A few years back, as part of an effort to demonstrate that it was taking EVs more seriously than it had previously demonstrated, Honda’s global CEO Toshihiro Mibe gathered members of the automotive press in Tokyo for a status seminar. He noted its partnership with General Motors as a hallmark, with joint plans to build vehicles not only on GM’s current Ultium platform, but to collaborate on future affordable EV underpinnings for later in the 2020s.

He discussed Honda’s plans to pilot solid-state batteries, an innovative and potentially transformative area in which he felt Honda could dominate. And he hinted at potential strategies for expanding hybrid production, particularly into its larger American market SUVs and trucks.

In the intervening years, none of that has really happened. So when Honda invited me to another such confab at this year’s Japan Mobility Show, I vehemently accepted. I arrived with a lot of questions. I managed to parse out a few answers.

What went wrong GM, and what's next for EV partnerships?

Less than a year-and-a-half after it formally began in April of 2022, Honda and GM summarily cancelled their $5 billion EV collab, having birthed only one badge-engineered mid-five-figure vehicle each for Acura and Honda, the Blazer EV-based ZDX and Prologue. (The ZDX has already been canceled.)

Mibe was a bit cryptic as to why this fell apart. “We found out that, even if we collaborated together, it was very difficult to come up with one clear winning and profitable strategy in EVs,” he said.

He did, however, hint a bit at what went wrong. As a company known for a deep commitment to R&D and to out-of-the-box thinking, Honda might have bristled a bit at partnering with (or supplicating itself to) GM. “In terms of technology, Honda would like to have the leading position,” Mibe said. “So ideally, if Honda has developed the technology, it can be shared with other OEMs. That would be best.” He added that the company remained open to “exploring different ways to work with other partners,” but didn’t name any names.

Telemetry vice president of market research Sam Abuelsamid concurs that the Honda/GM partnership may have been a poor match, in part because neither company could find a play for its alleged strengths in new technologies. Honda’s expertise in fuel cells didn’t yield any tangible results, and GM’s advanced work in autonomous driving imploded as its Cruise subsidiary flamed out.

“I think that Honda also looked at the challenges that GM was having on the software side on the Ultium platform and the intense weight of that platform, and probably decided, we can do something better on our own or with a different partner,” Abuelsamid added.

One new company that Honda has already partnered with is LG Energy Solutions, with whom it has a joint venture in Ohio. “LG is the first manufacturer building LFP [lithium-iron-phosphate] cells at scale in North America,” Abuelsamid said, mentioning the more stable, longer-lasting, and less expensive nature of this battery chemistry as potential benefits. “So, it’s absolutely possible that Honda, and other joint venture partners like Stellantis and GM, will use some LFP capacity to provide a lower cost option for some of their EVs.”

Will Honda make an affordable EV for the U.S. market?

Mibe noted that reducing battery cost is an obvious linchpin in any strategy to create more affordable electric vehicles. And while he noted that Honda is currently considering a range of potential technological and chemical solutions for that, he was no longer touting a strong position in any particular solution. This includes the brand’s formerly heavy reliance on solid-state batteries as the key to the future.

“We are working on increasing the capacity of all EV batteries, and solid-state batteries are part of that,” Mibe said. “They are in the research stage, and it is going quite well. We already have established a pilot production line. But even if the technology is good, the cost remains high. In order to get that into the market, we need to have the proper volume in order to justify the investment.” Continuing to kick the can down the road, he said that Honda hoped to launch a solid-state-powered product “by around 2030 or so.”

Even if this occurs, this may not be a core differentiator for the brand. “Everybody’s working on solid state,” Abuelsamid said. “Honda is still cracking away at that. But so is Nissan and Toyota and everybody in that space.” Mercedes and Stellantis, too, have made moves toward SSBs.

As far as developing an affordable EV in the short term, Honda seems to be not only monitoring the current regulatory retrogradism in Washington, but abiding it. “What’s making it a little bit difficult is that the EV subsidies are now gone,” Mibe said. “With the Trump administration in place, we have the sense that maybe EV growth has been moved back out by maybe five years into the future. So, the timing for doing anything right now would be difficult.”

In fact, Mibe stated outright that the brand is waiting until at least the midterm elections in late 2026 to make any further decisions about progressing with such programs. “We need to look at how the administration would act in view of the latest environmental activity,” he said, as if the vehemently anti-clean energy Trump administration could be called on to change in any significant way by a Democratic-led Congress. “That would have an impact on our EV strategy, so we need to monitor the situation carefully to make any decisions.”

Whether by strategy or coincidence, other automakers are not playing the same wait-and-see game. Instead of sitting on their thumbs, they are aggressively pursuing affordability. The new Nissan Leaf, the Chevy Equinox EV and the revival of the Chevy Bolt, Hyundai’s announced $9000 price cuts on the Ioniq 5, Kia’s planned introduction of the EV3 and Ford and Slate’s forthcoming electric trucks are all examples of appealing EVs in the sub-$35,000 or even sub-$30,000 range.

“From what we’ve seen of the electric products that are coming from Honda, they don’t look like they’re focused on the really affordable end of the market,” Abuelsamid said. “They’re more in the middle, like $50,000 or $60,000. And I think that’s going to be the toughest segment going forward because customers for those vehicles were probably more sensitive to the presence of the tax credits.”

While I was in Japan, Honda unveiled a smaller, more affordable electric SUV to add to its battery-only 0 Series lineup, the Alpha. This vehicle will be aimed mainly at the Indian market, now the world’s third largest after China and the U.S.

The company was predictably tight-lipped on how it was going to remove cost from the vehicle, though Abuelsamid suspected that it might include reducing battery price through the use of LFP or NMC (nickel-manganese-cobalt) cells, and declining to include some of the more advanced electronics—like the zonal architecture—that will underpin other 0-Series models, substituting them with “more legacy components.”

But when asked if Honda had any plans to bring this reduced-price vehicle to the States, Mibe was quite confident in his response. “We think the 0 Series Alpha is a bit too small for the US market because of the size of the car,” he said. “We are not planning to sell the 0 Alpha to the US.” And while he said that the company would “like to consider this $30,000 EV in the future,” he did not provide any specifics as to how it would accomplish this goal, or with what product.

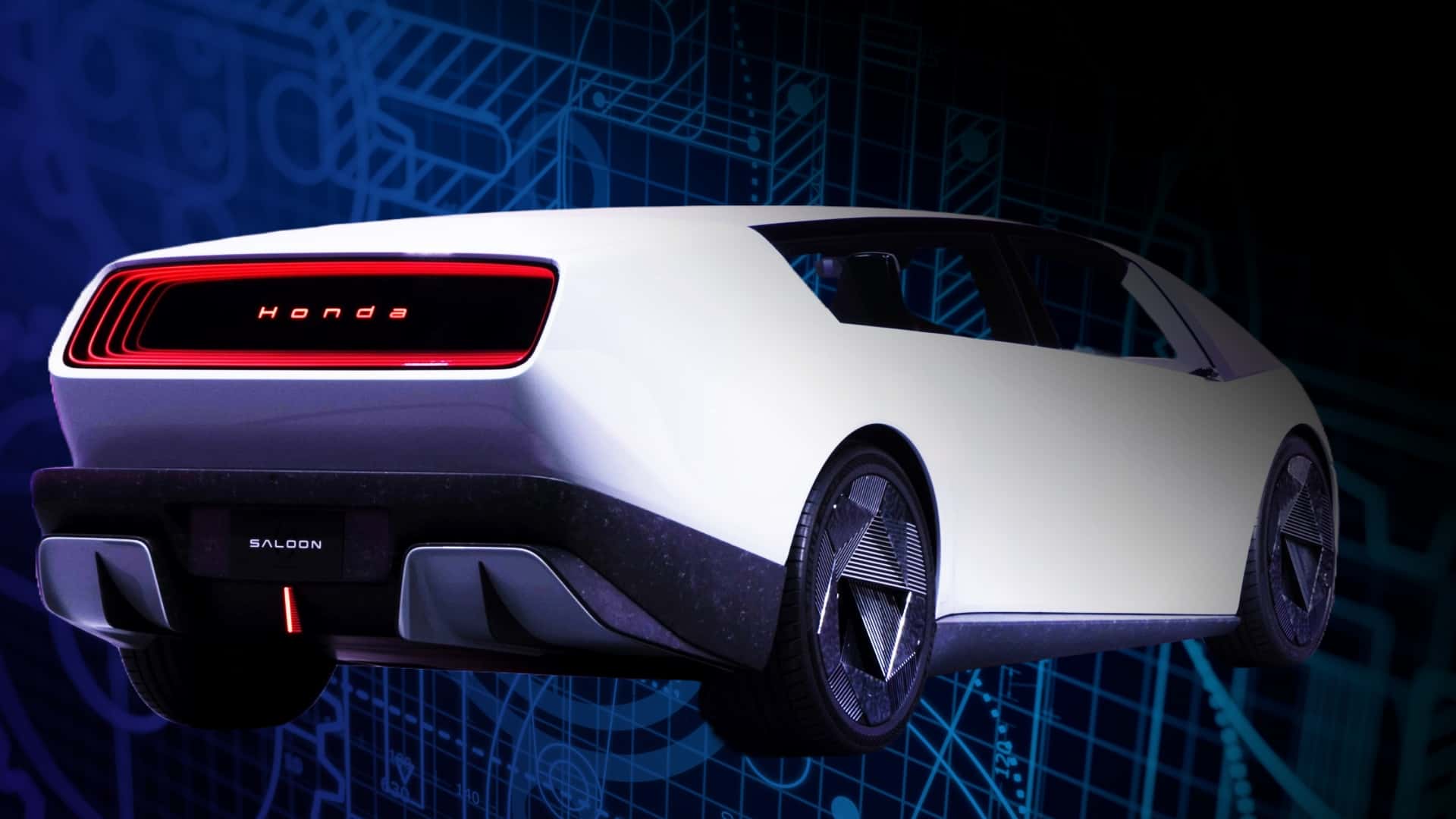

Instead, the brand is still moving forward with its intention to bring its far pricier (and very handsome) 0 Series sedan and SUV to market later in the decade. “Our plan is to launch the 0 Series according to our current plan,” Mibe said. “However, probably the initial volume will be less than we had imagined earlier.”

At least Honda isn’t planning on pulling a Stellantis, and undermining its electrification efforts by stuffing gas engines into its nominally electric vehicles. “The 0 Series is designed for EVs,” Mibe said when I asked him about this. “So there is no plan to install a hybrid in the 0 Series.”

And while Honda won’t be bringing its adorable, cheap Super-One micro-hotrod EV to the US, it hasn’t ruled out the idea of performance EVs. “I think it remains an important area for racing, so research into EV-based sports cars has continued, and we have many prototypes already made internally,” Mibe said.

He even touted a potential electric performance tech transfer derived from Honda’s participation, with Aston Martin, in the forthcoming hybridized F1 season. “In order to win, we must have good EV technology in this power unit. And this is an opportunity for us to demonstrate Honda’s electrification technology.”

Still, don’t get your hopes up for a new electric CRX anytime soon. “Given this slowing down in the electrification market, it’s hard to decide when we would make them available to the market,” Mibe said.

So what is Honda’s electrification strategy?

One word: Hybrids.

“We are thinking of a strategy to increase the number of hybrids,” Mibe said. The first step in this is a complete revamp of the automaker’s hybrid system, which will move to a larger battery pack, coupled to more efficient I-4 and V6 gasoline engines, and, in larger models—including SUVs, trucks, and sedans—seemingly endowed with rear electric motors for all-wheel-drive capabilities. Mibe said that this will occur by 2027, and will offer both savings and benefits. “Hybrid cost will come down by 20%, and the performance will get enhanced.”

Mibe stated that Honda hoped to increase its global hybrid sales from the current level of around 800,000 units to over 2 million units by 2030. Of course, this alone will not get Honda to its ongoing goals of total carbon neutrality by 2050. “If we look at our North American market as a total, we will maintain at least the current level of carbon or maybe decrease it a little from what it is now,” Mibe said. He vaguely mentioned ideas of biofuels and carbon capture as potential solutions.

Abuelsamid worries about the long-term viability of this focus, especially as it pertains to EV development. “Honda has chosen to split their resources across all of these different pathways—electric vehicles, combustion vehicles, and hybrid vehicles,” he said. “And that makes it more difficult and more challenging to do the longer-term EV stuff when you still also have to do the near-term spending on combustion and hybrid.”

What does all of this mean?

In the short term, it means that Honda, like others in the industry, is seemingly using the current administration’s ill-conceived antipathy to electrification as cover for its ongoing retreat from the category. I’m not convinced this makes good long-term business sense, globally, given the pressures from other markets, including China.

With U.S. automakers pulling EV investment from Canada and Mexico, and moving production to the U.S. to comply with the President, it seems possible that our neighbors will be motivated to collaborate with the Chinese to keep factories running and workers employed. “The Chinese are making really good, lower cost EVs, and if our OEMs don’t keep moving down that path, the Chinese are eventually going to find some pathway into the North American market,” Abuelsamid warned.

Moreover, ignoring the seemingly inevitable progress toward electrification occurring in the rest of the world in favor of abiding by the whims of a capricious and bilious autocrat does not seem strategic. If we are no longer making desirable, global vehicles, Abuelsamid said, “the US becomes an island unto itself. We’ll be stuck with products that no one else in the world wants to buy, we’ll have the Chinese at our front and back doors, and we’re not going to have any product to compete with them here or abroad.”

The solution? Tune out the blather and focus on the big picture. “I think to some degree the industry needs to ignore the noise coming from Washington,” Abuelsamid said. “Clearly the current administration wants them to ignore electrification, ignore sustainability, and ignore climate change. But the rest of the world is not doing that, so they have to continue to invest heavily in all of that.”

Brett Berk is a freelance automotive writer based in New York. He has driven and reviewed thousands of cars for Car and Driver and Road & Track, where he is a contributing editor. He has also written for Architectural Digest, Billboard, ELLE Decor, Esquire, GQ, Travel + Leisure and Vanity Fair.