/Apple%20products%20on%20desk%20by%20Ake%20Ngiamsanguan%20via%20iStock.jpg)

Apple (AAPL) just delivered another blockbuster quarter, smashing expectations and signaling that something big may be on the horizon. It also wrapped up fiscal 2025 with an all-time high revenue record of $416 billion. While AAPL stock has risen 23% in the last 52 weeks, it is up 9% year-to-date (YTD), trailing the tech-led Nasdaq Composite Index's ($NASX) gain of 20%. As the company pushes down on innovation and continues to dominate worldwide markets, the question remains: is AAPL a buy before its next big move?

iPhone Still Rules the World

Despite countless new smartphones flooding the market with cutting-edge features, the iPhone still rules the world. Apple's seamless combination of luxury design, unrivaled ecosystem integration, and reliable performance keeps customers loyal year after year. Hence, the iPhone business continues to be Apple’s crown jewel, generating $49 billion in revenue, a 6% year-over-year (YoY) increase in the fourth quarter of fiscal 2025, despite supply constraints on the new iPhone 16 and iPhone 17 models. The company set September quarter records in emerging markets such as Latin America, South Asia, and the Middle East, as well as an all-time record in India. According to 451 Research, customer satisfaction remained unusually high in the U.S. this year, at 98%.

The iPhone 17 Pro, powered by the new A19 Pro chip, is claimed to be the most powerful iPhone yet, including a groundbreaking ADEX telephoto camera and beautiful finishes such as Cosmic Orange. Meanwhile, the iPhone Air is gaining popularity for its larger, brighter ProMotion display, which provides a more economical upgrade route for longtime Apple customers.

Apple reported $102.5 billion in revenue, up 8% YoY, marking a new September quarter record. Despite tariff-related charges of $1.1 billion, earnings per share increased 13% to $1.85, with a gross margin of 47.2%.

New Era of AI Performance

Aside from the iPhone, the Mac line stood out as a remarkable performer in Q4, with revenue increasing 13% YoY to $8.7 billion, boosted by the success of the MacBook Air. According to the same survey, nearly half of Mac purchases were from new customers, with satisfaction rates reaching 96%. Additionally, iPad revenue remained stable at $7 billion, while Wearables, Home, and Accessories generated $9 billion, boosted by strong Apple Watch and AirPods sales.

Meanwhile, Apple’s Services division generated $28.8 billion in revenue, up 15% YoY, marking an all-time record. The company achieved all-time highs across categories such as Apple Pay, App Store, cloud, music, and video, putting annual services revenue above $100 billion for the first time.

Beyond its stellar financials, Apple is gearing up for the next age of technological innovation. CEO Tim Cook announced that Apple plans to invest $600 billion in the U.S. over the next four years, with an emphasis on advanced manufacturing, silicon engineering, and artificial intelligence (AI). This major project builds on Apple's long-standing commitment to American innovation, which currently supports 450,000 jobs across 50 states. Additionally, Apple is also leading efforts to establish an end-to-end U.S. silicon supply chain, which may boost domestic technology production and reduce reliance on overseas manufacturing.

Apple’s $1 Billion AI Bet: Partnering With Google to Supercharge Siri

During the Q4 earnings call, management stated that Apple is preparing for more than just another product cycle. In fact, it is poised to redefine the next decade of technology. Cook underlined that a more personalized Siri, which is anticipated next year, will help Apple realize its vision of creating devices that learn, adapt, and respond naturally to customer demands.

On Nov. 6, Bloomberg News reported Apple's intention to collaborate with Alphabet's (GOOG) (GOOGL) Google in a major AI effort that might change Siri's future. Notably, Apple intends to integrate Google's sophisticated 1.2 trillion-parameter Gemini AI model into its voice assistant Siri as part of a temporary but strategic makeover. The agreement, thought to be valued at roughly $1 billion per year, presents Google's AI as a bridge while Apple continues to develop its own in-house systems. With competitors like Amazon (AMZN) and Google already embedding advanced AI into their assistants, Siri has lagged. This could help close that gap. However, the partnership doesn’t include integrating Google’s AI search tools into Apple’s operating systems, keeping the focus mainly on improving Siri's intelligence and responsiveness.

Something Huge on the Horizon

Tim Cook hinted that the December quarter may be Apple's strongest ever, particularly for the iPhone. Apple expects revenue to climb by 10% to 12% YoY, as well as double-digit iPhone growth. The company expects a gross margin of 47% to 48%, even as it intensifies its AI expenditures. Nonetheless, Apple remains cash-rich and committed to returning to shareholders. It ended the quarter with $132 billion in cash and marketable securities, less $99 billion in total debt, for a net cash position of $34 billion. The company paid out $24 billion to shareholders, including $3.9 billion in dividends and $20 billion in stock buybacks.

Looking ahead, analysts expect Apple’s revenue and earnings to increase by 8.8% and 10% in fiscal 2026. Apple stock is currently trading at 32x forward earnings, compared to its historical average of 28x.

What Does Wall Street Say About AAPL Stock?

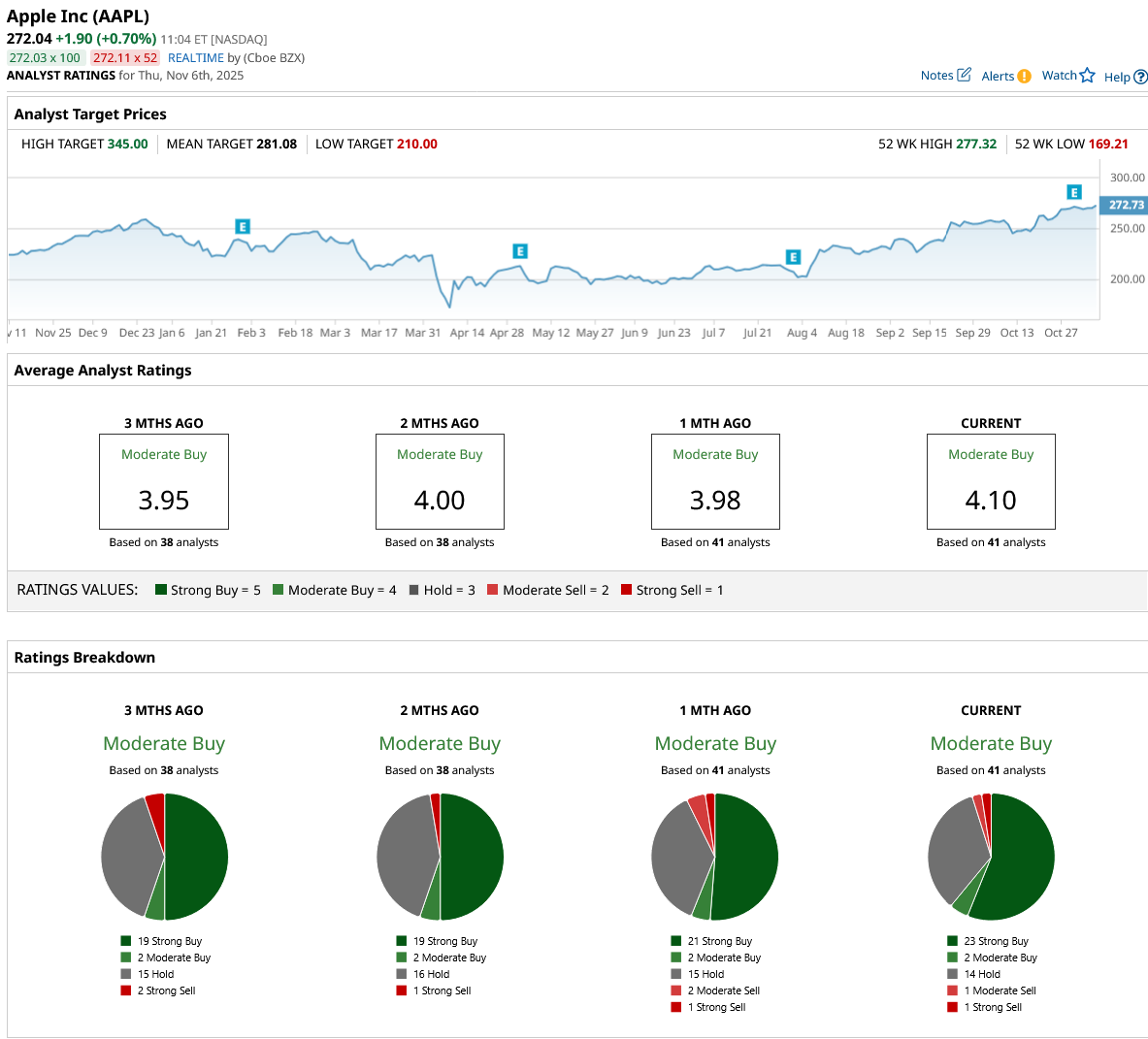

On Wall Street, AAPL stock is rated a consensus “Moderate Buy.” Of the 41 analysts covering it, 23 recommend a “Strong Buy,” two rate it a “Moderate Buy,” 14 suggest a “Hold,” one suggests a “Moderate Sell,” and one more says it is a “Strong Sell.” With an average price target of $281.08, analysts project a potential upside of around 3.3% from current levels. The highest price target of $345 suggests the stock could rise as much as 27% from current levels.

Whether it’s the evolution of Apple Intelligence or a bold new AI-powered Siri, all signs point to Apple getting ready for something massive. Over the next decade, Apple, currently worth $4 trillion, may reward investors who are patient and believe in the company's vision.