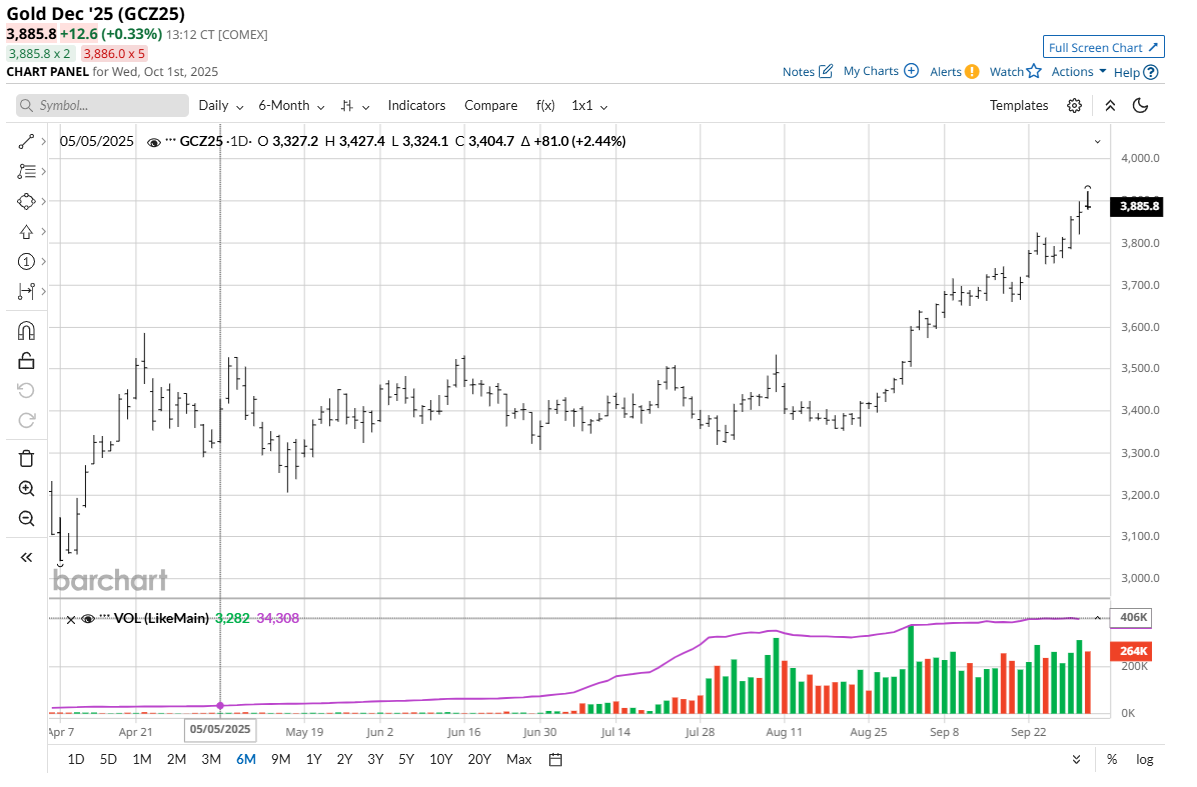

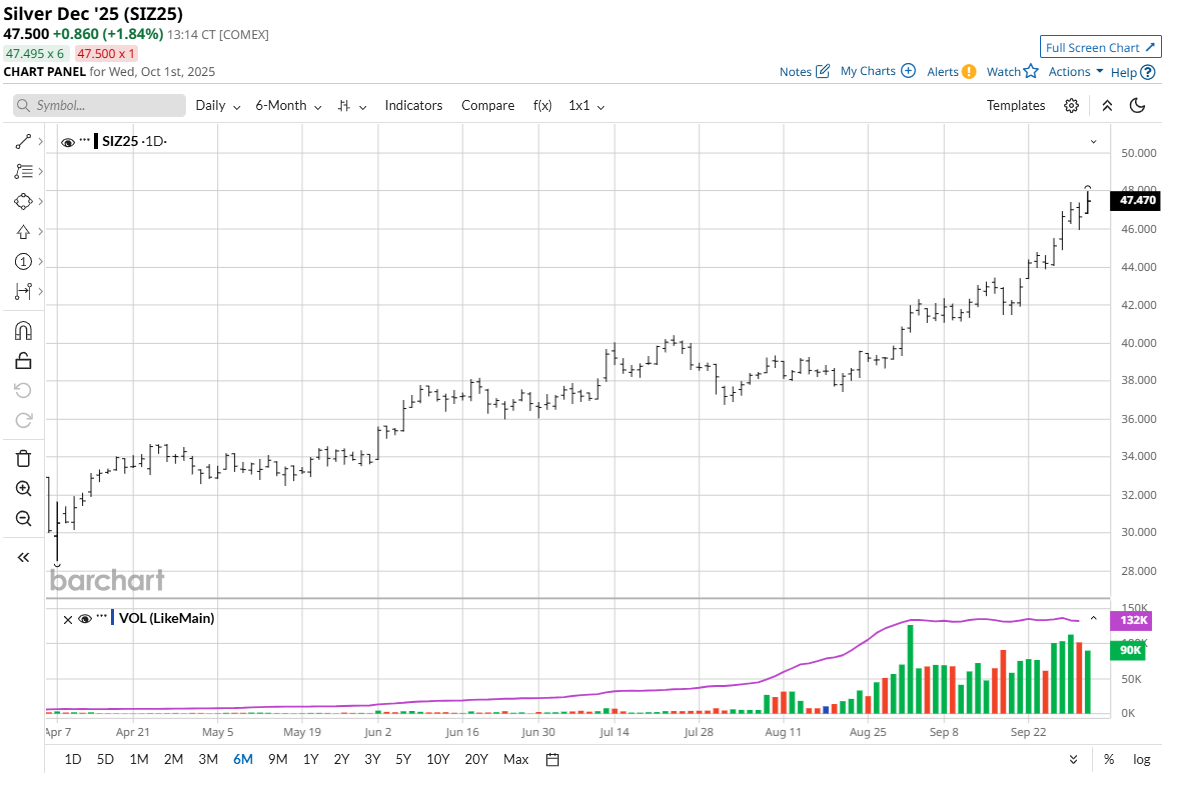

Gold (GCZ25) prices overnight hit another record high of $3,922.70, basis December Comex futures. Siver (SIZ25) prices scored another 14-year high of $47.825 in December futures. Better safe-haven demand amid the uncertainty of the U.S. government shutting down at midnight last night is the latest bullish catalyst for the two precious metals.

In this report I’m going to offer my perspective on the record-setting bull move in gold and the near-record (possibly to be broken soon) bull run in silver. I will address two major questions all gold and silver market watchers are asking:

One: What’s it going to take to extend the mature bull runs?

And two: What’s going to end them?

Here goes.

What Will Continue to Fuel the Strong Price Uptrends in Gold and Silver?

Several elements are working to push gold and silver prices sharply higher. These are the elements that are likely to continue to be bullish drivers.

Geopolitics. There is seemingly always something going on around the world that has traders and investors uneasy. It’s just that presently there are more “somethings” driving better safe-haven demand for gold and silver. The present geopolitical list includes the ongoing Russia-Ukraine war, an unstable Middle East, debt problems in South America and especially Argentina, a disruptive U.S. presidential administration, political troubles in France, and the U.S. and China staring each other down in their battle for global economic and military supremacy.

“De-dollarization.” Developed and developing countries around the globe have been on a mission the past few years to move away from conducting global finance in mostly U.S. dollars. The leaders of this move are the BRICS countries — Brazil, Russia, India, China and South Africa. The de-dollarization is bearish for the greenback and in turn bullish for gold and silver. The U.S. dollar index ($DXY) is a key daily “outside market” for gold and silver, and the metals’ daily price movements are generally inverse to that of the U.S. dollar index’s daily price moves. De-dollarization has also seen countries buy more gold for their sovereign reserves as they move away from the U.S. dollar.

Economics. The Federal Reserve is leading a move by most major central banks to lower their interest rates to induce better economic growth. The rate-cutting cycles by central banks are likely to last well into next year. Lower borrowing costs mean better consumer and commercial demand for goods and services, including better demand for precious metals. Lower interest rates in China and India are especially bullish for gold.

Technical charts. Gold and silver prices are in short-term and long-term price uptrends on the technical charts. That means the path of least resistance for price direction remains sideways to higher.

What Will Be the Early Clues the Major Bull Runs in Gold and Silver Have Run Out of Gas?

Calmer geopolitical scene. A Russia-Ukraine cease-fire or Middle East peace accord would be two calming elements.

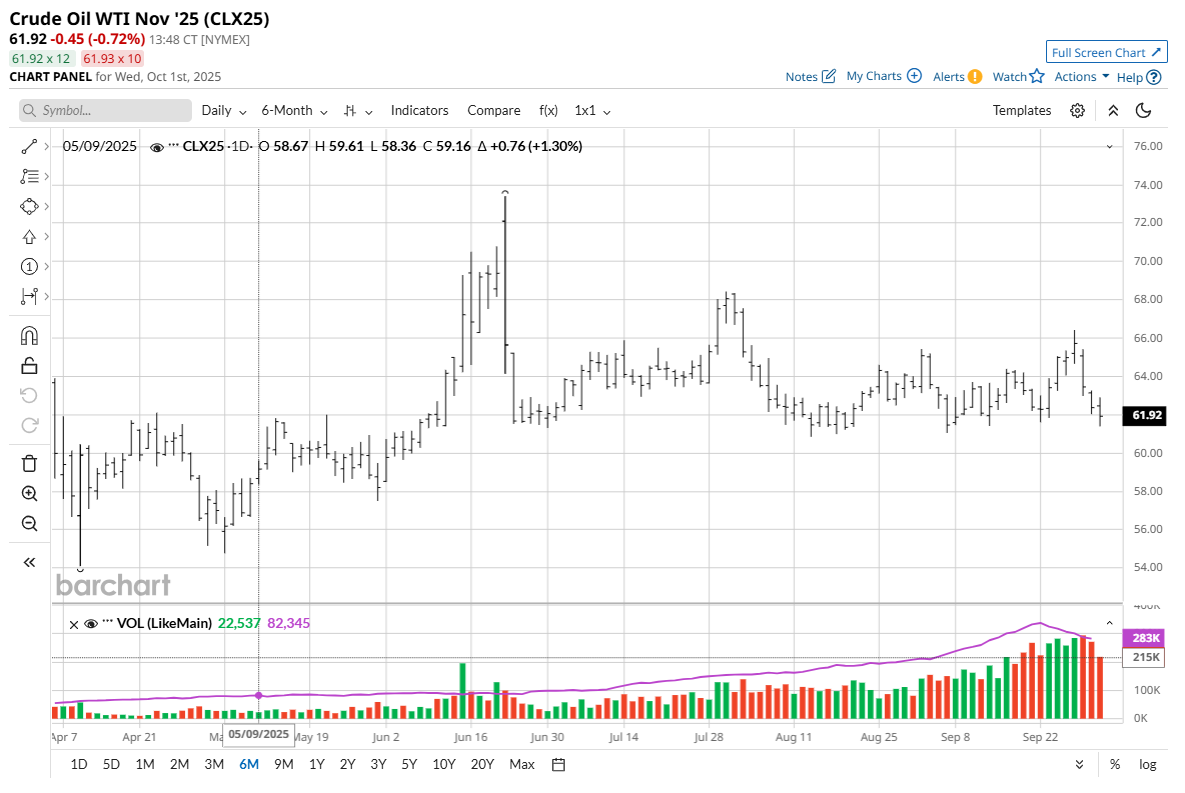

Falling crude oil prices. Crude oil is the leader of the raw commodity sector. If oil starts to trend down, that would be a bearish anchor on most raw commodities, including metals.One firm is forecasting crude oil prices to drop into the $50-a-barrel range in the coming quarters on expectations for “punishing oversupply” as output expands. Macquarie Group analysts remain “fundamentally bearish on the energy complex” due to crude-supply growth from OPEC-plus and drillers outside the group.

Tighter monetary policies from central banks. An end to the easier monetary policy cycle from the major central banks would be a significantly bearish development for the gold and silver markets. Rising interest rates mean higher borrowing costs for consumers and businesses, and in turn less demand for goods.

Deteriorating technicals. Two very big down days in a row would suggest the bulls are exhausted and that market tops are in place. A technically bearish weekly low close on a Friday would also suggest bulls have run out of gas. Divergence in the Relative Strength Index, whereby the market makes a new for-the-move high, but the RSI does not. Such has already recently occurred in December gold and silver futures markets. Declining open interest in gold and silver futures on price rallies. Such has not occurred in gold and silver futures as open interest is rising — a bullish signal.

Deteriorating technicals also includes gold and/or silver prices selling off following fresh, seemingly bullish fundamental news. This would suggest the bulls have finally become too exhausted to extend the very mature bull runs in gold and silver.

Tell me what you think. I really enjoy getting email from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.