/Jen-Hsun%20Huan%20NVIDIA)

Nvidia (NVDA) shares jumped roughly 5% higher on Oct. 28, and are extending their gains in pre-market trading today, as investors reacted enthusiastically to CEO Jensen Huang’s optimistic vision for the company’s future during his keynote address at the GTC conference in Washington, D.C. The event reflected Nvidia’s dominant position in the artificial intelligence (AI) boom and indicates that the company’s growth story is far from over, despite concerns about an AI bubble.

NVDA Partners With Oracle, Palantir, and More

Nvidia is strategically cementing its presence across multiple sectors through global partnerships, accelerating its growth. In Europe, it has teamed up with Nokia (NOK) to accelerate the development of AI-native mobile networks and next-generation networking infrastructure. Notably, Nvidia announced a $1 billion equity investment in Nokia at $6.01 per share.

In the U.S., Nvidia is collaborating with Oracle (ORCL) and the Department of Energy (DOE) to build the largest AI supercomputer, featuring a record 100,000 Blackwell GPUs. The project is expected to power breakthroughs in national security, energy, and scientific research.

Huang also announced alliances that extend Nvidia’s AI footprint into enterprise, cybersecurity, and mobility ecosystems. The company is joining forces with Palantir Technologies (PLTR) to create a comprehensive operational AI stack designed for complex enterprise and government applications. Another partnership with cybersecurity leader CrowdStrike (CRWD) will leverage Nvidia’s AI platforms to deliver continuously learning AI agents that protect networks in real time. Meanwhile, a collaboration with Uber (UBER) aims to scale autonomous mobility solutions using Nvidia’s DRIVE AGX Hyperion 10 platform and purpose-built Level 4 autonomy software.

$500 Billion in Bookings

Most importantly, Huang revealed that Nvidia’s next-generation Blackwell and Rubin chips have already secured $500 billion in bookings through 2026. This figure excludes China and Asia. Further, he highlighted that demand for Nvidia’s GPUs remains solid, with 6 million Blackwell GPUs shipped in the first four quarters of production. These numbers highlight Nvidia’s stranglehold over the high-performance computing market and the growing scale of AI infrastructure spending worldwide.

The visibility of $500 billion in cumulative Blackwell and Rubin revenue over the next few quarters implies a growth trajectory that could easily surpass Wall Street’s current expectations. Even if those projections are interpreted conservatively, they suggest substantial upside potential to Nvidia’s financials and share price.

Here’s What Nvidia’s Valuation Indicates

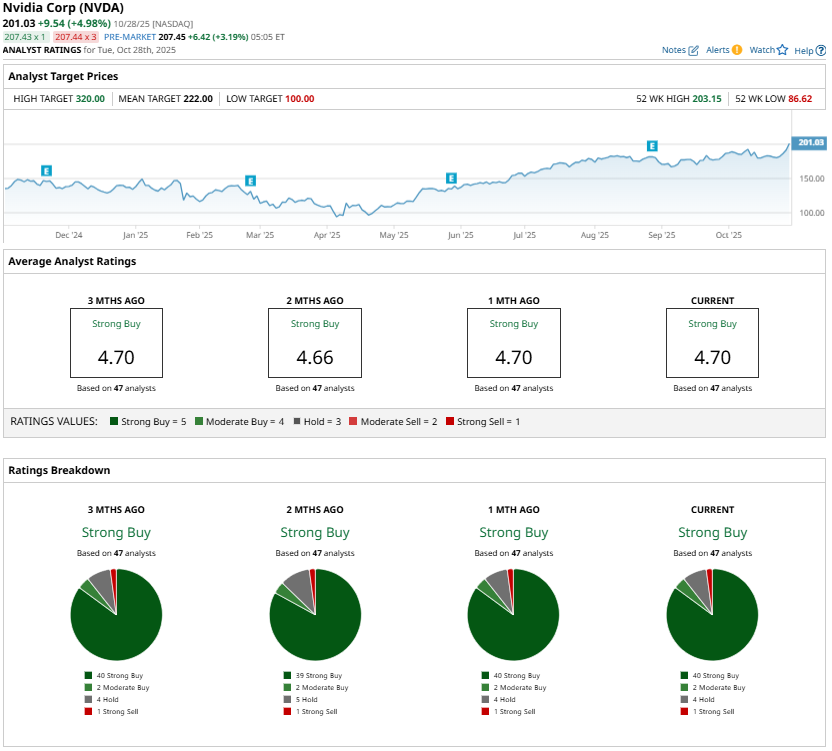

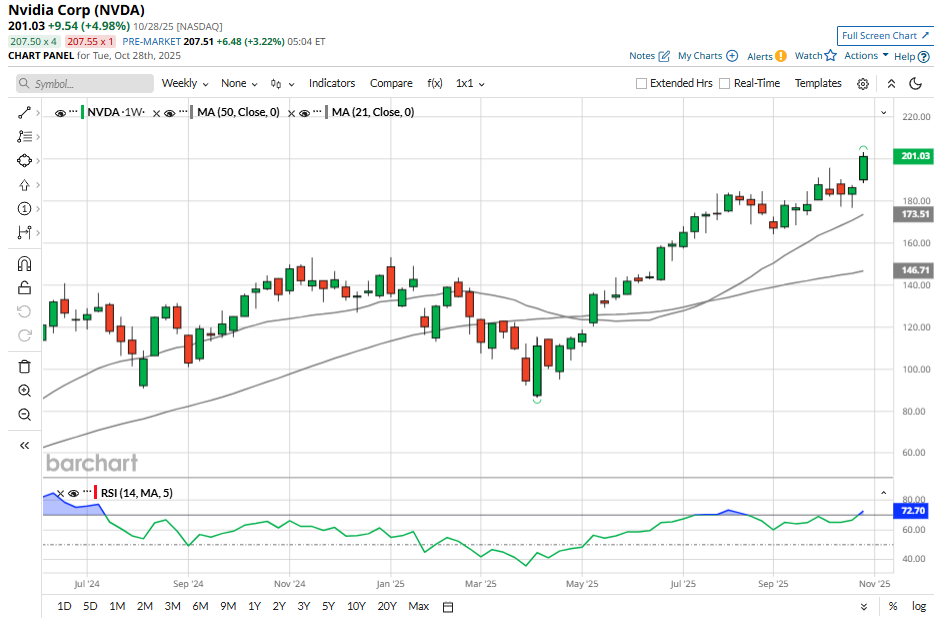

Nvidia stock has gained about 85% over the past six months, and just hit a new high of $203.15.

Despite the recent run, Nvidia stock is trading at 34 times its projected EPS of $5.92 for fiscal 2027 based on Tuesday’s closing price of $201.03. The stock looks undervalued, as analysts’ estimates are expected to rise. Moreover, the current EPS forecast suggests over 40% year-over-year growth, which makes its valuation attractive.

Is Nvidia Stock a Buy Now?

Given Nvidia’s guidance and bookings momentum, its valuation looks too cheap to miss. Earlier this month, Huang stated that the past six months have yielded a significant surge in AI-driven computing demand, which will likely boost its financials.

The company’s next-generation Blackwell chips are in exceptionally high demand, and this enthusiasm is translating into stellar financial results. In the second quarter of the current fiscal year, Nvidia posted record revenue, with data center sales soaring 56% year-over-year. The Blackwell platform has become a key growth catalyst, with quarterly revenue up 17% sequentially.

Further, the ramp-up in production indicates that Nvidia is well-positioned to capture the rising demand for AI chips. Its strong product roadmap, expanding capacity, and dominance in the GPU market strengthen its long-term growth story. The company’s GPUs are powering applications across industries, broadening its addressable market and revenue base.

Nvidia’s valuation still appears compelling relative to its growth trajectory and earnings momentum. The company continues to deliver on both technological innovation and financial performance, which strengthens its leadership in the AI revolution. As a result, Nvidia stock is still one of the most attractive investments.

Wall Street analysts are also bullish about NVDA, and maintain a “Strong Buy” consensus rating. The highest price target for Nvidia stock is $320, implying up to 59% upside from its recent close of $201.03.