The International Monetary Fund’s First Deputy Manager, Gita Gopinath, is raising concerns regarding the growing global exposure to U.S. equities, making a market correction at this stage very detrimental to the global economy.

Global Exposure To US Equities ‘At Record Levels’

On Wednesday, in a post on X, Gopinath said that “the exposure of the world to US equities is at record levels,” while warning that “a stock market correction” from these levels would have “severe and global consequences,” relative to what followed soon after the dot-com crash in 2000.

See Also: Bank Earnings Lift Wall Street, Gold Hits $4,200: What’s Moving Markets Wednesday?

She said, “the tariff wars and lack of fiscal space compounds the problem,” adding that the underlying problem behind it all is not “unbalanced trade, but unbalanced growth.”

As such, Gopinath emphasized the need for higher growth and returns across more regions in the world, and “not just in the U.S.”

The post links to her opinion piece in The Economist, where she said that “a market correction of the same magnitude as the dotcom crash” could wipe out $20 trillion in wealth for American households, and another $15 trillion in losses for investors located across the globe.

US Markets Outperform Global Equities

Between September 2009 and late 2024, U.S.-listed stocks have outperformed global equity markets by 340%, and are still showing no signs of slowing down.

Just NVIDIA Corp.’s (NASDAQ:NVDA) market capitalization, at $4.37 trillion, makes up 4.84% of the MSCI All Country World Index, while dwarfing the equity markets of Germany, Japan, UK, France, and Canada. This highlights the scale of American dominance in global equities.

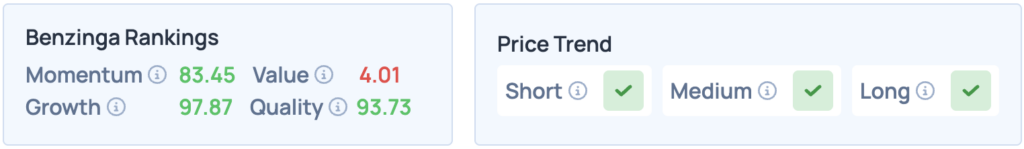

Nvidia shares were down 0.09% on Wednesday, closing at $179.83, but are up 1.10% in overnight trade. The company’s shares are up 30.02% year-to-date. The stock scores high in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Read More:

Photo courtesy: Shutterstock/Maxx-Studio