up the gas in AI.

On the date of publication, Mohit Oberoi had a position in: AAPL . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.