Wednesday was a good day for unusual options activity, with 1,302 divided 65/35 between calls and puts, a very bullish indicator.

Not surprisingly, the S&P 500 closed at a record high of 6,532.04, up 0.3% on the day. It was the second consecutive day closing at a record high. Investors were egged on by Oracle's (ORCL) 36% jump, which made co-founder Larry Ellison the wealthiest person on the planet, passing Elon Musk.

While the call options held sway yesterday, it is the put options that captured my attention this morning as I reviewed Wednesday’s unusual options activity.

Specifically, there were 459 unusually active put options yesterday. Several of the puts can generate outsized returns for aggressive investors willing to take the risk.

Here are three that jump out at me. All three had Vol/OI (Volume-to-Open-Interest) ratios over 10. All three could generate annualized returns in excess of 70% by selling the puts.

Upstart (UPST)

First up is Upstart (UPST), the AI lending platform that helps banks make better and faster lending decisions.

Its stock has had a topsy-turvy go of it over the past year. While UPST shares are up 78% over this time, it’s come with significant volatility. It’s had 74 moves of 5% or more, up or down, in the past 12 months. As a result, its share price has ranged from a high of $96.43 in February to a low of $31.40 in April.

Yesterday, thanks to the IPO of Klarna (KLAR), the latest BNPL (buy now pay later) business to go public, its shares lost nearly 10% on the day.

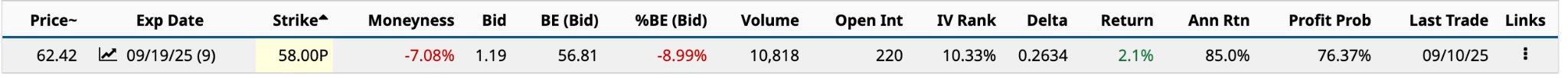

So, why would I recommend selling the Sept. 19 $58 put for income given the momentum lower?

I don’t see another big move in the cards over the next nine days. Furthermore, yesterday’s investor reaction to Klarna was overkill. The two firms don’t play in the same sandbox.

Upstart, according to MarketWatch, is expected to earn $1.65 a share in 2025, $2.44 in 2026, and $3.06 in 2027, 85% higher over the next two years.

The expected move, up or down, over the next nine days is $5.12 (8.2%). The lower price of $57.30 is ITM (in the money) by 70 cents. However, the breakeven is $56.81, so you’d still make money on the trade. If OTM (out of the money) at expiration, your annualized return would be 85%, a hefty return indeed.

Nu Holdings (NU)

The Brazilian fintech and digital bank’s stock is up 50% year-to-date, including 31% in the past month alone. Yet, it’s seen $15 before. A year ago, it traded nearly as high as where it is today, highlighting the stock’s volatility.

I’ve been a fan of Nu Holdings (NU) for several years, in part because I love Latin American stocks, but also because Warren Buffett’s Berkshire Hathaway (BRK.B) bought NU stock in its December 2021 IPO and held the shares until earlier this year.

In July 2024, I wrote positively about Nu and its unusually active options, stating, “Sure, operating in Latin America presents some risks not found in the U.S., but the growth of digital banking down there remains significant. It’s a gamechanger for millions of average people.”

I recommended the Jan. 16/2026 $12 call. At the time, the $12 call’s ask price was $4.10. Today, the ask price is $4.00 as I write this. With four months to expiration, it still has a good shot to be trading over the $16 breakeven. But I digress.

Nineteen analysts cover NU stock. Fourteen rate it a Buy, with a $17 target price, about 10% higher than where it’s currently trading. Over the next 12 months, I see the share price moving into the $20s.

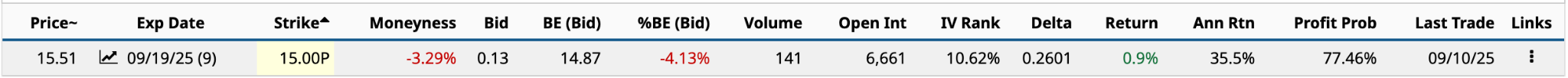

The expected move over the next nine days is $0.55 (3.6%). The lower price of $14.96 is ITM by four cents. However, the breakeven is $14.87, so you wouldn’t lose money on the trade in this scenario. If OTM at expiration, your annualized return would be 36%..

Trade Desk (TTD)

Trade Desk (TTD) stock has gotten hammered in 2025, down 61%, including 13% in the past month. Less than a year ago, it traded as high as $141.53, an all-time high.

I’m uncertain whether the company’s cloud-based technology platform, which enables advertisers and agencies to buy, manage, and optimize digital advertising campaigns, can generate sufficient growth in a highly competitive space to bring the stock back into the triple digits.

However, TTD stock is oversold. The stock’s relative strength is 26.05%. Anything below 30% is considered oversold.

Analysts have become more pessimistic about the company’s chances in recent months. Currently, 20 of 37 analysts rate TTD a Buy (3.86 out of 5), down from 25 of 36 (4.31 out of 5) two months ago.

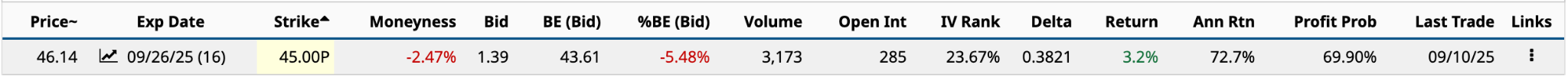

The Sept. 26 $45 put was 2.47% OTM at the close yesterday with a $43.61 breakeven. The $139 premium, should the share price stay OTM over the next 16 days, would generate a 72.7% annualized return.

With an expected move of $3.06, the lower price of $43.56 is pennies away from losing money on the trade. However, the worst-case scenario of having to buy 100 shares of TTD at $43.61 a share, in the long run, won’t be a losing proposition.

Although it may not be worth $141.53, the intrinsic value of its stock is likely higher than $43.61. For what it’s worth, the analysts’ median target price is $75.