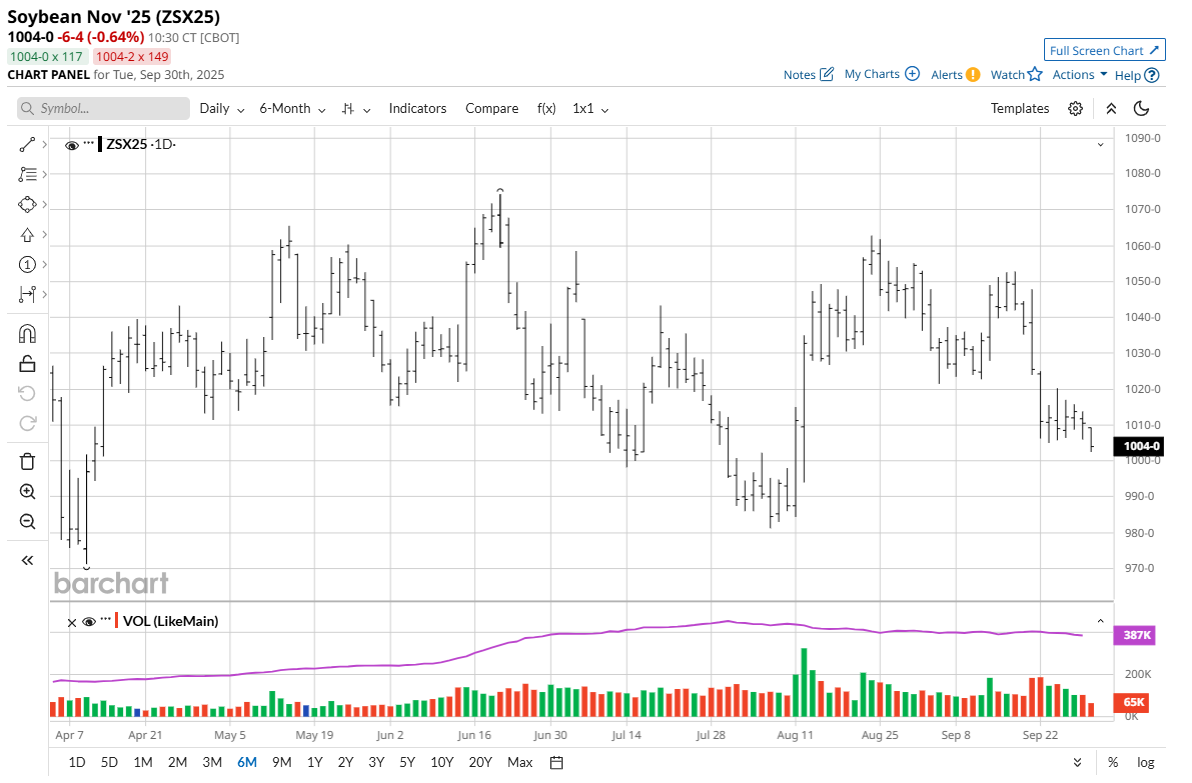

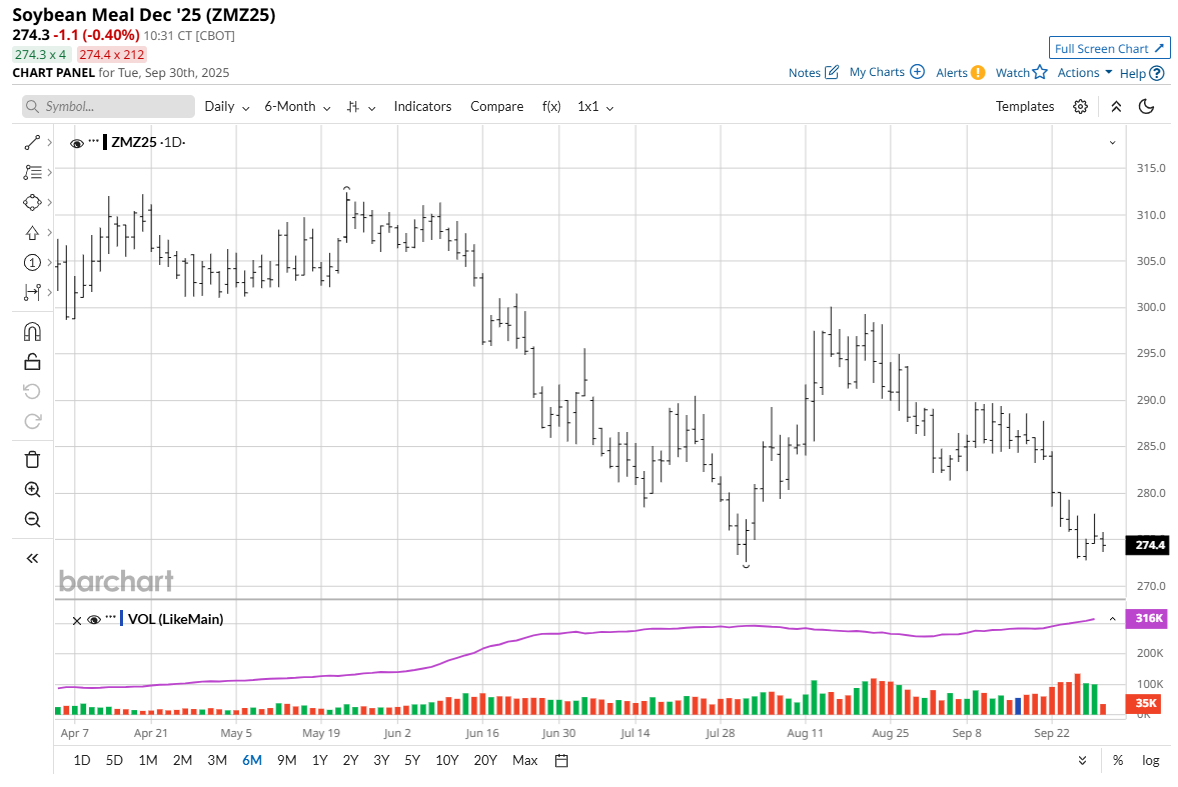

The soybean (ZSX25), soybean meal (ZMZ25) and soybean oil (ZLZ25) futures markets have been hit by last week’s news that around 40 cargoes of Argentine soybeans were registered for export in November and December during last week’s temporary grain export tax suspension by Argentina’s government, which has since ended. Most of those soybean cargoes were booked by China, which did some bargain buying and is a major soybean importer. In years past, China has been a big buyer of U.S. soybeans. Not so this year.

Heightened U.S.-China trade and political tensions in recent months that have included new U.S. tariffs on China’s imports, and retaliation from China, have put American soybean farmers in the middle of a struggle for global supremacy by the world’s two largest economies.

Said American Soybean Association President Caleb Ragland last week:

“U.S. soybean farmers have been clear for months: the [Trump] administration needs to secure a trade deal with China. China is the world’s largest soybean customer and typically our top export market. The U.S. has made zero sales to China in this new crop marketing year due to 20% retaliatory tariffs imposed by China in response to U.S. tariffs. This has allowed other exporters, Brazil and now Argentina, to capture our market at the direct expense of U.S. farmers. The frustration is overwhelming. U.S. soybean prices are falling, harvest is underway, and farmers read headlines not about securing a trade agreement with China, but that the U.S. government is extending $20 billion in economic support to Argentina while that country drops its soybean export taxes to sell … shiploads of Argentine soybeans to China.”

A Deeper Dive into the Market Implications of China’s Argentine Soybean Buys Last Week

It is important to note that China typically buys around 90% of Argentina’s soybean exports. Total bookings so far still do not stray far from what is considered normal for Argentine soybean exports. So, while Argentine soybean export sales increased markedly last week, total exports may not be that far off from what was expected prior to the Argentine government’s temporary tax cut.

China has shown a robust appetite for soybeans. While Argentina will supply short-term needs, global demand for soybeans will continue to grow and a tight U.S. soybean supply and demand balance sheet will persist. That’s a bullish longer-term scenario for the U.S. and global soybean markets.

While last week’s big China purchases of tax-free Argentine soybeans was a newsmaker and a psychologically bearish development for the soybean futures market, the overall global supply and demand balance has not changed. The Argentina-China soybean news last week has been digested by grain market traders, and their focus now is on today’s important USDA quarterly grain stocks report that is out at midday. This report has a history of USDA making significant grain stocks revisions that impact grain markets’ prices. A Reuters survey of grain analysts shows the average estimate for Sept. 1 U.S. soybean stocks of 323 million bushels. That would be down 5.6% from the prior year and below the 330 million bushels USDA projected for 2024/25 soybean ending stocks in its Sept. 12 monthly supply and demand report.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.