In my Q2 Barchart recap of the price action in the grain and oilseed markets, I had the following conclusion about Q3 and beyond:

The leading grains and oilseeds- corn, wheat, and soybean futures are trading at low levels compared to the 2022 highs, but they also display a long-term, multi-decade pattern of higher lows. Population growth means that production must keep pace with the fundamental equations’ ever-expanding demand side for food. Moreover, the increasing demand for biofuel puts additional upward price pressure on the agricultural products. Therefore, I continue to believe that grain and oilseed futures have limited downside and the potential for explosive upside price action. While prices could move over as the 2025 crop year progresses, lower prices could be a buying opportunity for the coming years.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Nearby CBOT soybean futures settled Q2 at $10.2425 per bushel, after posting a marginal 0.94% gain in Q2 and a 2.60% increase over the first half of 2025. At near $10.35 per bushel, oilseed futures have made upside progress but remain far below the 2022 highs as the 2025 Northern Hemisphere crop year draws to a close.

Sideways trading with a bullish bias

New crop CBOT November 2025 soybean futures reached a $9.7125 low on April 9, 2025, as the uncertainties due to U.S. tariffs on worldwide trading partners caused selling in markets across all asset classes.

The daily year-to-date chart of the 2025 new crop soybean futures shows that while the uncertainty of the 2025 crop caused the November bean futures to rally 10.6% to a June 20, 2025, high of $10.7425, the soybeans ran out of upside steam, declining 8.7% to an August 6 higher low of $9.8125 as the 2025 crop progressed. The bean futures recovered since the low of August 6, rallying to around the $10.33 level in September 2025. While beans are in a choppy trend, the longer-term trend remains sideways with a bearish bias.

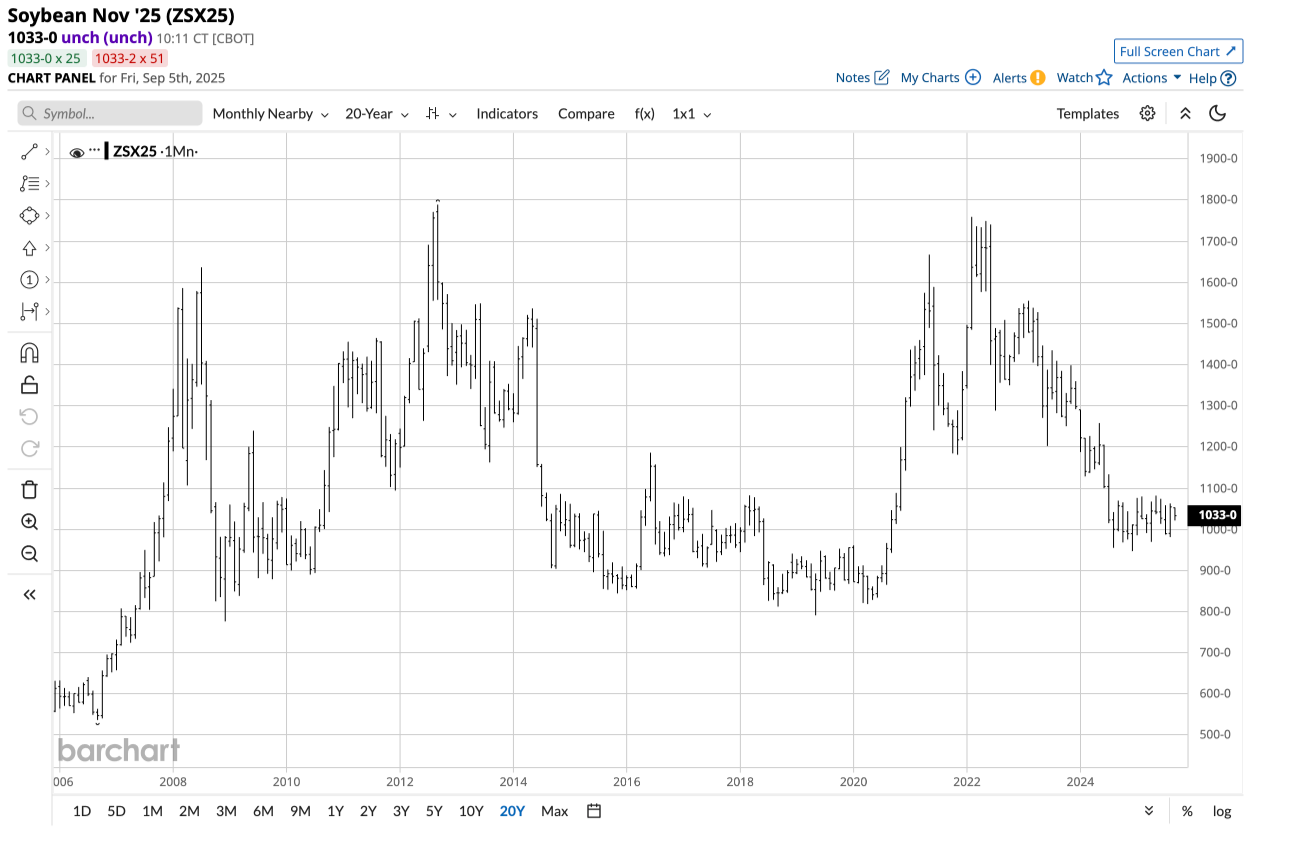

The quarterly twenty-year chart highlights that soybean futures reached a record high of $17.89 per bushel in September 2012. In 2022, the beans rose to $17.5925, just under 30 cents shy of the all-time peak. Since 2022, the soybeans have made lower highs and lower lows, reaching a low of $9.47 in December 2024. In 2025, the bean futures have been in a sideways consolidation range between $9.6950 and $10.82 per bushel.

The August WASDE was not bearish for the beans

The USDA’s monthly World Agricultural Supply and Demand Estimates Report (WASDE) is the gold standard for agricultural fundamental supply and demand data.

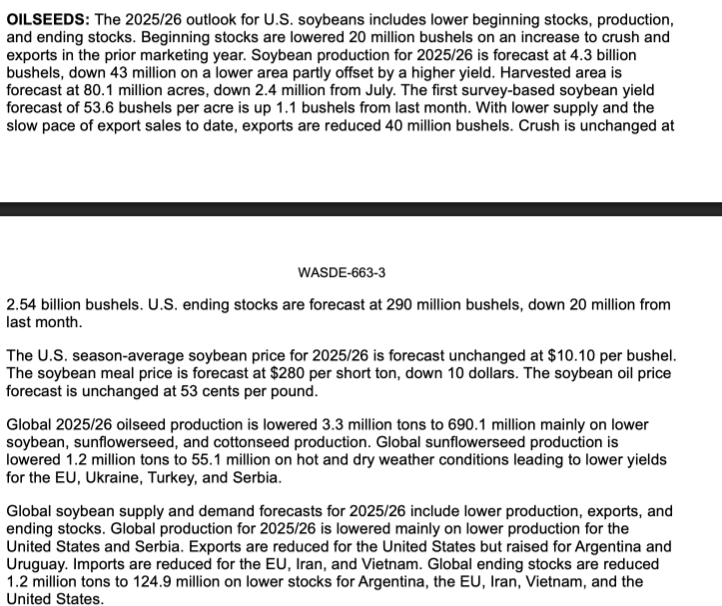

The August WASDE report told the oilseed market:

The USDA lowered U.S. beginning and ending inventories and production from the previous month and forecast lower global stocks for the period. However, the USDA left soybean and soybean product price forecasts unchanged from the prior report.

Lower inventories and production are not bearish for soybean prices as they reflect commodity cyclicality. Commodity prices tend to fall to levels where production declines, inventories decrease, and consumption increases, leading to price bottoms.

The focus shifts south to Brazil

As the 2025 U.S. growing season ends and the harvest approaches, soybean supplies are ample to meet current global demand. However, the U.S. is only the second-leading global soybean-producing country.

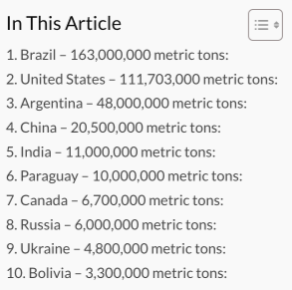

In 2024, Brazil was the leading soybean-producing country with 163 million metric tons of output. The breakdown of the leading producers was as follows:

The chart shows that the second and third leading producers, the United States and Argentina, have a combined output lower than Brazil, making the South American producer the most significant factor in the path of least resistance of soybean futures prices. Brazil is south of the equator, so the 2025/2026 crop year will begin as the Northern Hemisphere’s harvest ends. Therefore, the weather in Brazil and Argentina will determine the path of least resistance of soybean futures over the coming weeks and months as the planting season gets underway.

Trade issues could impact soybean prices in 2026 aside from the weather

Brazil is the world’s leading soybean-producing country, and China is the top oilseed importer. Tariffs are trade barriers that distort global commodity flows and prices, creating shortages in some areas and oversupply in others. Brazil and China are in the crosshairs of the Trump administration’s tariffs in 2025. China, historically the top buyer of U.S. soybeans, has turned to Brazil for supplies. In an August 19, 2025, letter from the President of the American Soybean Association to President Trump, Caleb Ragland wrote:

Over the past five years, China has imported an average of 61% of the world’s available soybean supplies – more than the rest of the world combined. Historically, the U.S. was the provider of choice for Chinese customers. However, due to ongoing tariff retaliation, our longstanding customers in China have and will continue to turn to our competitors in South America to meet their demand, a demand Brazil can meet due to significantly increased production since the previous trade war with China.

Unfortunately for our soybean growers, China has contracted with Brazil to meet future months’ needs to avoid purchasing any soybeans from the United States. U.S. soybeans currently face a duty 20% higher than soybeans from South America due to Chinese retaliatory tariffs. That puts our farmers at an untimely competitive disadvantage. China has not purchased any U.S. soybeans for the months ahead as we quickly approach harvest. The further into the autumn we get without reaching an agreement with China on soybeans, the worse the impacts will be on U.S. soybean farmers.

The bottom line is that the tariff issue and trade barriers with China and Brazil are critical factors in determining the path of least resistance for U.S. soybean prices over the coming weeks and months. A trade deal would alleviate concerns, while ongoing trade frictions could lead to a substantial bifurcation between U.S. and Brazilian prices.

SOYB is the soybean ETF- Limited downside potential?

Soybeans are one of the commodities in the crosshairs of the ongoing tariff disputes because China is the world’s leading importer, Brazil is the top producer, and the U.S. is the second-leading oilseed-producing country. Uncertainty can lead to significant price volatility in the soybean futures market, which is sitting near the lowest level since 2020.

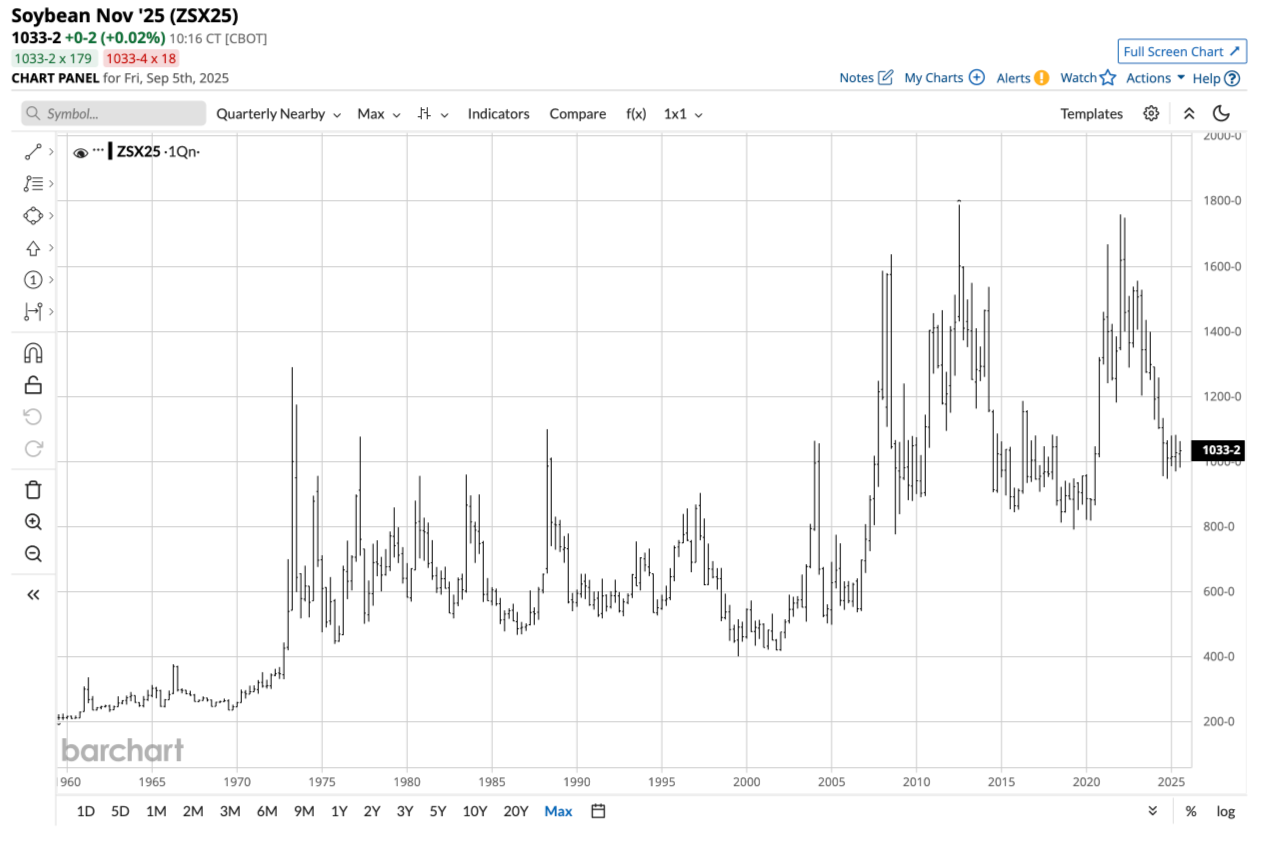

The quarterly chart highlights a long-term bullish trend of higher lows over the past decades. Rising soybean prices are a function of demographics as the world’s population continues to grow. In 1959, there were fewer than three billion mouths to feed, whereas in 2025, the population exceeds 8.24 billion. Moreover, aside from soybeans’ role in feeding the world, innovations in energy have made the beans a critical ingredient in biofuel production, thereby increasing the demand side of the soybean fundamental equation.

At around the $10.33 per bushel level, the downside price potential could be limited, but tariffs could cause significant price variance over the coming weeks and months. The most direct route for a risk position in soybeans is the CME’s CBOT division soybean futures and futures options market. The Teucrium Soybean ETF product (SOYB) moves in tandem with a portfolio of three actively traded CBOT soybean futures, excluding the nearby futures contract, to minimize roll risks. At $22.04 per share, SOYB had $25.357 million in assets under management and charges a 0.83% management fee. As SOYB excludes the nearby soybean futures contract, which tends to experience the most volatility due to speculative activity, SOYB often underperforms the most actively traded soybean futures contract on the upside and outperforms during downside price action.

As the end of the 2025 Northern Hemisphere soybean crop year approaches, all eyes will turn south to Brazil, where the weather and trade issues will determine the path of least resistance of prices over the coming weeks and months. Soybean prices are at a level where demographics and commodity cyclicality favor a price recovery; however, the trade issues could result in high volatility in the current environment.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.