Gold, the leading precious metal, rose to its eighth consecutive quarterly record high in Q3 2025; however, ironically, the yellow metal posted the smallest percentage gain among the other precious metals.

In my Q2 report on precious metals on Barchart, I concluded with:

I remain bullish on the precious metals sector, but even the most aggressive bull markets rarely move in straight lines. Buying on price corrections has been optimal in gold since the 1999 low, and I expect that trend to continue in gold, silver, platinum, and palladium over the coming months.

Prices soared in Q3, posting across-the-board double-digit percentage gains. Moreover, prices continued to gain in early Q4, with gold reaching its ninth consecutive quarterly record high, and silver moving to a new record peak.

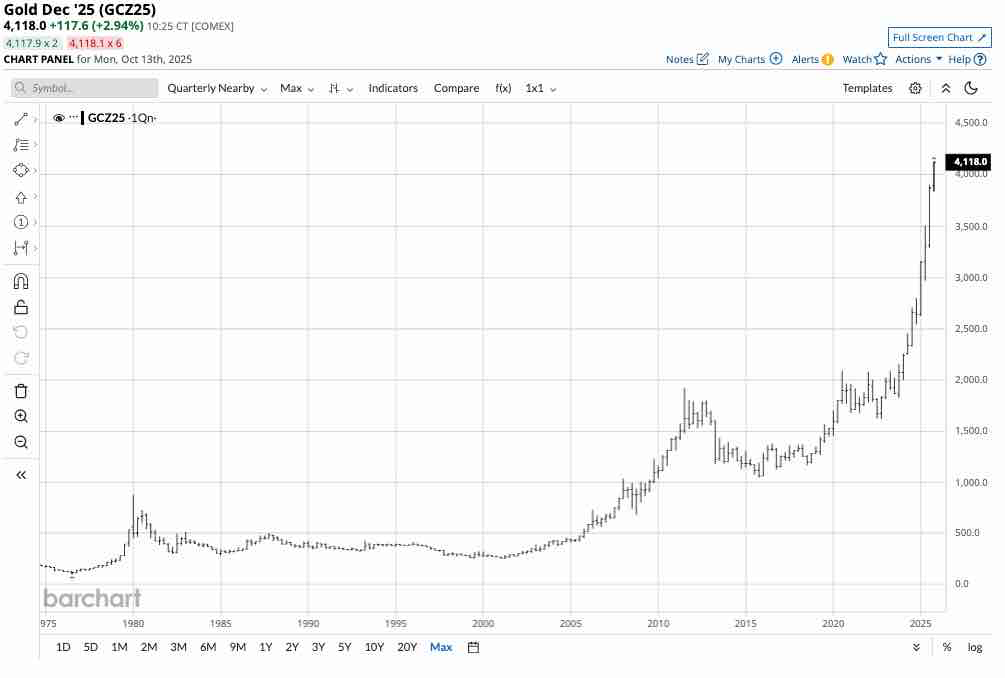

New highs in gold continue as the price surpasses $4,100 per ounce in early Q4

COMEX gold futures rose 16.12% in Q3 and were 45.43% higher over the first nine months of 2025, settling at $3,840.80 on September 30, 2025.

As the quarterly chart highlights, the bullish price action in gold continued in early Q4, lifting the leading precious metal to its ninth consecutive quarterly record peak. Gold reached a new high of $4,124.30 in October 2025, eclipsing the $4,000 per ounce level. Gold’s bullish trend since the $252.80 low from 1999 remains firmly intact.

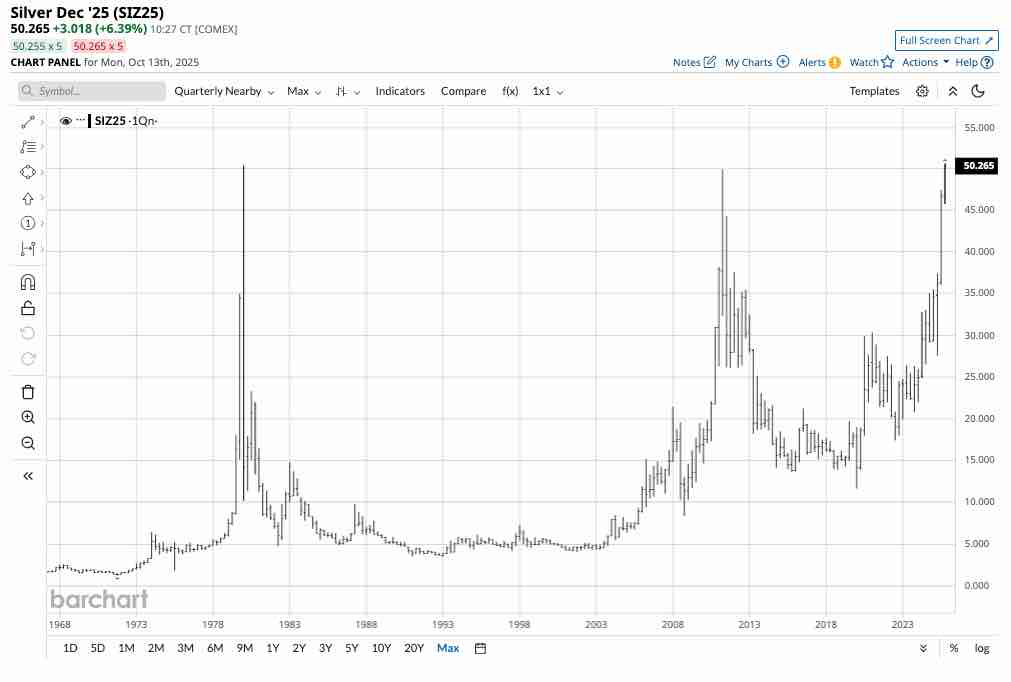

Silver eclipses $50 per ounce

COMEX silver outperformed COMEX gold and led the precious metals sector in the third quarter, rising 30.09% in Q3 and was 59.50% higher over the first nine months of 2025, settling at $46.64 on September 30, 2025.

The quarterly COMEX silver futures chart illustrates that the second-leading precious metal continued to rise in early Q4, reaching $50.56 per ounce on the nearby COMEX silver futures chart. Silver futures moved above the 2011 and 1980 respective highs of $49.82 and $50.36 per ounce as tariff concerns and declining physical silver inventories caused the spot price to rise to a new record peak of over $52 per ounce in October 2025.

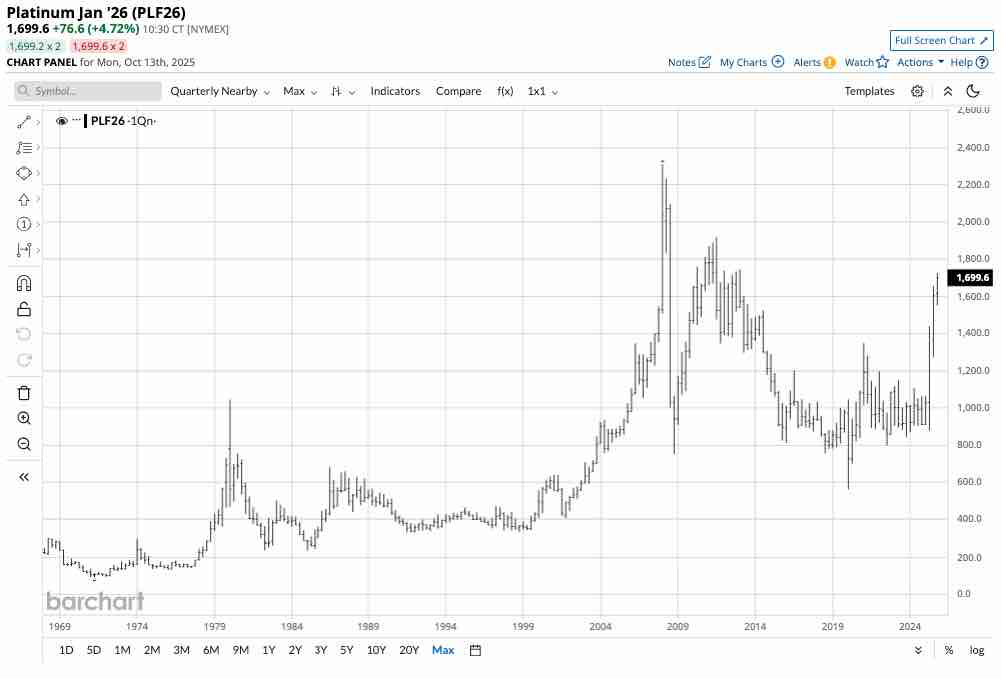

Platinum was the Q3 leader

NYMEX platinum futures rose 18.79% in Q3 and led the precious metals sector with a 77.25% gain over the first nine months of 2025, settling at $1,584.60 on September 30, 2025.

The quarterly continuous NYMEX platinum futures chart shows that platinum continued to rally in Q4, reaching $1,725.70 per ounce, the highest price since the first quarter of 2013. The upside target is the record 2008 high of $2,308.80 per ounce. After trading around the $1,000 per ounce pivot point for nearly a decade, platinum broke out of its consolidation range in Q2 2025 and continued to reach higher highs in Q4 2025.

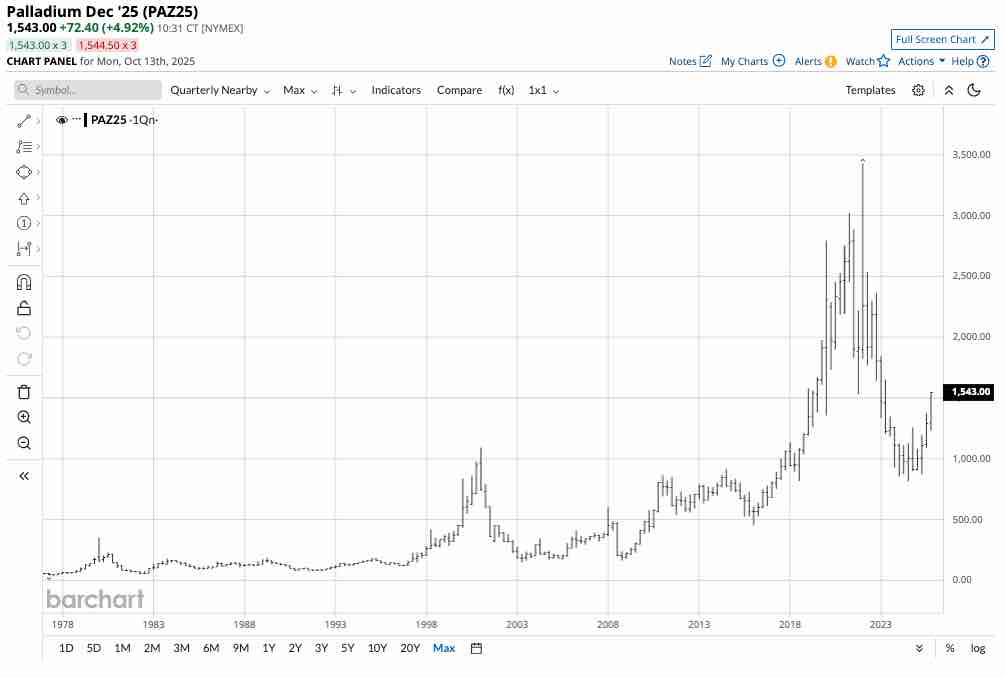

Palladium and rhodium post impressive gains

NYMEX palladium futures rose 16.29% in Q3 and were 41.50% higher over the first nine months of 2025, settling at $1,287.40 on September 30, 2025.

The quarterly continuous NYMEX palladium futures chart illustrates that the bullish price action continued in Q4, lifting palladium futures to the most recent high of $1,550 per ounce, the highest price since the second quarter of 2023. Palladium reached a record high of $3,425 per ounce in Q1 2022 when Russia invaded Ukraine. Russia is the world’s leading palladium-producing country, with South Africa a close second.

Rhodium, the platinum group metal that only trades in the physical market, gained 24.66% in Q3 2025, and was 50.27% higher over the first nine months of 2025, settling at a midpoint of $6,950 per ounce on September 30, 2025. Rhodium was higher at $7,100 per ounce on October 13.

GLTR is a diversified precious metals ETF product

Precious metal prices remain on fire in Q4 2025, as the markets continue to rise to new multi-year highs in gold. Silver is approaching a new record peak in the futures market, while platinum and palladium have exploded and could be heading for challenges of their respective all-time highs.

The most direct route for risk positions or investments in precious metals is the physical market for bars and coins. However, physical purchases involve premiums and discounts for the bars and coins, storage, and insurance expenses. The COMEX and NYMEX futures have physical delivery mechanisms but involve margin and specialized futures accounts. There are many ETF and ETN products available in the precious metals sector that track gold, silver, platinum, and palladium prices. Meanwhile, the Aberdeen Physical Precious Metals Basket (GLTR) owns all four of the precious metals trading on the CME’s COMEX and NYMEX divisions. As of October 9, 2025, GLTR’s holdings were as follows:

- Physical gold bullion 63.13%

- Physical silver bullion 28.62%

- Physical palladium bullion 4.72%

- Physical platinum bullion 3.53%

Source: Seeking Alpha

At $178.50 per share, GLTR had over $1.975 billion in assets under management. GLTR trades an average of over 94,000 shares daily and charges a 0.60% management fee. The expense ratio covers storage and insurance costs.

The monthly chart shows that GLTR moved 19.76% higher in Q3, and was 50.68% higher over the first nine months of 2025, settling at $165.45 per share on September 30, 2025. At the $178.50 level on October 10, GLTR continued to reflect the bullish price action in the gold, silver, platinum, and palladium futures markets.

The trend is always a trader’s or investor’s best friend, and it remains bullish for precious metals in October 2025. GLTR is a product that trades on the NYSE Arca and enables market participants to diversify precious metals exposure. I rate GLTR a hold at the current price level, as even the most aggressive bullish trends rarely move in straight lines. However, any pullback or correction could be a golden buying opportunity.

Remember, every price correction in gold has been a buying opportunity for over a quarter of a century.