With a market cap of $31.2 billion, EQT Corporation (EQT) is the largest producer of natural gas in the United States, with operations primarily focused on the Appalachian Basin. The company engages in natural gas exploration, production, gathering, transmission, and marketing, with a strong presence in the Marcellus shale play across Pennsylvania, West Virginia, and Ohio.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and EQT fits this criterion perfectly. Leveraging its vast reserves and drilling inventory, EQT is strategically positioned to drive production growth while maintaining investment-grade status.

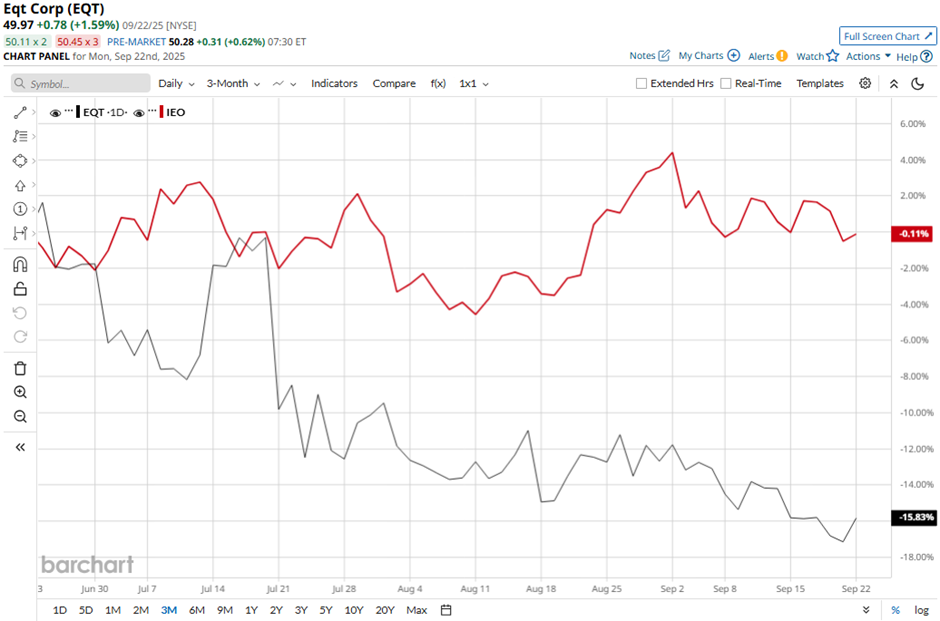

Shares of the Pittsburgh, Pennsylvania-based company have fallen 18.1% from its 52-week high of $61.02. EQT stock has decreased 17.3% over the past three months, lagging behind the broader iShares U.S. Oil & Gas Exploration & Production ETF's (IEO) 3.2% decline over the same time frame.

Longer term, EQT stock is up 8.4% on a YTD basis, surpassing IEO's marginal gain. Moreover, shares of the company have surged 43.5% over the past 52 weeks, compared to IEO's 3.8% drop over the same time frame.

However, EQT stock has fallen below its 50-day moving average since late July.

Despite reporting better-than-expected Q2 2025 adjusted EPS of $0.45 on Jul. 22, EQT shares fell 4.4% the next day as adjusted operating revenues of $1.6 billion missed the forecast. Investors were also concerned about rising operating expenses, which climbed to $1.42 billion from $949.5 million a year ago. Additionally, natural gas and liquid sales volumes of 568 Bcfe and 5,631 MBbls, respectively, came in below estimates.

Nevertheless, rival Expand Energy Corporation (EXE) has lagged behind EQT stock. EXE stock has dipped 1.3% on a YTD basis and returned 25.2% over the past 52 weeks.

Due to the stock’s strong performance over the past year, analysts remain bullish on EQT. It has a consensus rating of “Strong Buy” from the 25 analysts in coverage, and the mean price target of $64 is a premium of 28.1% to current levels.