It’s not the most appealing idea for unusual options activity, that much is certain. However, Copart’s (CPRT) unusual business — at least relative to the broader push in artificial intelligence and other innovations — could make it a surprise sleeper hit for contrarian traders.

As an online auction platform, Copart provides a wide range of remarketing services to process and sell salvage and clean-title vehicles. On a fundamental level, economic headwinds may force consumers to consider used vehicles or to repair existing rides. Theoretically, this dynamic should help bolster demand.

Barchart contributor StockStory also mentioned specific financial strengths that underscore the potentially positive fundamentals, including annual revenue growth of 16.1% over the last five years. In addition, the company has generated impressive free cash flow, affording it surprising flexibility.

Of course, it’s difficult to ignore the giant pink elephant in the room. Since the start of this year, CPRT stock has dropped more than 22%. Circumstances haven’t been rosy in the near term as well, with the security slipping almost 9% in the trailing month.

To top it off, the Barchart Technical Opinion indicator rates CPRT stock as a 100% Strong Sell. Still, there’s a decent possibility that it’s too early to write off Copart.

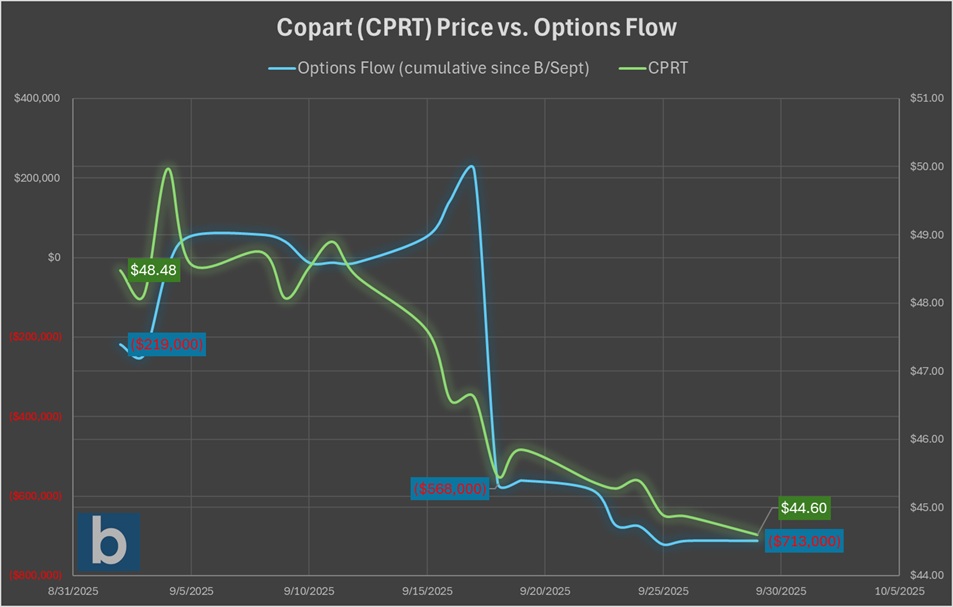

Looking at options flow — which focuses exclusively on big block transactions — CPRT’s net trade sentiment started off at the beginning of the month at $219,000 below parity. By yesterday’s close, the cumulative options flow was $713,000 below parity.

On the surface, the flow’s direction sounds unenticing for the bulls. However, from Sept. 18 to Sept. 29, the net change in flow was “only” $145,000 in the negative direction. Yes, CPRT stock still suffers from bearish demand, so to speak. But its magnitude appears to be diminishing, setting up a potential contrarian opportunity.

Looking to the Past to Decipher the Future of CPRT Stock

Over the last few months, I’ve completely pivoted away from traditional mechanisms of deciphering options market activity, which primarily involve integrating various elements — share price, implied volatility, time to expiration, etc. — into a simulated model such as Black-Scholes-Merton (BSM).

BSM is mathematically elegant, don’t get me wrong. However, the end result is a stochastic calculation, meaning that the output is a symmetrical distribution. For instance, expected move calculators utilize BSM to provide a range of pricing expectations. In CPRT’s case, the equity may land between $41.16 and $48.04 at the November monthly expiration chain, assuming an anchor price of $44.60 (Monday’s close).

That’s all fine and well, especially if you’re looking for a spectrum of possibilities. Unfortunately, we don’t know which outcome (above the anchor or below) is more likely. To figure that out, we need to pivot away from prescriptive models like BSM and toward a descriptive framework, one that aligns with the empirical pricing geometry of the target security.

To be quite blunt, I’ve been at great pains to explain the process — the so-called sequencing logic —that I’ve been utilizing these past few months. The technical term would be a first-order Markov chain defined on higher-order states. That doesn’t exactly flow from the tongue.

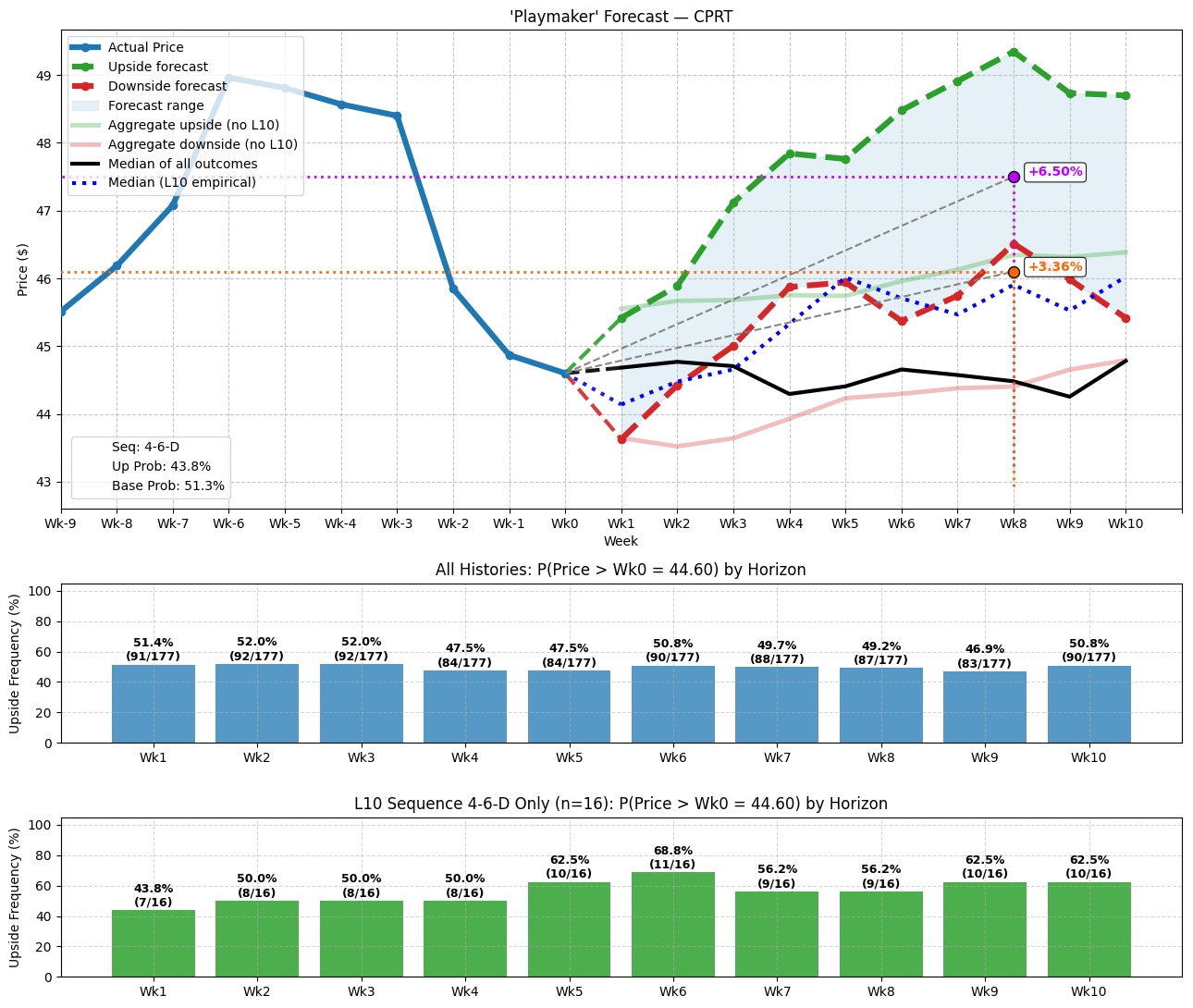

Basically, my hypothesis is that the last 10 weeks of pricing behavior (which is defined as a single behavioral state) can help illustrate what may happen in the next 10 weeks. It’s a bit more complicated than that but this is the main idea.

Now, what makes Copart intriguing is that in the trailing 10 weeks, CPRT stock has printed a 4-6-D sequence: four (4) up weeks, six (6) down weeks, with an overall (D)ownward trajectory. Running my algorithm back to January 2022, I was able to identify that this sequence has materialized a total of 16 times on a rolling (non-independent) basis.

Interestingly, from the fifth week following the flashing of the 4-6-D to the tenth, the probability of upside (that CPRT stock can rise above the anchor price) is at least 56.2%. Granted, we’re talking about super-small sample sizes so we shouldn’t get too excited. However, the baseline probability of all outcomes tends to be slightly worse than a coin toss.

Stated differently, when the last 10 weeks’ behavioral state tilts negatively, speculators tend to buy the dip.

Playing the Contrarian Game

Based on the intelligence available, the trade that arguably makes the most sense is the 45.00/47.50 bull call spread expiring Nov. 21. This transaction involves buying the $45 call and simultaneously selling the $47.50 call, for a net debit paid of $110 (the most that can be lost in the trade).

Should CPRT stock rise through the second-leg strike price ($47.50) at expiration, the maximum profit is $140, a payout of over 127%. Breakeven lands at $46.10, which is 3.36% above Monday’s close. This price point is also significant because it’s near where the median price of pathways associated with the 4-6-D sequence would be projected to hit on expiration.

More aggressive traders may consider raising the second leg to $50. However, based on the data, that might be pushing one’s luck too far. What’s more palatable is the $47.50 target, which seems realistic given the 53 calendar days to expiration.