Exxon Mobil Corp (NYSE:XOM) shares are trading marginally higher Thursday, benefiting from a sector-wide rally after the U.S. imposed new sanctions on Russian oil giants Rosneft and Lukoil. The news sent West Texas Intermediate (WTI) crude futures soaring over 5% to above $61 a barrel.

- XOM is performing well relative to peers. Stay ahead of the curve here.

What To Know: These sanctions are causing XOM stock to rise due to the basic principles of supply and demand. By targeting major Russian producers, the U.S. is effectively removing a significant amount of oil from the global market. This reduction in supply, assuming demand remains constant, drives the price of crude oil higher.

For an integrated oil and gas company like Exxon Mobil, higher oil prices directly translate into greater revenue and higher profit margins for every barrel it produces and sells. Investors anticipate this boost to Exxon’s profitability, making the stock more attractive and pushing its share price upward.

Traders and investors are meanwhile watching for Exxon’s upcoming earnings report on October 31. Analysts are forecasting earnings of $1.81 per share on revenue of $84.87 billion for the quarter.

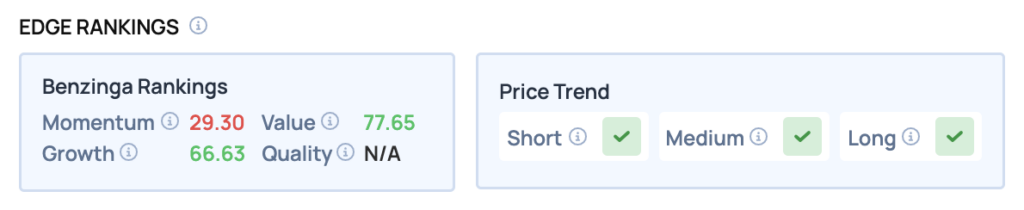

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, the company boasts a strong Value score of 77.65.

XOM Price Action: Exxon shares were up 0.98% at $115.83 at the time of publication on Thursday. The stock is trading within its 52-week range of $97.80 to $123.21.

From a technical perspective, Exxon is trading approximately 3.1% above its 50-day moving average of $112.09 and about 5.2% above its 200-day moving average of $109.82.

These indicators suggest that the stock is in a bullish trend, with the potential for further gains if it can maintain its position above these key moving averages.

Read Also: Tesla Stock Is Trading Lower Thursday: What’s Driving The Action?

How To Buy XOM Stock

By now you're likely curious about how to participate in the market for Exxon Mobil – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Exxon Mobil, which is trading at $115.83 as of publishing time, $100 would buy you 0.86 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock