In my second quarter animal protein report on Barchart, I concluded:

I expect a continuation of elevated beef and pork prices. Significant corrections over the coming months could be buying opportunities. Given the volatility in animal protein futures, buyers should leave plenty of room to add on declines, as it is virtually impossible to pick bottoms in the meats or any other commodity markets.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

The bullish price action in live and feeder cattle continued in Q3, while lean hog prices declined, reflecting the offseason for demand.

Fat cattle futures add to gains in Q3

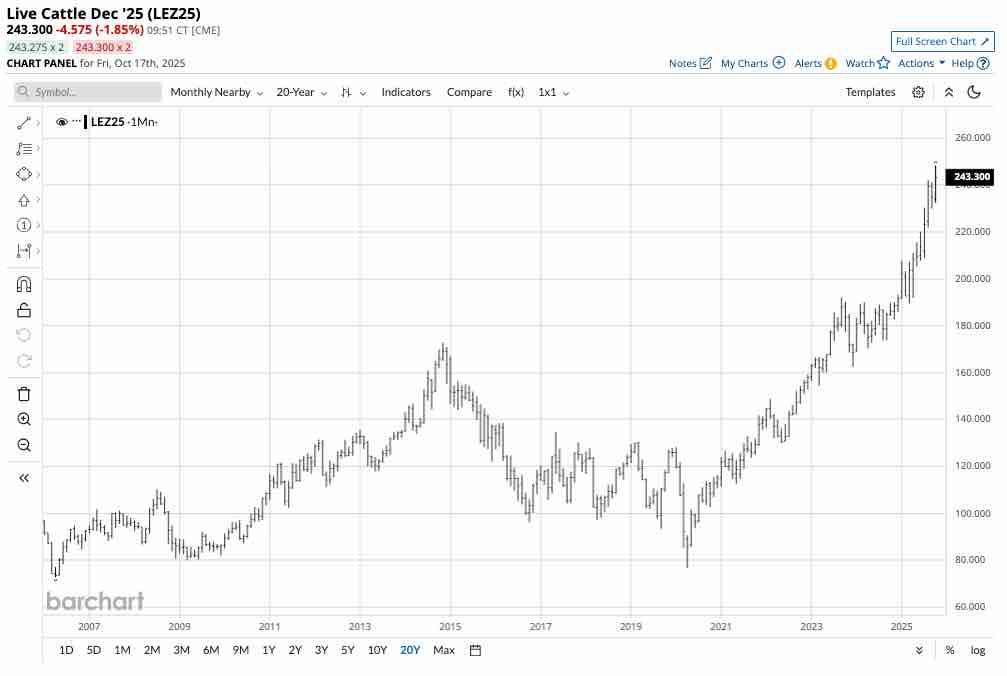

Nearby CME live cattle futures rallied 8.40% in Q3, and were 21.01% higher over the first nine months of 2025.

The monthly continuous live cattle futures chart highlights the move to a new record high in early Q4. Live cattle futures settled at $2.3185 per pound on September 30, 2025, and the price was over the $2.43 level in October, which is the offseason for beef demand.

Feeder cattle outperform the fat cattle

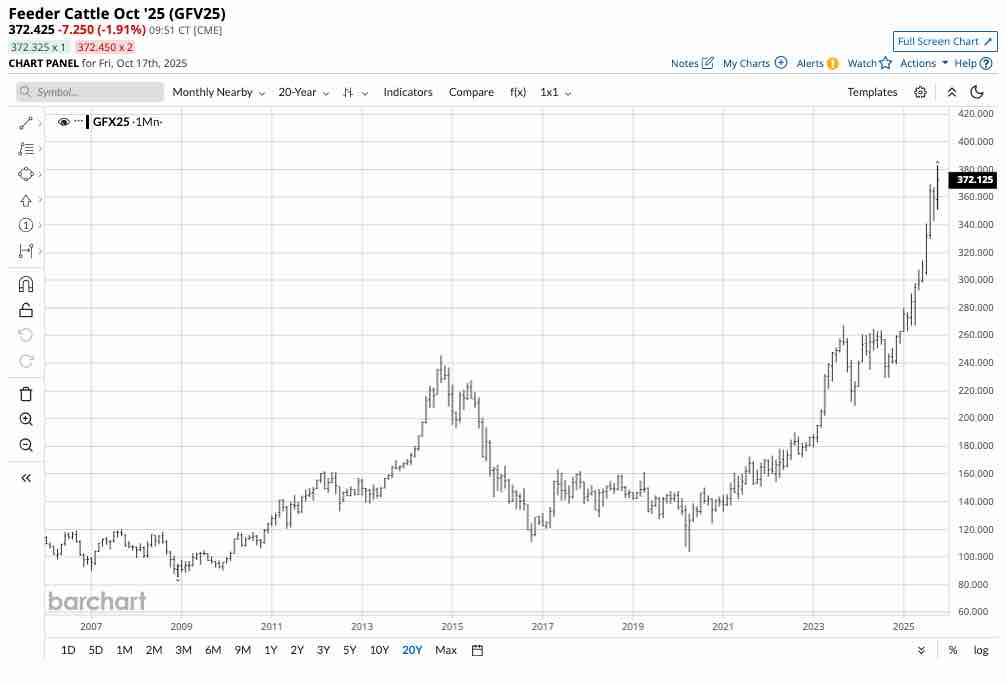

Nearby CME feeder cattle futures outperformed the live cattle, rallying 16.21% in Q3, and were 37.26% higher over the first nine months of 2025.

The monthly continuous feeder cattle futures chart highlights the move to a new record high in early Q4. Feeder cattle futures settled at $3.61025 per pound on September 30, 2025, and the price was over the $3.72 level in October, which is the offseason for beef demand.

Lean hogs declined in Q3, but were still nearly 23% higher over the first three quarters

The nearby CME lean hog futures underperformed the cattle in Q3, posting a 9.31% decline. However, the pork futures kept pace with the live cattle over the first three quarters, and were 22.82% higher from the end of 2024 through September 30, 2025.

The monthly continuous lean hog futures chart highlights that the nearby pork futures settled at 99.85 per pound on September 30, 2025, and the price was lower, below 83 cents per pound in October, which is the offseason for pork demand.

Seasonality is critical for the meats

Beef and pork demand typically peaks during the annual grilling season that runs from late May through early September. The 2025 grilling season ended in Q3 as the temperatures cooled, and barbecues went back into storage until late next spring.

While the offseason for demand has historically caused beef and pork prices to fall to annual lows, over the past years, since the 2020 pandemic, prices have remained elevated, particularly in the cattle market.

The monthly live and feeder cattle charts highlight bullish trends of higher lows and higher highs since the April 2020 low. While there have been minor price pullbacks, the trends have almost moved in straight lines over the past five and one-half years. While lean hog futures have been choppy, displaying more seasonality, the pork futures have made higher lows since the lows from April 2020. If the over one-half decade trends hold, beef and pork prices will likely remain elevated throughout the 2025/2026 offseason for demand.

Buying on price weakness could be optimal for 2026

In April 2020, beef and pork prices fell to the lowest levels in years, with lean hog futures reaching 41.50 cents per pound, live cattle falling to 76.60 cents, and feeder cattle futures dropping to a low of $1.03625 per pound.

The low prices caused ranchers and animal protein producers to reduce herds, leading to shortages. Moreover, rising production costs caused by inflationary pressures only exacerbated the shortages, resulting in record-high prices in cattle and elevated pork prices.

The odds favor continued tightness in the beef and pork markets through the 2026 grilling season. Therefore, buying on price corrections, leaving plenty of room to add if prices drop further, could be optimal over the coming months.

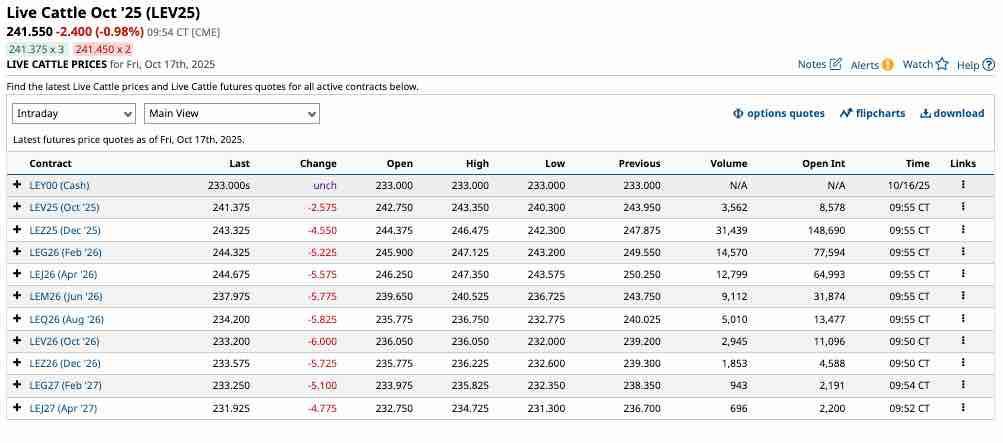

The forward curve in live cattle futures shows that prices remain near record highs for delivery in April, June, and August 2026.

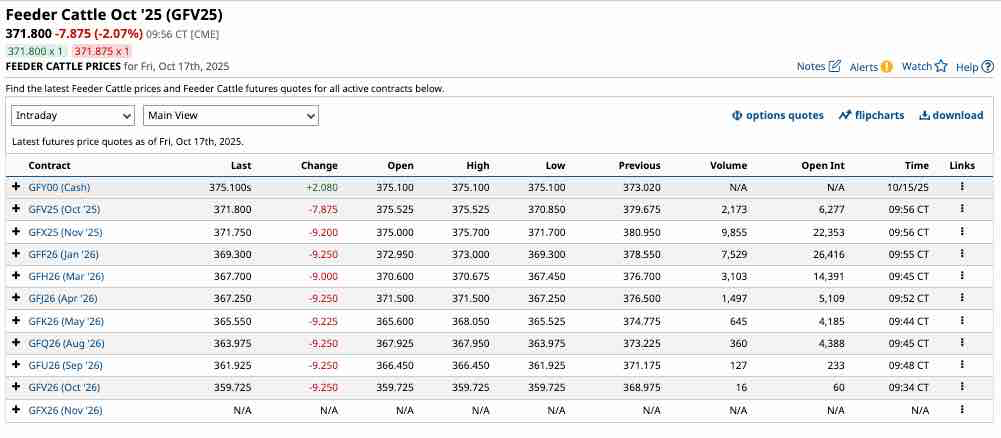

The forward curve in feeder cattle futures shows that prices remain near record highs for delivery in April, May, and August 2026.

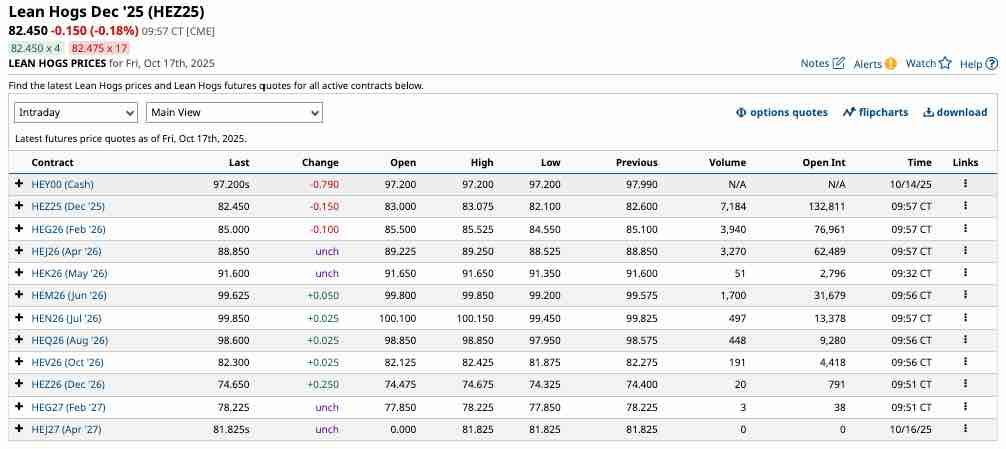

The forward curve in lean hog futures shows that prices remain elevated for delivery in April, May, June, July, and August 2026.

The forward curves for beef and pork futures highlight the expectations for continued tightness and high prices during the 2026 peak grilling season. Any significant correction in the deferred contracts over the coming weeks and months could be a buying opportunity for the peak season in 2026.