Warner Bros. Discovery Inc (NASDAQ:WBD) shares are trading higher Friday, building on this week’s rally. The stock’s momentum follows reports that Paramount Skydance Corporation (NASDAQ:PSKY), led by David Ellison and backed by RedBird Capital, is preparing an all-cash bid to acquire the company. Here’s what investors need to know.

What To Know: News of the potential takeover sent Warner Bros. Discovery stock soaring over 28% on Thursday, its largest single-day gain ever. Investors are optimistic about the prospect of a merger, which would unite powerhouse franchises. The combined entity would pair Warner Bros. Discovery’s assets like HBO, DC Comics and the Harry Potter universe with Paramount’s portfolio, including “Mission: Impossible,” “Top Gun” and the CBS network.

A successful deal could provide a significant cash-out opportunity for Warner Bros. Discovery shareholders and create a formidable media giant. However, investors remain watchful of potential hurdles, including Warner Bros. Discovery’s substantial debt load and the likelihood of intense regulatory antitrust reviews that an all-cash deal would aim to mitigate.

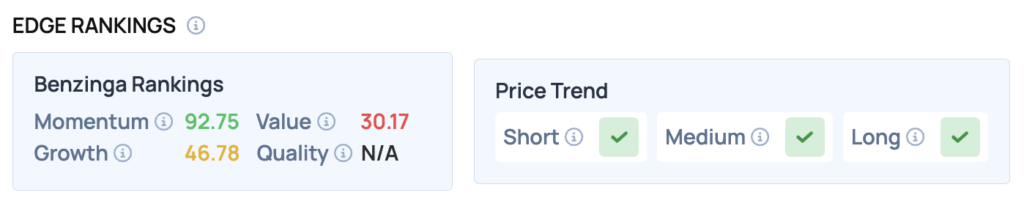

Benzinga Edge Rankings: Highlighting the stock’s recent surge, Benzinga Edge data gives the company an impressive Momentum score of 92.75.

Price Action: According to data from Benzinga Pro, Warner Bros. Discovery shares are trading higher by 13.01% to $18.23 Friday morning. The stock has a 52-week high of $18.02 and a 52-week low of $7.25.

Read Also: What’s Going On With Super Micro Computer Stock?

How To Buy WBD Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Warner Bros. Discovery’s case, it is in the Communication Services sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock