Shares of Quantum Computing Inc (NASDAQ:QUBT) are caught in a broader market selloff Tuesday as rising U.S. Treasury yields spook investors away from growth sectors. The benchmark 10-year Treasury note climbed to 4.293% Tuesday morning, pulling capital away from growth sectors.

What To Know: The sell-off in quantum stocks, which are inherently long-term growth plays, is a direct reaction to the spike in Treasury yields. Higher yields on government bonds, which are considered a risk-free investment, present a more attractive alternative to speculative growth stocks. This competition for capital pressures the valuations of companies like QUBT.

The valuation of growth stocks is heavily dependent on future earnings potential. When Treasury yields rise, the discount rate used by investors to value these future earnings also increases. A higher discount rate diminishes the present value of future cash flows, making the stock less attractive at its current price.

For a capital-intensive and futuristic industry like quantum computing, higher interest rates also translate to increased borrowing costs for research and development. This can potentially slow down the pace of innovation and commercialization, adding another layer of concern for investors during Tuesday’s session.

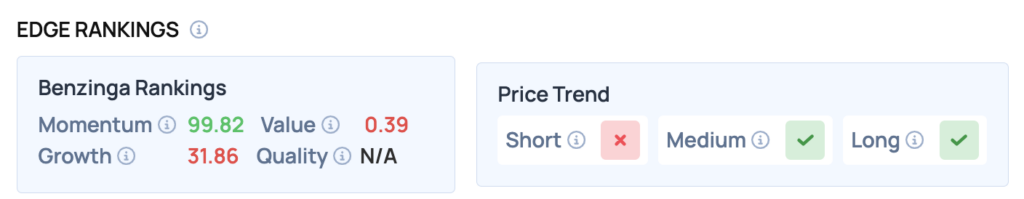

Benzinga Edge Rankings: Highlighting the stock’s profile as a high-flying growth name, Benzinga Edge data shows QUBT with a nearly perfect Momentum score of 99.82 but a very low Value score of only 0.39.

Price Action: According to data from Benzinga Pro, QUBT shares are trading lower by 7.41% to $14.61 Tuesday afternoon. The stock has a 52-week high of $27.15 and a 52-week low of $0.58.

Read Also: What’s Going On With Nvidia Stock?

How To Buy QUBT Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Quantum Computing’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock