Retail giant Walmart (WMT) will announce its second-quarter earnings on Thursday, Aug. 21. Year-to-date, WMT stock has mirrored broader market gains, rising 10.9%, with the company’s underlying business showing resilience. Despite challenges from tariffs, Walmart’s diversified revenue streams and growing contribution from higher-margin businesses position it well to deliver steady and profitable growth.

Notably, Walmart’s fundamentals remain solid. Further, the stock’s 14-day Relative Strength Index (RSI) stands at 52.57, which is comfortably below the 70 overbought threshold. That suggests WMT stock has room to run if the upcoming earnings report and guidance exceed market expectations.

Walmart to Deliver Steady Revenue and Earnings Growth in Q2

Walmart’s revenue and earnings are expected to show steady growth despite tariff-related headwinds. Management expects net sales to rise between 3.5% and 4.5%, building on momentum from its core U.S. business and expanding global operations.

The retailer continues to benefit from its value pricing strategy, growing market share in the grocery business, higher shopping frequency, and stronger unit volumes. At the same time, Walmart’s fast-expanding e-commerce platform, driven by store-fulfilled pickup, rapid delivery, and robust advertising growth, could once again be the key engine of its sales momentum.

The company’s international business is also proving to be an important growth lever, particularly in China and India, through Flipkart. The adoption of its e-commerce platform is accelerating abroad, with Walmart ramping up delivery speed to meet customer demand. In fact, during the first quarter, international orders delivered the same or next day rose 35%, with nearly half arriving in under three hours.

Sam’s Club could once again support WMT’s top line. The convenience of Scan & Go technology, coupled with club-fulfilled delivery and pickup, continues to resonate with members, boosting sales and reinforcing Walmart’s membership-driven strategy.

Membership fee income itself is climbing across the company, with nearly 15% growth enterprise-wide. In the U.S., Sam’s Club fees rose almost 10% as more shoppers opted for premium “Plus” memberships, while Walmart+ maintained double-digit expansion. Overseas, Sam’s Club China delivered standout growth, with membership income surging over 40% on a sharp increase in sign-ups.

While Walmart’s top line will maintain steady growth, its earnings per share (EPS) could again grow at a faster pace than sales. Walmart is seeing benefits from its portfolio of higher-margin businesses. While tariffs remain a challenge, the retailer’s investments in e-commerce, advertising, membership programs, and marketplace operations are paying off, cushioning margins. Further, the growing penetration of private-label brands augurs well for growth.

Notably, its e-commerce operations achieved profitability, helped by improved delivery economics and customers opting to pay more for faster shipping. At the same time, its advertising business continues to deliver solid growth, supported in part by the acquisition of Vizio. Membership income is also growing well and is likely to support its profitability.

Analysts expect Walmart to report earnings of $0.73 per share in Q2, a 9% increase from the prior year. With the retailer having topped Wall Street’s expectations in each of the past four quarters, including a recent earnings beat of more than 7%, Walmart appears well-positioned to continue delivering steady growth in both revenue and profits..

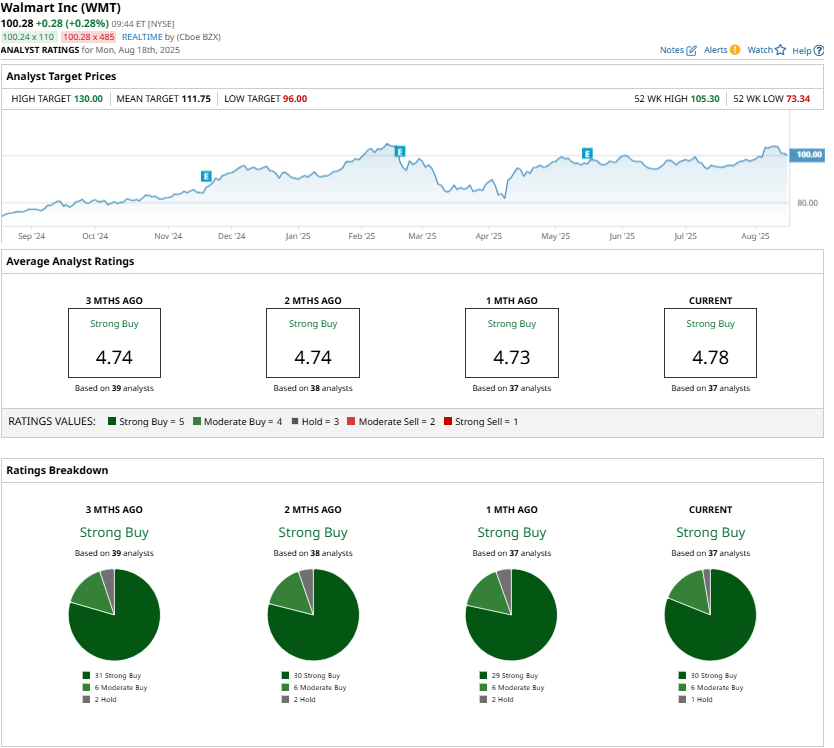

Wall Street Is Bullish on WMT Stock Ahead of Earnings

Wall Street’s sentiment toward Walmart remains optimistic as the retail giant prepares to report earnings. Unlike many of its peers, Walmart is well-positioned to navigate the tariff-related challenges. Its large scale and global sourcing network give it the flexibility to absorb macro pressures.

Beyond its core retail business, Walmart is building additional earnings power through high-margin digital ventures and the growth of subscription-based income streams. These initiatives are diversifying revenue while also deepening customer loyalty, giving the company new growth levers.

Analysts maintain a “Strong Buy” rating on WMT stock. Moreover, the Street high price target of $130 suggests about 30% upside potential.

The Bottom Line

Walmart’s expanding e-commerce platform, rising membership income, and high-margin businesses position it to deliver both steady revenue and accelerating earnings growth. With Wall Street maintaining a bullish outlook and the stock still trading below overbought levels, a positive earnings surprise could drive WMT higher.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.