An 80-year-old woman in Florida has lost nearly $150,000 after scammers impersonating government employees tricked her into handing over large sums of money and gold – part of a growing scam that targets older adults.

Patricia Toder, from Lady Lake, was targeted in an elaborate “phantom hacker” scheme after being convinced she was the victim of fraud and needed to move her cash, which included money from her deceased husband’s life insurance policy, to a safer place, ultimately landing it in the hands of scammers.

“I couldn’t believe it happened,” Toder told News 6/ClickOrlando. “They were so good at what they did.”

Earlier this year, the older woman was left terrified after a woman, claiming to be with the Office of Inspector General, called to say that she was under investigation, and could be arrested on allegations of money laundering, drug trafficking, and theft by deception, according to a report obtained by News 6 / Click Orlando.

After handing over personal information, including her Social Security number and bank account information, Toder was told she was the victim of fraud by the individual, and that an employee at her bank was the suspect.

“She had me go to Wells Fargo and take $20,000 out, cash, because they said they had to take it and put it in the government to save my money,” Toder told News 6.

After taking out the large sum, Toder returned home and waited for a courier, who she believed to be part of the government, to arrive and take the money from her, believing it would be secured in a new bank account, the report says.

Because Toder’s bank questioned her large transaction, scammers instructed the woman to purchase many gold bars. In total, Toder handed over nearly $150,000 to the scammers.

The chain of events follows a familiar playbook that the FBI and Federal Trade Commission have warned older adults about.

Known as “phantom hacker scams,” the scheme begins with an eye-catching lie about a person’s bank accounts, e-commerce account, or personal information being hacked, subject to fraud, or used to commit crimes.

The FBI said scammers will impersonate government employees, sending an email or letting with what appears to be official letterhead. Scammers will then provide solutions to scared victims by instructing them to move their money to a more secure account.

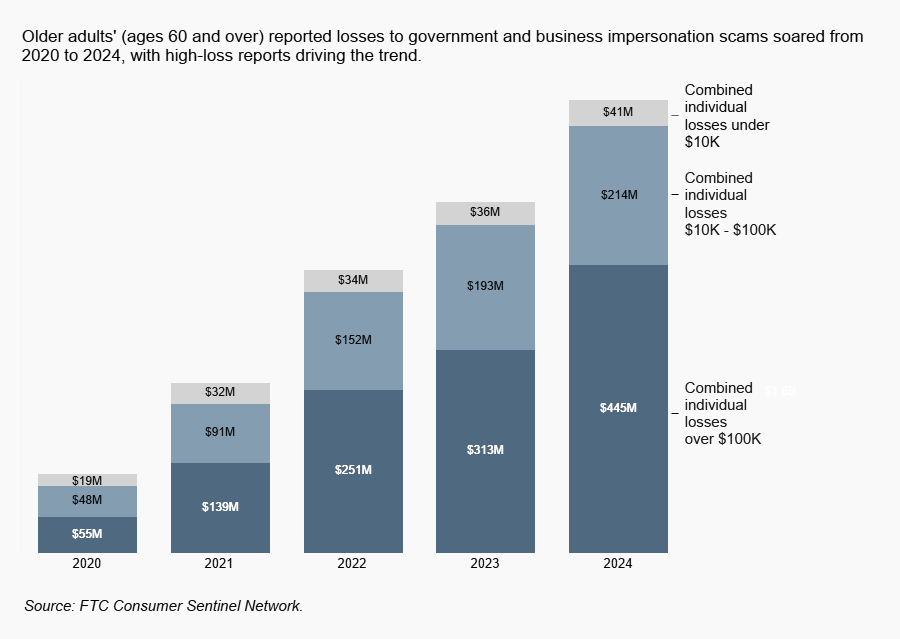

Between 2020 and 2024, the number of older adults who lost $100,000 or more to such scams has increased fourfold, according to the FTC.

In 2020, the combined total loss from adults over 60 was $55 million. In 2024 alone, that combined total loss jumped to $445 million.

The FBI and FTC warned people not to click unsolicited links or call random telephone numbers sent via text message, email or through pop-ups. If an unfamiliar person requests to “move” money immediately hang up and call the bank, company or agency directly.

New claims against Andrew of ‘grave concern’ and need examining – palace source

Government shutdown imperils dozens of Head Start preschool programs

Andrew’s ‘team’ tried to hire ‘internet trolls to hassle’ sex accuser – memoir

Hamas to release another dead hostage after Trump warns ‘behave or be eradicated’

Trump and Australian diplomat share tense moment in White House: Live

Johnson calls Trump ‘most effective to ever use social media’ for poop-bomb video