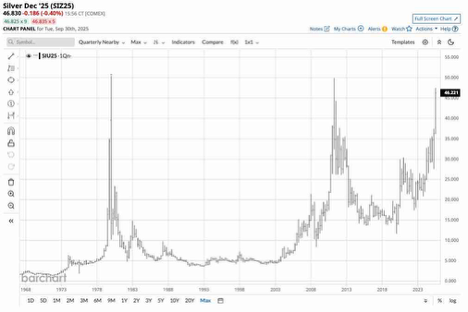

Precious metals significantly outperformed other commodities and commodity sectors for the month ending on Tuesday, September 30, in a month where the dollar index and bond futures were steady.

There were across-the-board double-digit percentage gains in all four of the precious metals trading on the CME’s COMEX and NYMEX divisions. Heating oil refining spreads posted the only other double-digit percentage gains, while Rotterdam coal and cocoa futures moved over 10% lower in September.

Precious Metals Shine- Copper Recovers

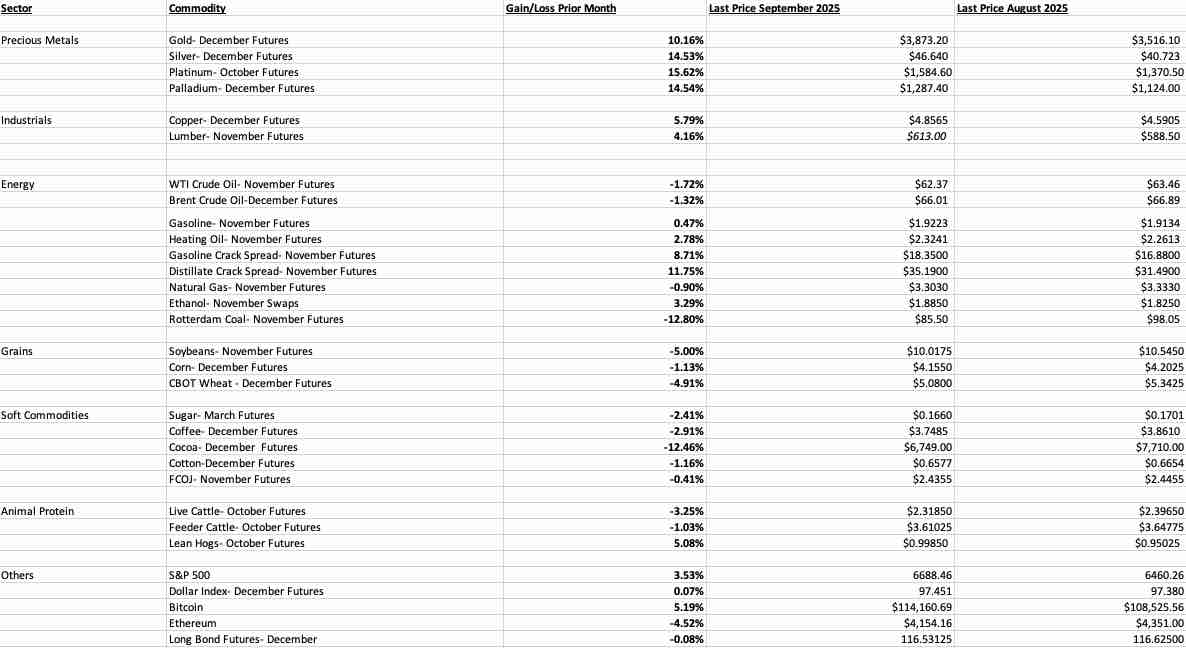

NYMEX platinum futures led the commodities sector on the upside in September.

The monthly chart of NYMEX platinum futures for October 2025 delivery highlights the 15.62% September gain. After posting a bullish key reversal pattern in the second quarter, platinum surged to the upside, leading the precious metals sector and reaching its highest price since February 2014.

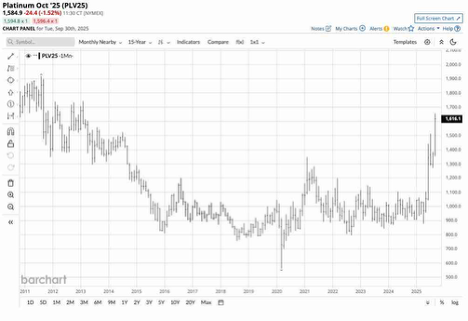

Palladium, the other traded platinum group metal, edged out silver for the silver metal, no pun intended, with a 14.54% September gain.

The quarterly chart highlights the upside follow-through from palladium’s second-quarter bullish key reversal. Palladium rose to the highest price since the second quarter of 2023.

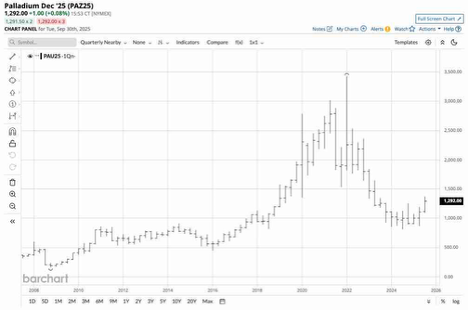

COMEX silver futures only marginally underperformed palladium with a 14.53% September gain.

The quarterly silver futures chart, dating back to the 1960s, illustrates the parabolic move in silver futures that took the price to its highest level since 2011, and brought it within striking distance of the $49.82 high from that year and the all-time $50.36 peak from 1980.

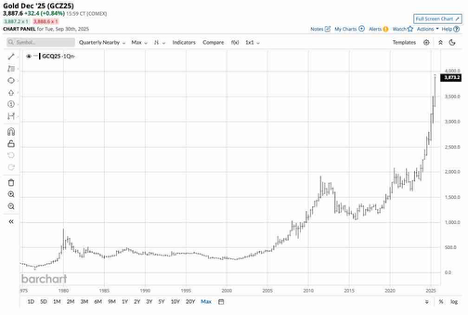

Not to be excluded, gold continued its parabolic bullish path, posting a 10.16% gain in September.

Gold reached a new record high of nearly $3,900 per ounce, posted its eighth consecutive record quarterly peak, and rose convincingly above its inflation-adjusted 1980 peak, while ironically being September’s worst-performing precious metal.

COMEX copper futures, the volatile red metal, recovered in September, after wild price swings over the past months due to tariffs. The futures contract rose 5.79% in September.

Declines in Agricultural Commodities

The prices of agricultural commodities in the grain/oilseed, soft, and animal protein sectors posted losses in September, except for October lean hog futures, which gained 5.08%.

Cooperative weather conditions, which led to ample supplies during the 2025 crop year, continued to push soybean, corn, and wheat prices lower. The tone of the September WASDE report remained mostly bullish on supplies and bearish on grain and oilseed prices.

The soft commodities posted across-the-board declines, with cocoa futures leading on the downside experiencing a 12.46% price plunge. World sugar, Arabica coffee, cotton, and frozen concentrated orange juice futures declined. However, coffee, cocoa, and OJ prices remain elevated, given explosive price action over the past months. Cotton and sugar have lagged the sector, and prices remained under pressure in September.

The 2025 grilling season ended in early September, so it was no surprise that the start of the offseason for demand sent live and feeder cattle prices lower. However, beef futures remain near record-high levels, despite the monthly decline. Lean hogs rallied by just over 5% in September.

The bottom line is that agricultural commodity prices moved lower, which is good news for food and some biofuel consumers.

Mixed results in energy

In September, increasing OPEC+ production and U.S. energy policy supporting more fossil fuel production led WTI and Brent futures prices being slightly lower. However, continued geopolitical tensions tempered the bearish sentiment in the crude oil futures market.

Oil products reflected seasonal forces as the end of the 2025 driving season led to a marginal gain in gasoline futures, while heating oil futures posted a more significant gain. Crack spread moved higher as the products outperformed the petroleum prices.

Natural gas, which is entering the peak demand season, posted a marginal decline of under 1% in September. Chicago ethanol swaps rose, despite a decline in corn prices, while Rotterdam coal futures dropped 12.80% to more attractive levels as winter approaches.

Stocks were higher and bonds edged marginally lower- The dollar was steady near the low- Cryptos were mixed

The U.S. tariffs and tensions between President Trump and the U.S. Federal Reserve continued to cause uncertainty. However, the Fed reduced the short-term Fed Funds Rate by 25 basis points at the September FOMC meeting. The move was the first rate cut in 2025.

The stock market continued to power higher in August. The S&P 500, the most diversified U.S. stock market index, rose 3.53%. Moreover, the S&P 500, the NASDAQ Composite, the Dow Jones Industrial Average, and the small-cap Russell 2000 index rose to record highs in September.

The U.S. 30-year Treasury bond futures edged only 0.08% lower in September. The long bond futures remained within the 110-01 to 127-22 trading range, which has been in place since December 2023.

The U.S. dollar index remains sensitive to concerns about tariffs, rising debt levels, and global uncertainty. While the index made a slightly lower low in September, it posted a marginal 0.08% gain for the month, remaining not far above the lowest level since 2022.

Factors to watch in October 2025- Can Gold Reach $4,000, and is silver heading for a new record high?

As the 2025 winter season approaches, the odds favor price weakness in meats and gasoline prices over the coming weeks and months. However, livestock futures remain at record highs and were elevated during the 2024/2025 offseason. Meanwhile, gasoline demand should decline as temperatures drop, but crude oil and oil products remain sensitive to events in the Middle East.

As I wrote in the August monthly recap, “the U.S. natural gas futures market tends to reach seasonal highs when the injection season ends and withdrawal from stockpiles begins in November. However, the futures market tends to reflect the upcoming peak demand season in early fall.” We could see increasing volatility in NYMEX U.S. natural gas futures over the coming weeks. LNG demand from Europe could support prices as U.S. supplies replace Russian natural gas exports to the European market. Nearby natural gas futures prices were just over $3.30 per MMBtu at the end of September, but prices for January 2026 delivery settled at $4.177 per MMBtu on September 30, as the market expects rising prices over the coming weeks and months.

Finally, keep a close eye on those precious metals, as gold established its ninth consecutive quarterly record high on the first of October. Silver is within striking distance of the 2011 and 1980 highs around the $50 level. Meanwhile, platinum and palladium led the sector in September after posting bullish key reversal patterns in the second quarter, along with silver, and following through on the upside in September and the third quarter that ended on September 30. Precious metals have been on a bullish freight train, and time will tell if the trends continue.

The stock market has had a rough history in October. The bull market in stocks continues, but the economic and geopolitical landscapes provide more than a few roadblocks. Moreover, October and the fourth quarter begin with a U.S. government shutdown as Democrats and Republicans have dug in their heels on ideological and political grounds. While past government shutdowns have not impacted stocks and other markets, this time could be different.

Expect continued volatility in the commodities asset class in October and beyond, and you will not be surprised or disappointed.