Donald Trump’s sweeping tariffs on India in response to its oil purchases from Russia could prompt New Delhi to set aside its longstanding rivalry with China and explore closer cooperation.

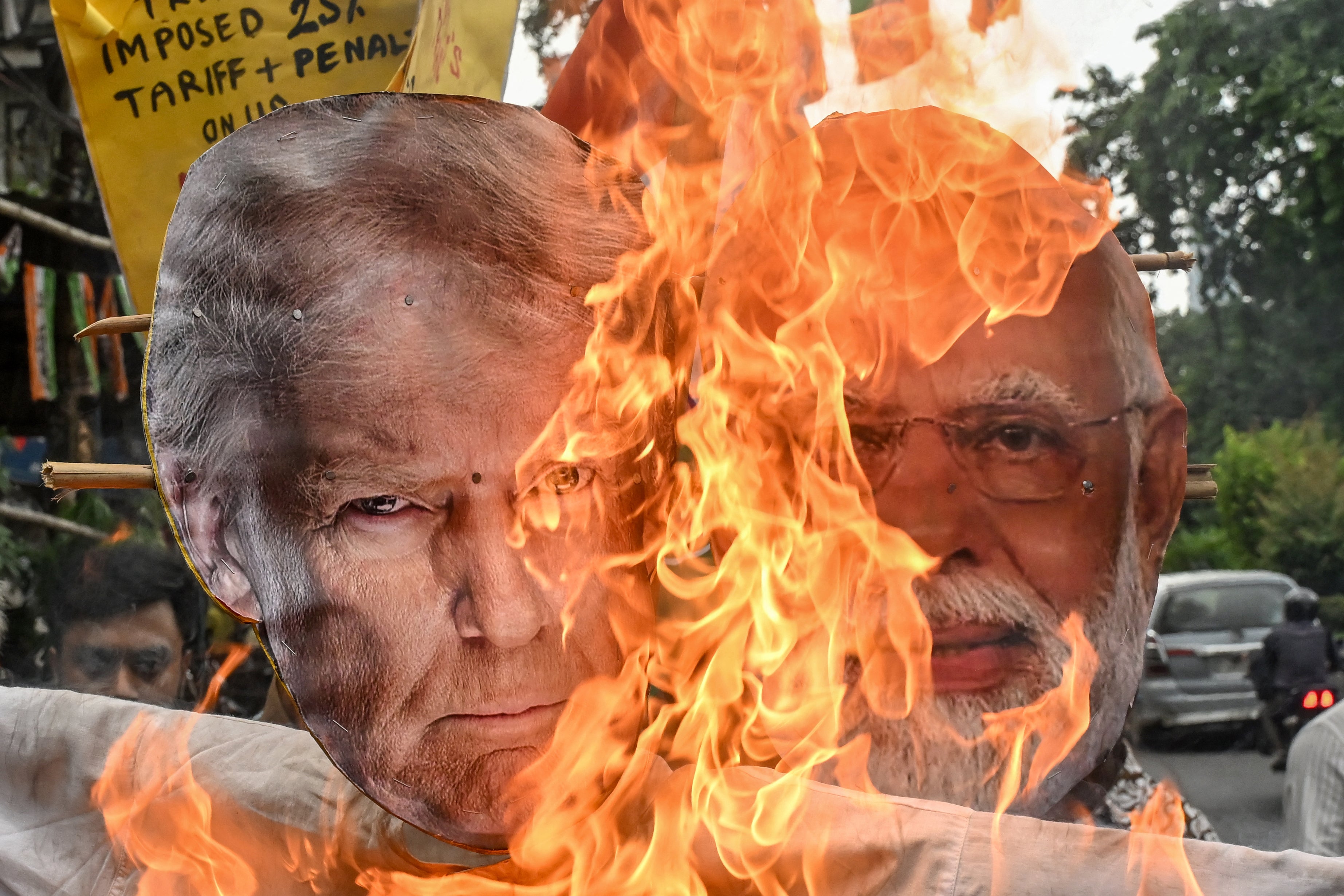

Trump imposed an additional 25 per cent tariff on Indian goods on Wednesday, raising the total duty to 50 per cent – among the highest imposed on any US trading partner. India criticised the move, calling it “unfair and unfortunate”.

Trump says he will impose new sanctions on Russia, as well as on countries that buy its energy exports, unless Moscow takes steps to end its war with Ukraine. Russian president Vladimir Putin has shown no public indication of altering his stance despite the deadline.

India’s foreign ministry said it “will take all necessary steps to protect its national interests” and added that the purchases were driven by market factors and the energy needs of India’s 1.4 billion people.

A commerce ministry official told Reuters that exporters hit by tariffs would receive financial assistance and be encouraged to diversify to markets such as China, Latin America and the Middle East.

Although India has been one of Washington’s key strategic partners in countering China’s dominance in the Asia-Pacific region, experts warn that the latest wave of US tariffs could prompt New Delhi and Beijing to seek closer mutual ties.

The eye-watering levy applies to a wide range of goods such as garments, gems and jewellery, footwear, furniture, and chemicals. It threatens thousands of small exporters, including in prime minister Narendra Modi's home state of Gujarat. It also puts India at a disadvantage in export competitiveness against rivals such as China and Vietnam.

Trump has also sought closer ties with Pakistan, repeatedly claiming credit for brokering a ceasefire between New Delhi and Islamabad – a claim that has been rejected by the Indian government. In addition, Trump’s taunt that India could buy oil from its arch-enemy Pakistan has not gone down well in New Delhi, two Indian government sources told reporters.

The new tariffs were imposed just days ahead of Modi’s first visit to China in more than seven years – an engagement that suggests a potential realignment in alliances. Modi will travel to China at the end of the month, when leaders of the Shanghai Cooperation Organisation are set to gather for a summit in Tianjin from 31 August to 1 September.

India and China have sought this year to repair ties that were strained by the 2020 border skirmish between their respective militaries. This year, both nations resumed the Mansarovar Yatra and ended the visa freeze for tourists.

In recent years, successive US administrations – even Trump’s, during his first tenure as president – have strategically deepened ties with India, but analysts believe the latest actions risk dragging the relationship to its lowest point since the US sanctioned India in 1998 over its nuclear tests.

Trump has been accused of selectively targeting India for purchasing Russian oil while EU continues to import liquefied natural gas from Russia.

Despite mounting US pressure, New Delhi and Moscow intend to increase their annual trade by 50 per cent to $100bn (£74bn) over the next five years.

The trade talks between India and the US broke down after five rounds of negotiations, over disagreement about opening India’s vast farm and dairy sectors to US imports, and stopping Russian oil purchases. Trump has intensified his criticism of New Delhi and Moscow, labelling them “dead economies” in a social media post last week.

“The next round of negotiations between the trade teams in August will ask more of India, but the question is, what would India give? The US side must also take into account India’s strategic importance as a China counterweight,” says Farwa Aamer, director of South Asia initiatives at the Asia Society Policy Institute.

“If US-India ties get strained further, it only helps China to maintain and expand its influence. It also makes a strong case for India to ensure that its own relations with China remain stable.”

India’s growing proximity to China has sounded alarm bells in the Republican Party, with Nikki Haley, the former US ambassador to the UN, warning Trump against burning the bridges that have been carefully built with New Delhi. “Don’t give China a pass and burn a relationship with a strong ally like India,” she wrote on X.

Trump’s executive order on Wednesday did not mention China, which also imports Russian oil, but he later said he could announce similar further tariffs on Chinese goods. Last week, US Treasury secretary Scott Bessent warned China that continuing to purchase Russian oil could trigger new tariffs, as Washington prepares for the expiry of a US-China tariff ceasefire on 12 August.

When asked about targeting India, Trump hinted at a wider crackdown on nations importing Russian oil. “It’s only been 8 hours. So let’s see what happens. You’re going to see a lot more... You’re going to see so many secondary sanctions,” he told reporters.

In 2024, bilateral trade in goods between the EU and Russia was worth €67.5bn (£58.6bn), India's foreign ministry spokesperson Randhir Jaiswal said this week. He claimed that European imports of LNG in 2024 reached a record 16.5 million tonnes, surpassing the last record of 15.21 million tonnes in 2022. Around 17 per cent of Europe’s gas still comes from Russia, via the TurkStream pipeline and LNG shipments, according to reports.

Jaiswal pushed back against Washington’s claims, saying that India began importing from Russia because traditional supplies were diverted to Europe after the outbreak of the conflict in 2022. “The United States at that time actively encouraged such imports by India for strengthening global energy markets’ stability,” he added.

The decision to import Russian oil was “meant to ensure predictable and affordable energy costs to the Indian consumer”, continued Jaiswal. “However, it is revealing that the very nations criticising India are themselves indulging in trade with Russia.”

“The decision to double tariffs on Indian goods to 50 per cent is another example of the deliberate and muscular unpicking of the rules‑based multilateral global system,” says Marco Forgione, the director general of the Chartered Institute of Export & International Trade.

Modi is also under tremendous domestic pressure to stand up to his long-term friend, Trump, whom the Indian opposition parties have accused of bullying.

“India is now in a trap: because of Trump’s pressure, Modi will reduce India’s oil purchases from Russia, but he cannot publicly admit to doing so for fear of looking like he’s surrendering to Trump’s blackmail,” says Ashley Tellis of Washington’s Carnegie Endowment for International Peace.

“We could be heading into a needless crisis that unravels a quarter-century of hard-won gains with India.”

Indian state refiners have in recent days stopped buying Russian oil as discounts narrowed and pressure from Trump rose, news agencies reported.

Modi, in his first statement after the tariff announcement, claimed that “India will never compromise on the wellbeing of its farmers, dairy [sector] and fishermen”.

“And I know, personally, I will have to pay a heavy price for it,” he added. Trump’s tariffs are poised mainly to affect exports of leather, chemicals, footwear, gems and jewellery, textiles, and seafood.

Relations between India and China are in an “up cycle” and, as leaders of the Global South, they have to really speak to each other, said Henry Wang, president of the Center for China and Globalization think tank in Beijing.

“Trump’s tariff war on India has made India realize that they have to maintain some kind of strategic autonomy and strategic independence,” he told Bloomberg.

India exported goods worth around $87bn to the US in the fiscal year ending March 2025, which accounts for about 2 per cent of India’s GDP. If the proposed 50 per cent duty on Indian goods is enforced from 21 August, pharmaceutical exports, which are subject to a different duty structure, may be the only products still shipped from India to the US.

One Indian government source told reporters that India needs to gradually repair ties with the US while engaging more with other nations that have faced the brunt of Trump tariffs and aid cuts, including members of the African Union and the Brics bloc, which includes Brazil, Russia, China and South Africa.

While India mends ties with China, Putin is expected to visit New Delhi this year. On Tuesday, Russia said the two countries had discussed further strengthening their defence cooperation “in the form of a particularly privileged strategic partnership”.

“Russia will attempt to exploit the rift between the US and India by proposing the restoration of the Russia-India-China trilateral and new projects in defence,” says analyst Aleksei Zakharov at the Observer Research Foundation. “India will undoubtedly be mindful of structural factors, such as sanctions against Russia, and will seek to find a compromise with the Trump administration.”