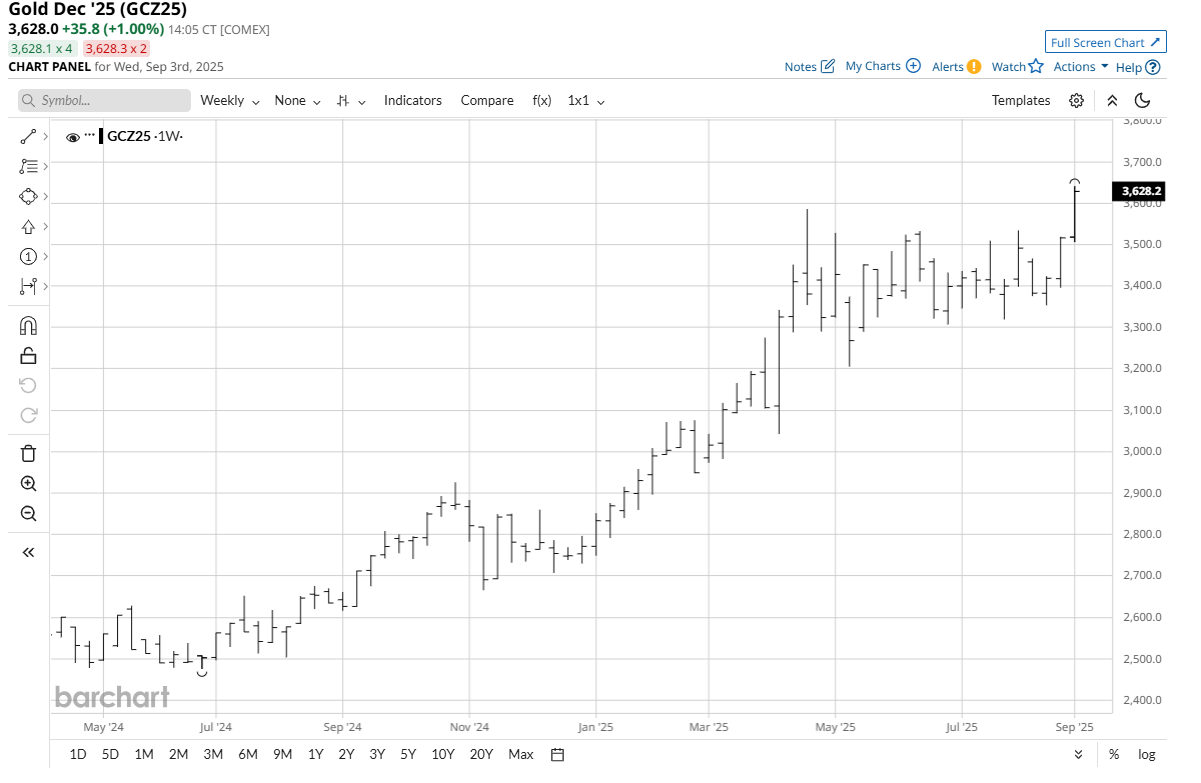

Comex gold (GCZ25) futures prices at mid-week traded to a record high of $3,631.00 an ounce, basis December futures. Meanwhile, December Comex silver (SIZ25) notched a 14-year high of $42.29 an ounce today. Safe-haven demand and an extra-nervous market is driving the precious metals higher.

What’s Driving the Bull Run in Precious Metals?

Lower U.S. interest rates, likely starting with a cut at the September meeting of the Federal Open Market Committee (FOMC), support both metals here. A half-point rate cut in the Fed funds rate is widely expected by the marketplace. Another rate cut is also likely from the Fed before the end of this year, barring any economic surprises such as much stronger U.S. economic growth or problematic price inflation.

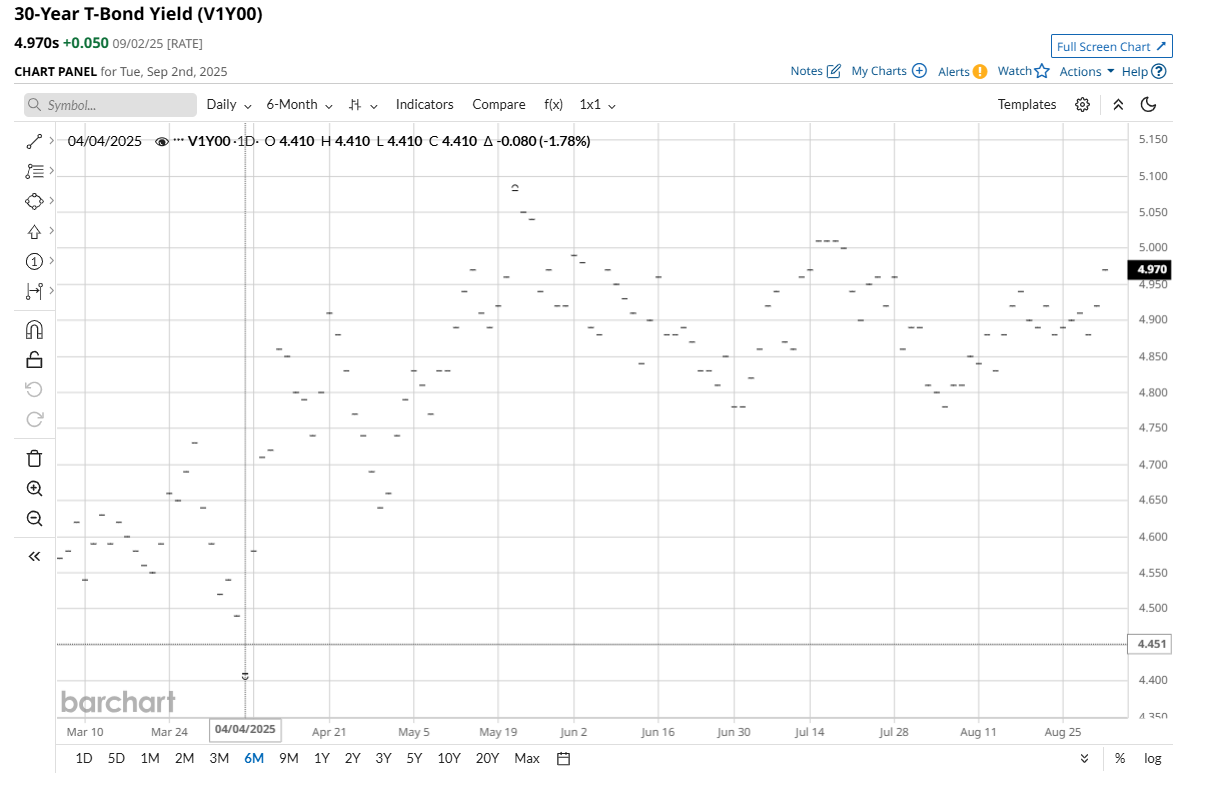

Another bullish fundamental for the safe-haven metals is a very jittery bond market. Global bond yields are on the rise (lower prices) mostly due to worries about inflation, government debt sales, and fiscal discipline. U.S. Treasury yields have advanced, with the 30-year bond now approaching the 5% level, while yields on U.K., Australian, and Japanese bonds are also increasing. The selloff in prices reflects traders’ concerns around too much government spending and the potential inflationary impacts. A Bloomberg gauge of global bond returns fell 0.4% on Tuesday.

Uncertainty surrounding the Federal Reserve’s independence is only adding to the bond market pressures and general trader and investor anxiety. President Donald Trump has brow-beat Fed Chair Jerome Powell since he took office in January. Also, Trump’s move to fire Fed Governor Lisa Cook has rattled many traders and investors. A non-independent Federal Reserve could have the negative consequences of major foreign buyers, including sovereign nations, pulling away from U.S. Treasuries due to the politicizing of the U.S. central bank. That would mean higher borrowing costs for the U.S. government, as well as likely for U.S. citizens.

Veteran market watchers know that history shows the months of September and October can be rough for the stock, financial, and currency sectors. The U.S. stock market’s worst performing month historically is September. That’s creating a jittery equities environment and that’s positive for the safe-haven metals, from a competing asset class perspective.

Both precious metals have more than doubled in price over the past three years, boosted by mounting geopolitical risks, including global trade disruptions caused by U.S. tariffs.

No Early Clues of Market Tops Close at Hand for Gold, Silver

Importantly, there are no early, strong technical warning signals that would suggest market tops are close at hand for gold and silver. That means the path of least resistance for prices will remain sideways to higher until some solid chart clues suggest market tops are in place.

And Just for Fun…

Mostly just for fun but just possibly with some predictive value, I’m going to lay out a timeline for gold and silver prices over the coming months and few years, based upon trendline analysis on the longer-term weekly charts for nearby gold and silver futures markets. Both markets are in longer-term price uptrends. So here goes:

Gold

Oct. 1, 2025: $3,434.00.

Jan. 1, 2026: $3,707.00

July 1, 2026: $4,256.00

Jan. 1, 2027: $4,790.00

Jan. 1, 2028: $5,864.00

Silver

Oct. 1, 2025: $40.13

Jan. 1, 2026: $46.36

July 1, 2026: $58.97

Jan. 1, 2027: $71.83

Jan. 1, 2028: $96.94

There you have it. Don’t bet the farm on these numbers, but one just never knows! Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.