Hydrogen fuel-cell power has been a moving target for the auto industry for some time. After all, there aren't many powertrain options out there that spit out water as a byproduct rather than hydrocarbon pollutants.

But there are many barriers to adoption—price, reliable access to fueling stations and technical maturity, just to name a few obstacles. The headaches the electric-vehicle space has are minuscule in comparison.

It should come as no surprise that many automakers are calling quits on the tech—at least for now. General Motors is joining them now, pulling the plug on its next-gen hydrogen platform as questions arise about how viable it is in the short term.

Welcome back to Critical Materials, your daily roundup for all things electric and tech in the automotive space. Also on deck: two of China's battery makers are responsible for more than half of all EV batteries and

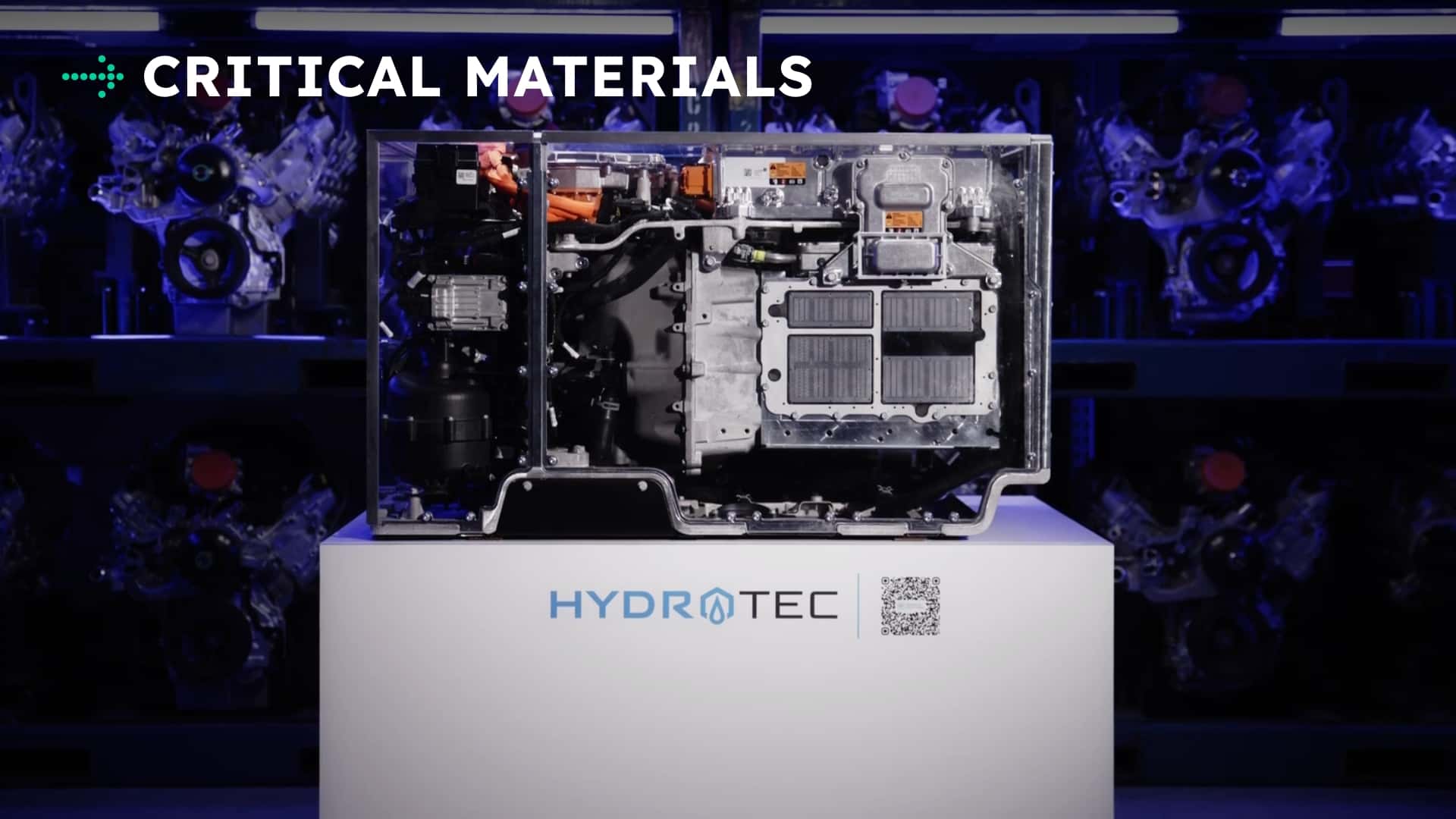

30%: GM Calls It Quits On Hydrotec FCEV Tech

GM is finally admitting that hydrogen cars aren't going mainstream anytime soon. The automaker announced on Friday that it's officially pulling the plug on its next-generation hydrogen fuel cell, citing high costs, infrastructure and what it politely calls a "long and uncertain" path to a sustainable business model. The scrapped plan for the Hydrotec-branded cell for vehicles includes axing a $55 million joint venture production facility that was set to be stood up in Detroit, which means cancelling a planned 140 new jobs.

It's not a total breakup, though. GM says that it will continue to work with Honda on hydrogen for commercial applications (think power generation for data centers), but leaves out any mention of vehicle development. This tracks with Honda's announcement from March that it developed its own next-gen fuel cell, which reportedly generates around twice as much power as the outgoing FCX unit co-developed with GM.

The statement issued by GM on Friday reads like an obituary for its own next-gen hydrogen program:

While hydrogen holds promise for specific high-demand industrial applications like backup power, mining, and heavy trucking, the path to reaching a sustainable business in fuel cells is long and uncertain.

High costs and limited hydrogen infrastructure in the U.S. has limited consumer adoption of fuel cell-powered vehicles. According to the U.S. Department of Energy, only 61 hydrogen refueling stations exist nationwide, compared to more than 250,000 level 2 or faster electric vehicle charging locations.

GM is sharpening its focus on the technologies that show the clearest path to scale and customer value.

In plain English, GM is saying that hydrogen tech is too expensive to develop and the refueling stations are too far and few between (even in California, where most automakers are exclusively selling FCEVs). It will focus on the tech that makes sense instead.

This means the concentration of research and development efforts, as well as funding, on EVs as a whole, plus batteries and charging technology. It makes sense, though. EVs have traction (literally and figuratively) in the industry, while even GM admits that hydrogen "has yet to fulfill its potential." By focusing its funding on EVs, GM is admitting that it sees BEVs as being present in the industry for the long haul, even despite recent politically-fueled efforts projected to dampen the EV market beginning this quarter.

Meanwhile, BMW is betting big on hydrogen tech, Honda has already developed its next-gen fuel cell, Hyundai continues to fund development and Toyota is pushing forward on its multi-pathway approach to powertrains. Maybe one of those approaches will pan out.

60%: CATL, BYD Own The Global EV Battery Game

As Western automakers fight over tariffs and try to navigate an overly complex geopolitical minefield, China's EV battery makers are chugging ahead with progress. According to new data from SNE Research, EV giants CATL and BYD are absolutely owning the top two spots in the battery manufacturing race with their combined efforts representing half of all installed EV battery capacity in the world from Q1 to Q3 2025.

Together, CATL and BYD make up 54.8% of all EV battery supply so far this year. CATL takes the lead with a whopping 36.8% market share, while BYD brings up second at 18%.

CNEVPost digs into the specifics:

CATL's EV battery installations reached 254.5 GWh from January to August, a 31.9 percent increase from the 193.0 GWh installed during the same period last year.

The Chinese battery giant maintained its position as the world's top supplier with a 36.8 percent market share during this period, remaining the only battery provider globally with over 30 percent market share.

[...]

BYD's EV battery installations reached 124.8 GWh from January to August, a 50.3 percent increase from 83.0 GWh during the same period last year.

The company ranked second with an 18.0 percent share in January-August, up from 16.2 percent in the same period of 2024 and also higher than the 17.8 percent share in January-July 2025.

It's not new that China is owning the EV battery industry. However, it's worth pointing out the massive rate of growth for both companies year-over-year. CATL's 254.5 Gigawatt-hours of battery storage is a growth rate of about 32% versus its 2024 output while BYD's 124.8 GWh is a uptick of 50.3% YOY.

To put this into perspective, LG Energy Solution—which takes third place—has just 9.7% of the market share with 67.4 GWh of output.

CATL isn't slowing down. It's worked to build out numerous plants around the world to ensure it's ready to handle whatever the market has to throw at it. BYD is doing the same, increasing its manufacturing footprint in Europe as a means to offset potential tariff implications while gaining market share.

The production numbers don't lie: the uncomfortable truth is that battery independence narrative being pushed by the last two U.S. presidential administrations has failed spectacularly. The U.S is still years behind China's production capabilities. Meanwhile, CATL and BYD are solidifying their battery empires.

90%: One In Four Cars Sold In California Last Quarter Was An EV

Just as the EV tax credit expired, new car buyers in California rushed to dealerships in order to make sure they didn't miss out. This, as expected, resulted in some absolutely smashed sales records to close out the quarter. In fact, California reported that 29.1% of all new cars registered in Q3 were Zero Emissions Vehicles. And of those 124,755 ZEV sales, a whopping 108,685 sales were for a fully electric vehicle.

Let's put that into perspective. California, the incubator that birthed early American sports car culture and once had smog so thick you could surf on it, has had a significant EV breakthrough. In the three-month span between July and September, one in every four new cars sold in California (25.4%) was an EV.

Gov. Gavin Newsom called it "unprecedented" and said that the figure represents the residents' confidence in California's EV infrastructure (California recently announced that there are 201,180 public charging ports across the state in September). And while I'm sure that helped, let's be honest—a lot of folks simply didn't want to miss out on that sweet, sweet $7,500 tax credit.

Unsurprisingly, the winner in this race was Tesla, which sold 50,391 EVs in California throughout Q3. The Model Y was the top seller with 34,238 sales and the Model 3 came in second with 12,400 units.

Other top contenders were the Hyundai Ioniq 5, coming in third with 6,975 sales, then the Honda Prologue with 6,248. Wrapping up the top five is the Ford Mustang Mach-E with 3,849 units sold. The Chevrolet Equinox EV, Volkswagen ID.4, Audi Q6 e-tron, Rivian R1S and Mercedes-Benz GLC rounded out the top ten spots. Special mention to the Tesla Cybertruck, hitting 11th place with just 1,687 sales.

Unfortunately, this adoption rate is expected to have spiked nationwide in Q3. With California unable to match the EV tax credit like Newsom wanted and the federal incentive disappearing, EV sales will likely fall in the coming months—but for now, California can celebrate that it his a pretty monumental number.

100%: Can The Rest Of The World Compete With China's Battery Dominance?

China's major battery makers now control more than 73.5% of the EV battery market share. That's an insane figure to think about—especially when you consider that just two companies make up nearly 55% of that figure.

While South Korea and other countries are competing, China is a mighty force to take on when it comes to EV battery production. The cells are cheap, plentiful and being shipped around the globe (tariffs permitting). Still, some new startups believe they can compete with China on price by revolutionizing how battery cells are produced.

We're at the point where it's worth asking: can the rest of the world compete with China's battery prowess? Or should countries like the U.S. that block China's batteries admit that allowing them in could help affordable EV production take hold? Let me know your thoughts in the comments.