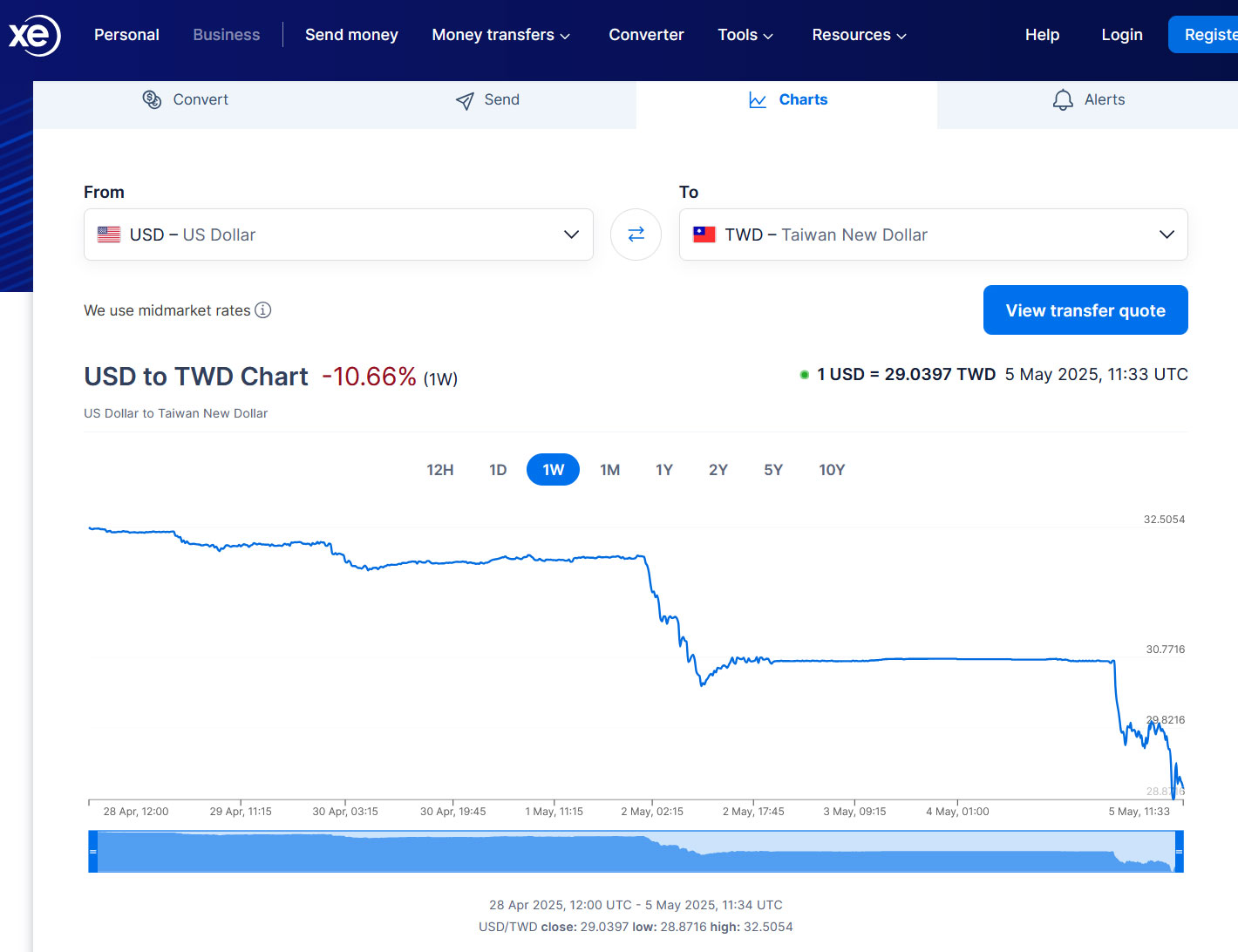

The strengthening of various East Asian currencies vs the U.S. Dollar (USD) has been one of the talking points in financial markets over the holiday weekend. The case of the Taiwan Dollar (TWD) is particularly alarming, as the currency of the 'silicon island' has appreciated over 10% vs the USD in the space of just a few days. This is the strongest Taiwan dollar appreciation in over 30 years, according to DigiTimes.

Crucially, when a trading partner's currency gets stronger, it typically becomes more expensive to buy their goods. Taiwan's chips and manufacturing play a big part in the most coveted PCs and components. So, are we looking at even more upwards pressure on electronics heading to U.S. retail?

DigiTimes shared statements and reports from some of Taiwan's major electronics players like Acer, Asus, Pegatron, Wistron, Foxxconn. It noted that most of these companies hold broad currency portfolios to lessen impacts / shocks when there is turbulence in exchange rates. However, if we are seeing the biggest currency valuation moves in over three decades, it is difficult to be prepared enough. One might hope this 10% dive in USD valuation is a temporary blip on the radar, or else there will be significant pressure on profit margins witnessed.

The source publication, and others, indicate that semiconductor companies have larger profit margins, to afford some flexibility on their part. For example, Focus Taiwan says that ASE Technology Holding Co., the world's largest IC packaging and testing services provider, expects a 1.5 percentage point impact on its gross margin "whenever the Taiwan dollar rises NT$1 against the greenback." It says TSMC and UMC would be hurt similarly by this valuation shift.

Taiwan's Central Bank attempts to steady the ship

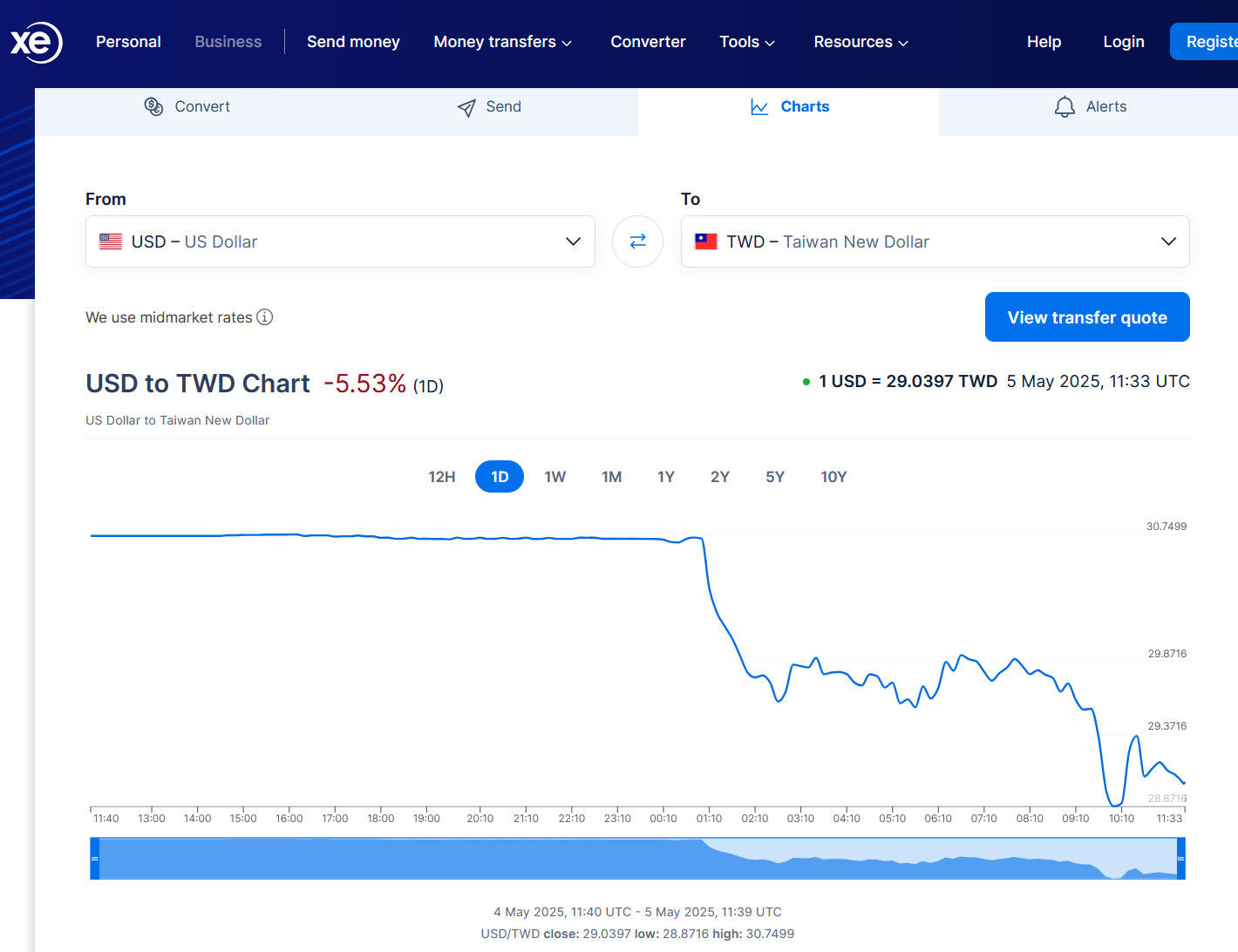

In a rare move, Taiwan's Central Bank held a press conference today, issuing a seven-point statement to the market (machine translation). In summary, the Central Bank believes that the TWD has surged due to speculation about recent trade discussions between Taiwanese and American officials. People seem to be expecting that the U.S. will ask Taiwan to manipulate its currency to make American imports cheaper. However, the governor of the bank denies there is any such influence.

Taiwan's Central Bank confirmed the country's economy remains strong. However, global financial markets are in a volatile era. Last but not least, individuals and organizations with an eye on currencies should be wary of speculators seeking to move valuations, helped by "overly exaggerated or untrue market analysis, generating irrational expectations." Looking at live data, the Central Bank's statement seems to have stemmed TWD's appreciation vs USD, for now.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.