President Donald Trump's sojourn to Asia carries much geopolitical significance as several countries in the world's largest continent work to hash out a trade deal with the biggest economy on the planet. Yet, the one that is being watched with bated breath is a possible deal with China.

The U.S. president is scheduled to meet with Chinese president Xi Jinping on the sidelines of the Asia‑Pacific Economic Cooperation (APEC) Summit, and rumors are rife that a trade deal will be signed by the two economic powerhouses, wherein China will buy more U.S. goods, such as soybeans, while also allowing more rare earth exports to the U.S.

But why has an impending trade deal with China led to the shares of MP Materials nosediving by 7.4% yesterday?

About MP Materials

Founded in 2017, MP Materials (MP) is the only rare-earth mining and processing facility of scale in the U.S., which operates in the resource-rich terrain of the Mountain Pass Mine in California. Mountain Pass is one of the largest known deposits of rare earth elements in the world, with over 18 million metric tons of rare-earth oxide (REO) equivalent in the ground, including cerium, lanthanum, neodymium, and praseodymium, among others. These light rare-earth elements have various critical industrial applications, such as building permanent magnets, optical lenses, and battery electrodes.

Valued at a market cap of $12.5 billion, MP stock has been on a tear this year (thanks primarily to the U.S. government purchasing a stake in the company earlier this year), rallying by 330% on a year-to-date (YTD) basis.

So, is the thawing of U.S.-China relations and the recent selloff an indication that MP Materials' days in the sunshine are over, and investors should shun it? Or is the correction an opportunity to add stock? Let's find out.

Financials Are Good (Well, Almost…)

Unlike other loss-making companies, MP Materials' financials are not alarming. For starters, it has actual revenues, and its losses have not increased in recent quarters. In fact, in the most recent quarter, the company reported a beat on both the top and bottom lines.

In Q2 2025, MP Materials had revenues of $57.4 million, up a sizeable 84% from the previous year. A record production of 597 metric tons of NdPr, which marked an annual growth of 119%, along with a 45% rise in the same period of REO production to 13,145 metric tons, contributed to the overall growth in sales. Moreover, NdPr sales volumes more than tripled year-over-year (YoY), reaching 443 metric tons.

Notably, NdPr stands for neodymium praseodymium, a blend of two closely related rare earth elements that are typically mined, refined, and used together because of their similar chemical properties. Both elements belong to the “light rare-earth” group and occur naturally together in minerals such as bastnäsite. NdPr is critical in the production of high-performance permanent magnets, which are used in technologies that convert electrical energy into mechanical motion.

Meanwhile, losses narrowed to $0.13 per share from $0.17 per share in the year-ago period, while also coming in narrower than the consensus estimate of a loss of $0.20 per share. Further, this was also the fourth consecutive quarter where the company's losses have come in narrower than the Street estimates.

However, net cash used in operating activities for the first six months of 2025 expanded to $66.9 million, from $10.3 million in the corresponding period a year ago. Notwithstanding that, the company's liquidity position remained solid, with a cash balance of $261.5 million as of June 30, 2025, which was much higher than its short-term debt levels of $67.4 million.

MP Materials is set to report its Q3 2025 results on Nov. 6.

Strategically Significant

The U.S.-China deal, if it happens, is definitely going to be a headwind for MP Materials. However, the geopolitical realities in today's dynamic world are as fickle as they can be, and it only requires a post from the president to upend the world economy. Thus, when the reality is that China controls 70% of the rare earth mining and about 90% of the processing, while the U.S. sources 70% of its rare-earth imports from China, the game is far from over for MP Materials, which has forged formidable partnerships with the likes of the Department of Defense, iPhone maker Apple (AAPL), and auto major General Motors (GM).

Notably, the deal with the Department of Defense locks in a 10-year minimum price of $110 per kilogram for MP Materials' NdPr starting in Q4 2025, with the government stepping in quarterly to bridge any shortfall against the benchmark average weighted volume price.

Beyond that, the company already has a multi-year supply pact in place with General Motors for magnets bound for EV motors, a telling sign of the deeper changes reshaping the sector. On another front, MP sealed a $500 million agreement with Apple to deliver rare earth magnets pulled from recycled streams for its consumer devices.

Meanwhile, the firm has also begun full-scale refining of NdPr and started trial manufacturing of next-gen rare-earth magnets at a fresh facility in Texas.

Thus, MP Materials' seamless control over the rare earth chain, from mining and separation to magnet assembly and eventual recycling, elevates it far above a typical extractive play. In today's charged geopolitical climate, that makes the company a cornerstone asset for U.S. supply security.

Analyst Opinion on MP Stock

Certainly, the recent selloff may have jolted some investors in the stock; however, if one zooms out and takes a long-term view, this can be a prime opportunity to load up on the MP stock. Although caution should be exercised while buying the stock, which involves having reasonable exposure due to its high valuations and yet-to-be-profitable status, MP Materials should not be seen merely as a mining play while ignoring its larger importance for the Western world.

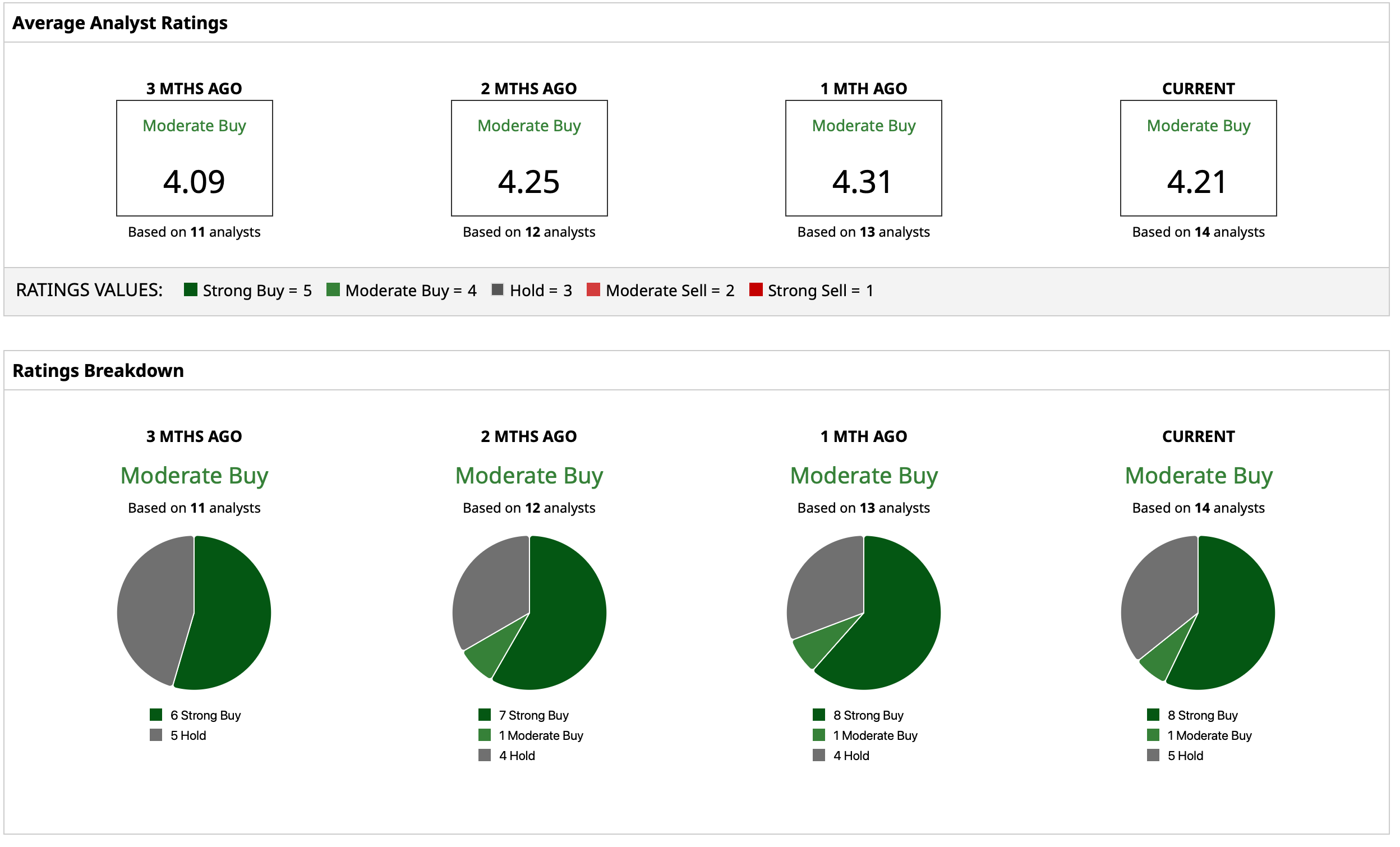

Overall, analysts remain cautiously optimistic about the MP stock, attributing to it a rating of “Moderate Buy,” with a mean target price of $81.27. This indicates an upside potential of about 24% from current levels. Out of 14 analysts covering the stock, eight have a “Strong Buy” rating, one has a “Moderate Buy” rating, and five have a “Hold” rating.