India’s diesel exports to Europe surged to an 11-month high in August, as European buyers rushed to stockpile supplies before a looming EU ban on fuels made from Russian crude.

Shipments hit about 260,000 barrels per day last month – a jump of 63 per cent on July and more than double the level a year earlier, according to tanker-tracking firm Kpler.

Almost all the cargoes came from Reliance Industries, India’s largest private refiner owned by industrialist Mukesh Ambani and his family.

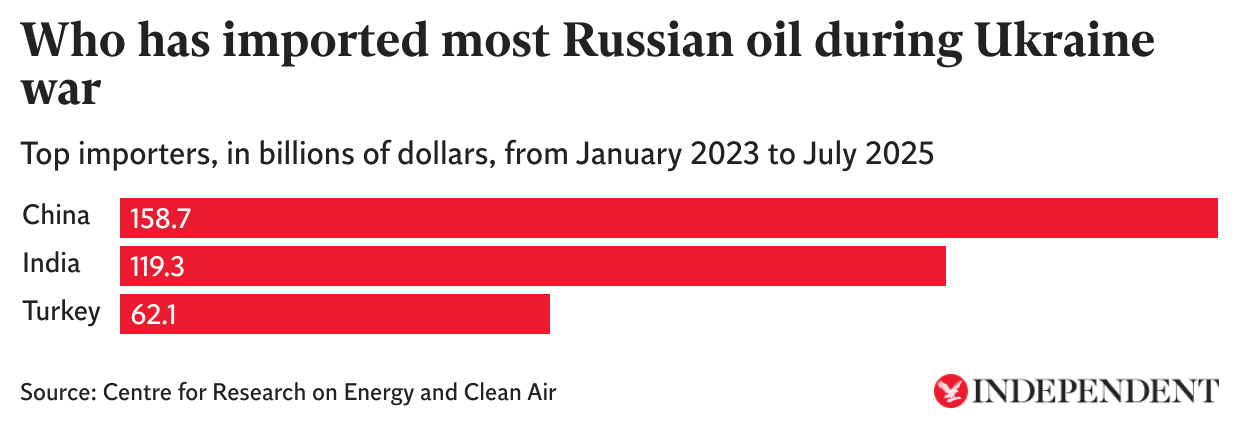

India’s purchases of Russian oil have contributed to the deterioration of relations between Delhi and Washington, with Donald Trump imposing tariffs of 50 per cent on Indian imports and accusing the Narendra Modi government of funding Russia’s war on Ukraine.

India has pointed to Europe’s ongoing purchases of Russian oil and gas products to call Mr Trump’s objections arbitrary. It has rejected criticism that it is profiteering by selling fuels refined from Russian crude to countries that have embargoes in place, insisting that its imports and exports comply with international law. Officials in Delhi argue that if Europe has concerns, it can simply stop importing.

While Europe banned direct imports of Russian fuels in February 2023, Indian refiners have emerged as a major supplier by processing discounted Russian crude and exporting diesel, jet fuel and kerosene westward.

However, from January 2026 new EU sanctions will prohibit the import of petroleum products refined from Russian oil in third countries.

Industry analysts say European buyers are building reserves while they can, echoing the stockpiling that took place ahead of the 2023 sanctions. The advance shutdown of Shell’s Pernis refinery in the Netherlands has added to demand, as has planned maintenance at Middle Eastern refineries later this year, which will tighten regional supply.

“This shift likely reflects anticipation of the January 2026 EU sanctions on products refined from Russian crude,” said Sumit Ritolia, Lead Research Analyst, Refining & Modeling at Kpler, according to The Indian Express.

The ban is expected to raise fresh questions about enforcement, given that most Indian refineries process a mix of Russian and non-Russian crude. Industry figures say distinguishing between the sources is nearly impossible, and Indian refiners could adapt to remain within the rules.

Analysts note that even if Europe cuts off Indian supplies, the disruption would likely be temporary. “If Europe stops buying from India, it will still have to buy from somewhere else,” one oil industry official said. “Flows will simply shift, with India finding other markets.”

The EU ban forms part of a broader campaign to pressure Moscow over the war in Ukraine. Last month, Brussels extended measures to target fuels produced from Russian crude in third countries, while exempting allies such as the US, UK, Norway and Canada.

Russia relies on oil and gas exports for roughly a quarter of its budget revenues. China and India have been its biggest buyers since 2022.

India has consistently defended its oil purchases from Russia as a matter of energy security. Since the invasion of Ukraine in 2022, Russian crude has made up more than a third of India’s imports.

“India will continue to buy Russian oil. It is our decision to buy what suits our needs, where we buy our oil from, we will have to take a call on it,” Niramal Sitharaman, India’s finance minister told CNBC in an interview this week.

Newborns die after being bitten by rats at top hospital in India’s ‘cleanest city’

Flood alert in India’s capital as river Yamuna breaches danger mark

Punjab floods threaten to devastate India’s rice harvest

At least 13 killed after suicide bomber targets political rally in Pakistan

Indian court sentences man to death for burning wife alive over skin colour

Trump aide Navarro asks why Modi is ‘getting into bed’ with Putin and Xi