Deciphering unusual options activity is tricky business. While recognizing which names are receiving heightened interest in the derivatives space can provide an edge, the raw data itself isn’t necessarily useful. It’s like finding a key somewhere in the suburban desert. It’s going to open something. You just have no idea what exactly that thing is.

Case in point is Cheniere Energy (LNG). Billed as a Barchart Technical Opinion “88% Strong Buy,” the liquefied natural gas specialist also has tremendous backing from Wall Street analysts. Among 21 ratings, the worst three ratings come in as a Hold. Adding to the positive narrative is its latest financial disclosure posted in August, which presented an encouraging read for investors.

For the second quarter, Cheniere posted adjusted earnings of $7.30 per share, beating out the consensus estimate of $2.30. Further, revenue clocked in at $4.6 billion, exceeding analysts’ target of $4.1 billion. Further, the latest tally represented a growth rate of 43% against the year-ago quarter, thanks in large part to a 45% jump in LNG sales.

Under this framework, LNG stock represented an unusual options winner on Friday. Total options volume hit 16,937 contracts, representing a 320.59% lift over the trailing one-month average. Further, call volume stood at 10,108 contracts, beating out the put volume of 6,829 contracts, yielding a ratio of 0.676.

Drilling into options flow — which focuses exclusively on big block transactions likely placed by institutional investors — revealed that net trade sentiment landed at $36,000 above parity. On paper, this metric favors the bulls. More significantly, last week’s aggregate net trade sentiment was $82,000 above parity, potentially demonstrating steady bullish interest.

Still, the rub of unusual options data is that you never truly know intentions. The flow could be a lone debit-based strategy or it could very much be part of a multi-leg strategy. That’s what I mean when I say it’s like finding a key but not knowing what it’s for.

Personally, I think it makes more sense to find the free object — and then just call a locksmith later.

Using Statistical Validation to Identify a Potential Opportunity in LNG Stock

Last month, Barchart content partner MarketBeat stated that LNG stock could potentially post new highs. The reason? Primarily, LNG has printed a bullish technical signal known as a triangle consolidation. Further, strong fundamentals — anchored by the aforementioned Q2 earnings report — will likely fuel this technical pattern higher.

I agree with the bullish assessment of LNG stock. Under the perspective of the financial publication industry, the analysis would likely be considered rigorous. However, what is unavoidable is that the structure represents an in-sample argument, where the conclusion (it’s a great time to buy LNG stock now) and the evidence (technical and fundamental strengths) are drawn from the same dataset.

In other words, there’s no discussion on whether the cited catalysts — quarterly beat, triangle consolidation and bullish analyst price targets — would be effective in other sentiment regimes. Without such out-of-sample statistical validations, it’s difficult to tell whether LNG stock is actually moving from these bullish signals or from some other unrelated factor.

Out-of-sample testing is one of the key methodologies necessary to establish a probability of causality, not just make an observation of correlation.

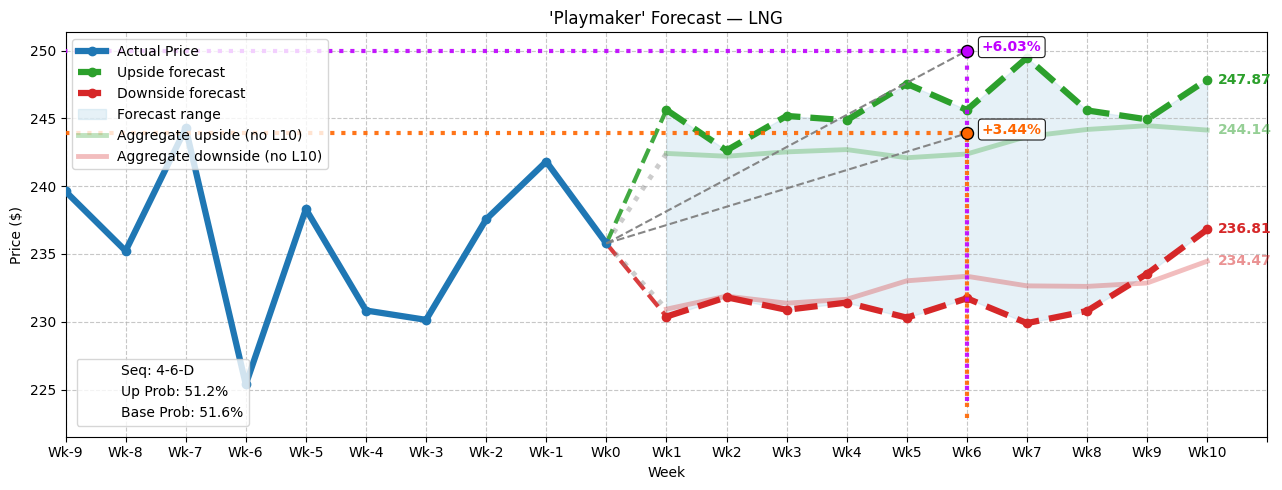

Quantitatively, what has triggered interest in LNG stock is that it has printed in the last 10 weeks a 4-6-D sequence: four up weeks, six down weeks, with an overall downward trajectory. Ordinarily, a higher balance of distributive sessions relative to accumulative may warrant caution. However, in my in-sample dataset (which runs from January 2019 through July 2025), this conditional drift tends to be positive relative to the expected drift from the aggregate or baseline performance.

Over the next 10 weeks following the 4-6-D sequence, LNG stock tends to drift from a median low of $236.81 to a median high of $247.87. Under baseline conditions, the drift is $234.47 to $244.14. To be fair, from a week-to-week perspective, the odds of upside are basically a coin toss: 51.2% favoring the bulls. However, my argument is that over the long run, the forward skew distinguishes itself with a positive bias.

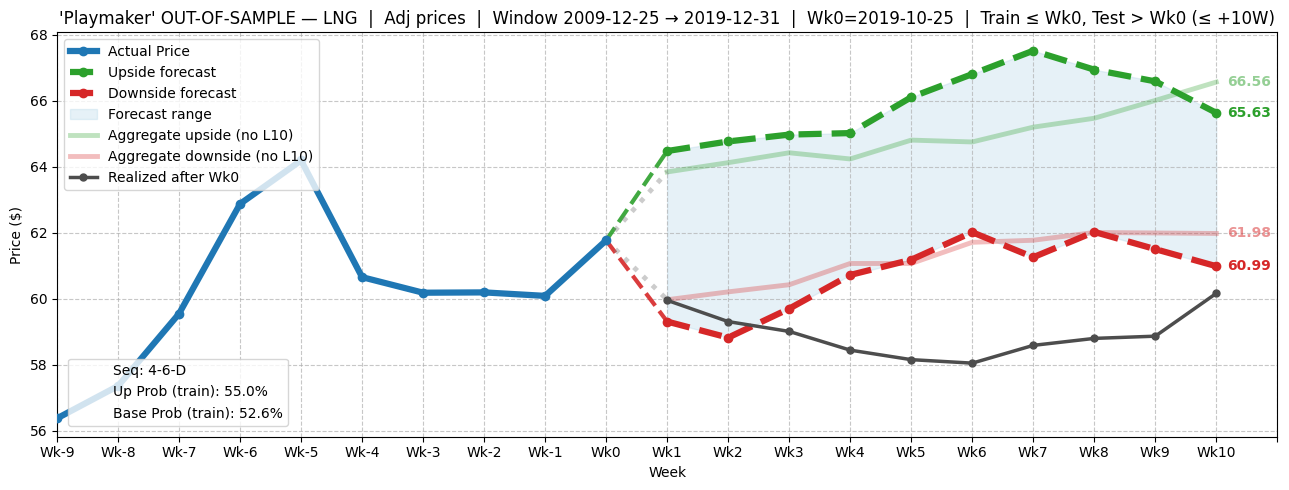

To test this logic, I ran an out-of-sample test of the 4-6-D sequence for the 2010s decade. Back then, the drift for the first eight weeks was definitely positive relative to baseline before tilting negatively. This test provides more confidence that we can consider the distribution-leaning signal of LNG stock as a buying opportunity, particularly for an October monthly options trade.

An Aggressive Trade for the Smart Speculator

While it’s an aggressive wager, there’s a case to be made for the 240/250 bull call spread expiring Oct. 17. This transaction involves buying the $240 call and simultaneously selling the $250 call, for a net debit paid of $390. Should LNG stock rise through the short strike price ($250) at expiration, the maximum profit stands at $610, a payout of over 156%.

Now, under the positive pathway, the median expected drift might take LNG stock a bit shy of the $250 target. There will be some luck necessary in that we would need the expected positive sentiment to push forward a week or so. Nevertheless, the above trade’s breakeven price of $243.90 is a statistically reasonable target. Therefore, I would be comfortable with this wager.

To be sure, there is a 230/250 Dec. 19 bull spread that could be more tempting for conservative speculators. The thing about the December option is that it’s difficult to predict what would happen that far out. Further, you’re paying for a lot of time, which may impact your ability to profitably exit the strategy early.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.