The equity market has made a sharp recovery as concerns over an economic slowdown began to fade, with tech stocks once again taking center stage. While these high-growth names tend to grab the spotlight, it’s easy to overlook the more stable performers, the companies that deliver consistent income and long-term capital appreciation quietly, year after year.

One such group of often-overlooked powerhouses is the Dividend Kings. These are companies that have increased their dividends for over 50 consecutive years. Among this elite group, Walmart (WMT) stands out for its consistent performance and its commitment to rewarding shareholders.

The retail behemoth has long been a staple in portfolios focused on stability, income, and resilience across market cycles. Walmart maintained its dividend growth streak and raised its dividend by 13% to $0.94 per share earlier this year. This marks WMT’s 52nd consecutive year of dividend increases, reflecting its financial strength and its ability to sustain payouts.

Walmart’s ability to raise dividends consistently isn’t just about size or market dominance. It reflects a deep-rooted operational efficiency and a business model that evolves with the times. In recent years, the company has made strategic moves to stay ahead of a shifting retail landscape. It has expanded into higher-margin ventures, such as advertising and membership programs, which are less dependent on pure retail volume and more focused on profitability. These initiatives are designed to drive long-term growth, even when traditional sales face headwinds.

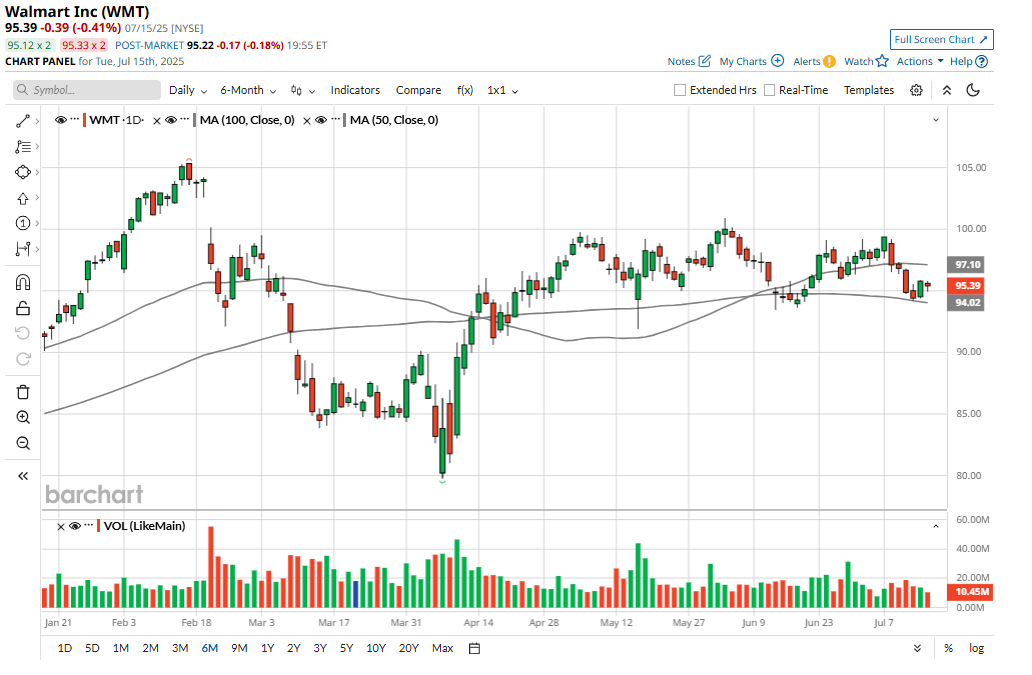

Despite its solid financials and dividend growth, Walmart’s stock has remained relatively subdued so far this year. The disconnect between its financial performance and stock price suggests that the market may be underappreciating Walmart’s growth potential, which presents an opportunity for buying.

Walmart’s positioning as a low-cost leader could play to its advantage, potentially acting as a tailwind for both earnings and stock performance.

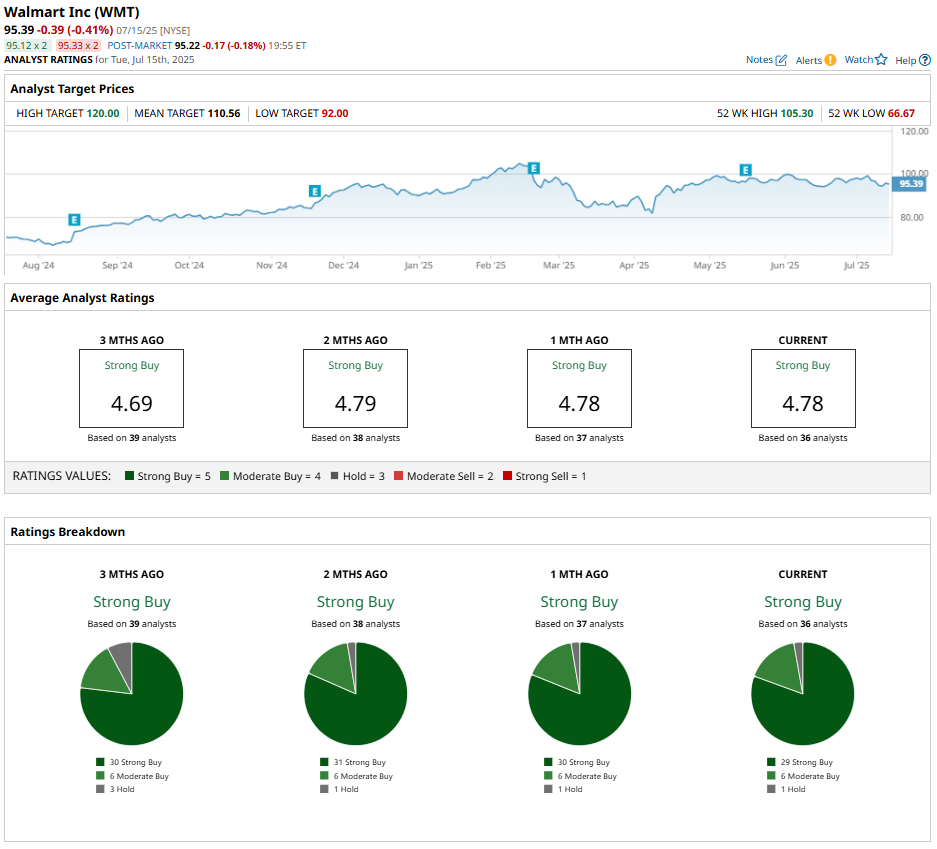

Moreover, analysts are bullish about its prospects, thanks to its reliable cash flows, strong balance sheet, and consistent execution in both physical and digital retail.

With this context, let’s explore why this Dividend King is poised to soar in 2025 and beyond.

Walmart’s Business Transformation Is Paying Off

Walmart is transforming from a traditional retail giant into a digital powerhouse, and the shift is paying off. While store sales remain solid, it’s the company’s growing focus on high-margin revenue streams, including e-commerce, advertising, and memberships, that’s accelerating its profitability at a faster pace than revenue growth.

Notably, Walmart’s e-commerce operations turned profitable in the first quarter of this fiscal year. Improved delivery efficiency, especially in last-mile logistics, is helping to cushion its margins. Moreover, as more customers are paying for faster delivery, unit economics and margins are improving. Walmart says it will “soon” reach 95% of the U.S. population with delivery in under three hours, and international same-day or next-day delivery has increased by 35%.

Walmart’s advertising business is expanding quickly and driving its margins. Advertising revenue jumped 50% across all markets in Q1, boosted in part by the addition of VIZIO. In the U.S., Walmart Connect, the company’s leading advertising platform, saw a 31% increase compared to the same period last year. Sam’s Club’s ad sales grew by 21%, while international advertising, driven by Flipkart in India, rose 20%.

Membership income continues to rise, growing nearly 15% companywide. Sam’s Club experienced approximately 10% growth in the U.S., driven by higher renewal rates and increased sales of Plus memberships. Walmart+ is expanding rapidly, while Sam’s Club China reported a staggering increase of over 40% in membership revenue.

These shifts are positioning Walmart to deliver strong earnings growth even amid economic headwinds, such as tariffs and shifting consumer demand. The company’s mix of digital services is boosting margins and enhancing resilience.

Although Walmart stock hasn’t delivered notable gains so far in 2025, momentum in its high-margin business and its focus on enhancing shareholder value make it a compelling investment. Analysts maintain a “Strong Buy” consensus on Walmart stock.

Walmart Stock to Soar Higher

Walmart may not have delivered the flashiest stock performance recently, but the retail giant’s fundamentals remain strong, laying a solid foundation for future growth.

Walmart is evolving beyond its traditional retail roots by expanding into high-margin areas, including e-commerce, advertising, and membership services. These newer business segments are already making meaningful contributions to profits, helping the company grow earnings faster.

As Walmart continues to execute on its transformation and enhance shareholder value, this Dividend King is ready to soar in 2025 and beyond.