Despite having an extraordinary track record on Wall Street, 2022 has been a testing year for FAANG stocks. Having taken a battering from tech stock sell-offs in the wake of record-breaking inflation and supply chain issues arising from the Covid-19 pandemic, leading growth stocks have struggled to recapture the form that pushed many companies to new all-time high prices last year. With firms like Netflix, which had a considerable presence in Russia before ceasing operation in the wake of the invasion of Ukraine, geopolitical tensions have also hit traditionally steady stocks hard.

FAANG stocks, consisting of Meta Platforms Inc (NASDAQ:FB), Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Netflix Inc (NASDAQ:NFLX), and Alphabet Inc (NASDAQ:GOOGL), have all experienced hardships that haven’t been seen since the depths of the initial Covid-19 crash in March 2020.

Together with Microsoft (NASDAQ:MSFT), FAANG stocks have lost $1.404 trillion in market capitalization in April alone - a value that’s larger than Australia’s GDP, for scale.

(Image: The Verge)

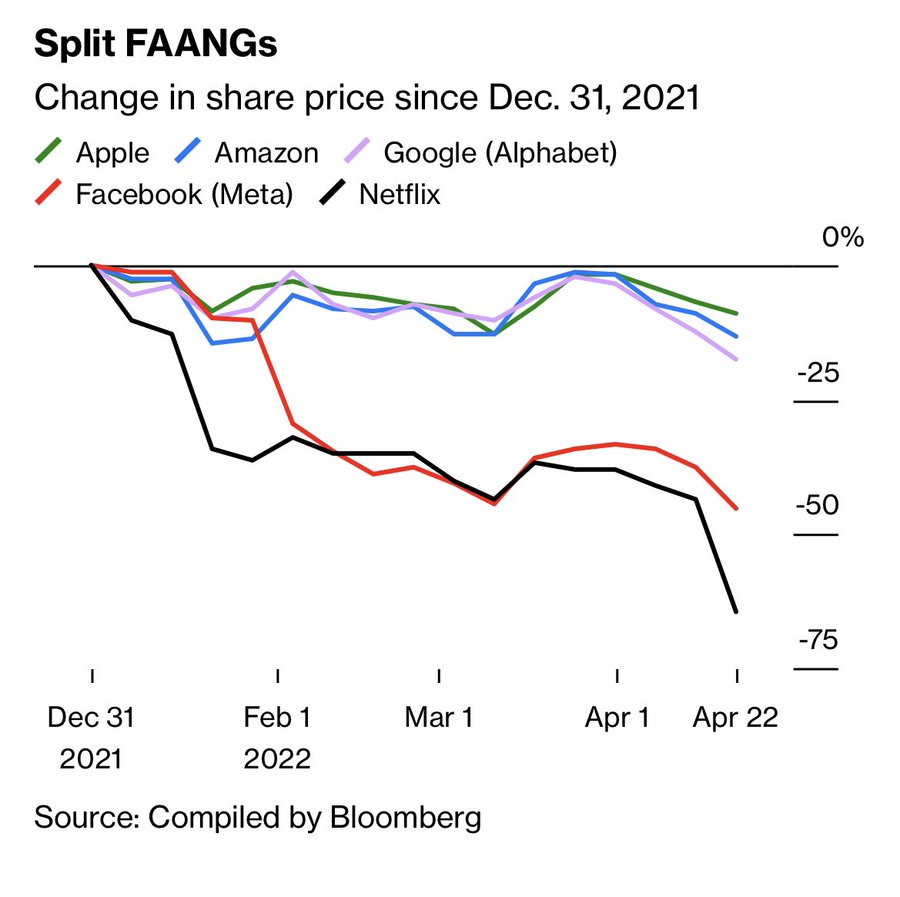

As we can see from the chart above, no FAANG stock is performing well in 2022, and the likes of Netflix and Meta have fallen significantly over the opening five months of the year.

With this in mind, why would investors look to buy into these tech players that have fallen on hard times of late? By zooming out, we can see a far clearer picture of why FAANG stocks have grown to be revered by Wall Street.

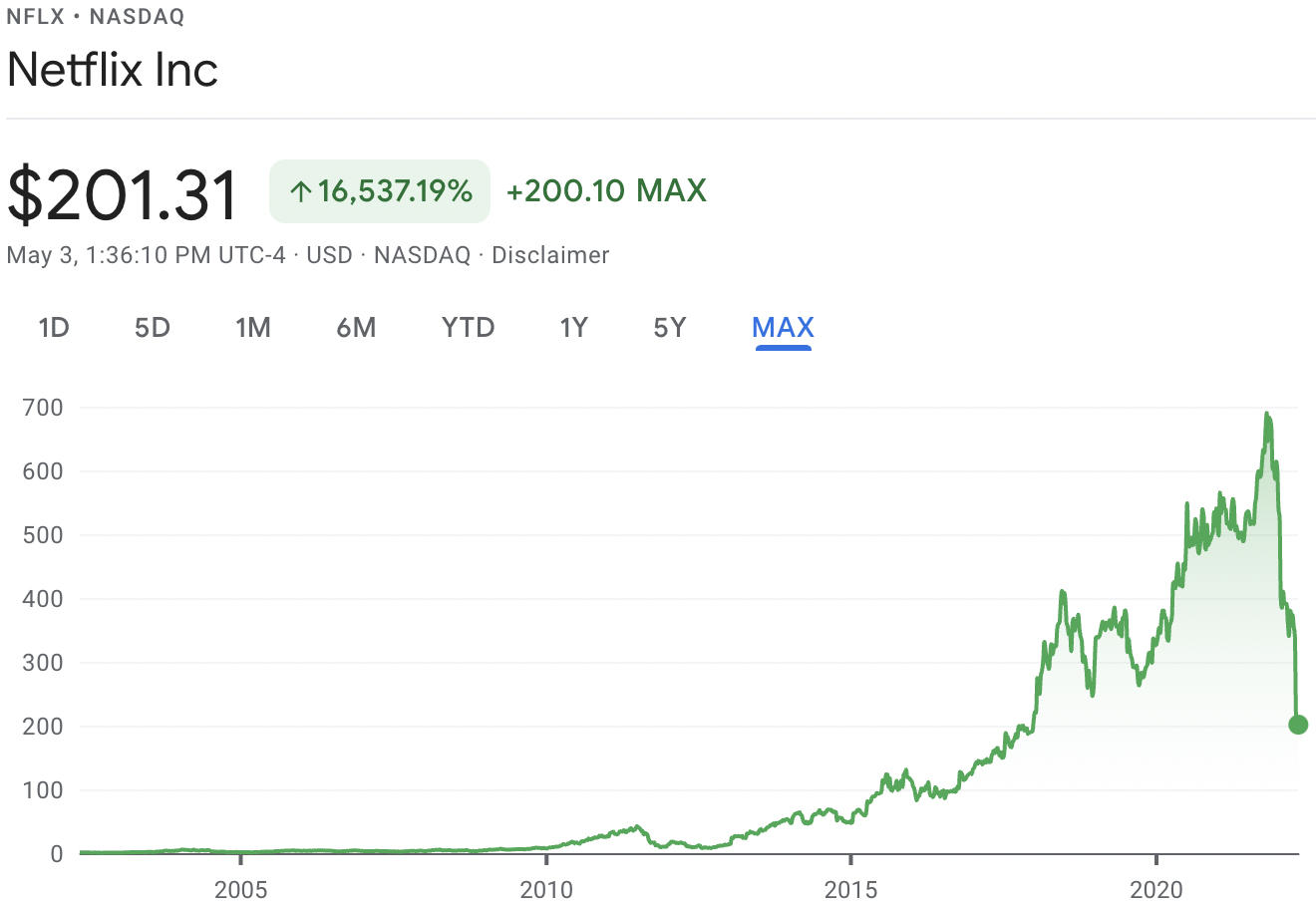

Taking Netflix, the hardest hit FAANG stock, as an example, we can see that the rate of the stock’s collapse is nothing short of astonishing. However, we can also see that NFLX is still some 16,500% up on the day it debuted on the Nasdaq.

Naturally, this is by no means an indicator of future performance, and investors should rightly be concerned by Netflix’s recent downturn, but NFLX, like the rest of the stocks that populate FAANG, are companies that have stood the test of time, and have consistently rallied to new highs in spite of volatile wider market conditions.

With this in mind, let’s take a look at the credentials of Wall Street’s FAANG favorites, and explore whether the much loved stocks can get their bite back in 2022:

Can FAANG Stocks Recover from their Lows?

One of the leading factors behind the struggles of tech stocks in recent months has come from investor fears surrounding the Federal Reserve’s raising of interest rates - which has contributed to pushing many stocks to their lowest levels since the initial emergence of the Covid-19 pandemic.

“We’re in a period where tech companies are being sold off and investors are nervous, so the downside is brutal, but that also creates an opportunity. It’s time to start building positions at the very least,” claimed Charles Lemonides, founder and chief investment officer at ValueWorks, adding.

Interestingly, Lemonides has remained optimistic in spite of Netflix’s recent hardships, claiming that the company has “adapted to challenging moments before.” He also calmed investor fears over Alphabet’s recent volatility, stating that investors “shouldn’t read too much into the choppiness.”

When assessing his selection of stocks that may deliver better growth in Q3 2022, Maxim Manturov highlighted FAANG companies as a great opportunity for investors to access better upside potential, but the head of investment advice at Freedom Finance Europe warned to stay away from firms with questionable balance sheets amidst the downturn.

“Investors should use a selective overall strategy and not forget about diversification. This includes an emphasis on quality deals that are based on solid balance sheets and high cash flow generation,” Manturov explained. “Also one of the ways to guard against market uncertainty is to abandon stocks with troubled balance sheets, which benefited from stimulus during the pandemic.”

“Instead, focus on profitable companies, with valuable brands and a US-centric business. There is also the large technology sector or FAANG segment, which looks extremely attractive after the correction, retaining fundamental upside potential.”

Could FAANG be Replaced by MANG?

However, not all analysts remain enamored by FAANG stocks, and in May, a team of Jefferies analysts led by Sean Darby stated that their position on the old Wall Street favorites remained the same as February: steer clear of FAANG and Microsoft stocks due to the prospect of rising interest rates and its impact on ‘long duration assets’.

However, Darby reiterated that a better prospect for investors revolved around MANG - referencing the stocks belonging to Microsoft, Apple, Nvidia Corp (NASDAQ:NVDA), and Alphabet as a better collection of stocks in the wake of rising rates. Darby noted that “their balance sheet, earnings yield and free cash flow yield,” made the MANG collective of stocks stand out amidst the uncertainty facing the likes of Netflix, Meta, and Amazon.

Despite Nvidia rarely finding itself included in the Wall Street collective of tech superstars, the stock is a computing heavyweight in its own right, and the prospect of emerging as a key player in the development of the metaverse has caused plenty of buzz around NVDA as a stock.

Naturally, no investor who has seen FAANG’s spectacular growth throughout the 2010s is likely to write the leading growth companies off in a hurry. However, the future stars of the metaverse may deliver something of a shift as to where investments may go in the short term. With this in mind, Web 3.0 may have more answers in store for where Q3’s investments are headed.