Strattec Security Corp. (NASDAQ:STRT), the automotive access and security systems supplier powering door handles, keys, latches, and power liftgates for General Motors Co. (NYSE:GM), Ford Motor Co. (NYSE:F), and Stellantis NV (NYSE:STLA), has just vaulted into the top 10th percentile of all U.S.-listed stocks in momentum.

Check STRT’s stock price here.

This Auto Parts Supplier Is All Set For A Breakout

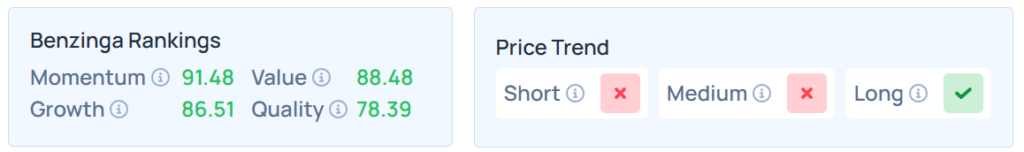

According to the latest Benzinga Edge Stock Rankings‘ momentum percentile report, STRT's momentum score has surged from 89.28 to 91.48 as of today — a gain of 2.2 points over the week.

This leap officially places Strattec among the elite top decile of momentum performers across all sectors and market caps, joining high-flyers like Advanced Micro Devices Inc. (NASDAQ:AMD), Nvidia Corp.‘s (NASDAQ:NVDA) leveraged ETFs, and biotech breakout names.

What Does Momentum Ranking Gain Mean For STRT?

The report defines Momentum as a percentile-ranked measure of a stock's relative price strength, volatility patterns, and trend persistence across multiple timeframes.

For STRT, this indicates a dramatic signal that the long-underappreciated auto parts name may be primed for a sustained breakout.

See Also: Cockroaches In The Vault? 3 Regional Banks Quality Scores Scurry Lower After Jamie Dimon’s Warning

What Do Other Edge Rankings Says About STRT?

Despite generating about 80–90% of its revenue from Detroit's Big 3, General Motors, Ford, and Stellantis, STRT has flown under the radar.

But with its growth ranking at 86.51, quality at 78.39, and value at 88.48 — all in the top quartiles — the stock now combines defensive fundamentals with explosive technical momentum.

However, it has a weak price trend in the short and medium term. Additional performance details are available here.

STRT Underperforms Market In 2025 Despite Strong Prospects

The shares of STRT were 4.82% lower in premarket on Thursday. The stock has declined by 12.28% on a year-to-date basis and 15.27% over the year.

On the other hand, the S&P 500 index has risen 17.42% YTD and 18.52% over the year.

On Thursday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were lower.

Meanwhile, on Wednesday, the S&P 500 index slipped 0.0044% to 6,890.59, whereas the Nasdaq 100 index rose 0.41% to 26,119.85. On the other hand, Dow Jones declined 0.16% to end at 47,632.00.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock