When you talk about the most reliable dividend stocks, Altria’s (MO) name usually comes up. With an attractive dividend yield of around 6%, which is significantly higher than the consumer staples average of 1.8%, the tobacco giant remains a magnet for income-oriented portfolios. The company has also increased its payout more than 50 times in a row, making it a member of the elite group of “Dividend Kings.”

Altria stock has gained 29% year-to-date, outperforming the overall market gain of 8.5%.

However, recently, concerns have been raised about the company’s ability to sustain its generous dividend program in the face of regulatory challenges, declining cigarette volumes, and shifting consumer preferences. Let’s find out.

The Appeal of Altria’s Dividend

Despite all headwinds, Altria’s dedication to rewarding investors has long been admired.

In the first half of 2025 alone, the company returned more than $4 billion in dividends and share repurchases. This shareholder-first approach is firmly rooted in Altria’s DNA. Cigarettes, Altria’s core business, are on the decline but remain staggeringly profitable.

Notably, domestic cigarette volumes fell by 10.2% in the second quarter and 11.9% in the first half of 2025. Altria is increasing earnings despite experiencing volume declines in its core business. That is because price realization is still strong. Net price realization was 10% in the second quarter, and 10.4% in the first half of 2025. In other words, Altria is successfully reducing volume pressures by raising prices. During the Q2 earnings call, management stated that Marlboro maintained its dominance, increasing its premium share to 59.5%. Even as fewer people smoke, the company makes more money from the customers it retains.

Tobacco remains one of the most resilient consumer products due to nicotine’s addictive nature. Cigarettes, unlike discretionary products, are in high demand even during recessions, ensuring that Altria’s cash flows remain relatively stable. Adjusted diluted earnings per share (EPS) increased by 8.3% to $1.44 in the second quarter, and by 7.2% in the first half. This profitability, combined with disciplined cost management, enables Altria to maintain free cash flows sufficient to support its payout.

The Risk: Sustainability in a Declining Industry

When a company pays out nearly all of its earnings in dividends, its sustainability is called into question. A dividend payout ratio is a measure of how much of its earnings the company distributes as dividends. If a company’s payout ratio is high, it does not have much left over to reinvest in the business, raising concerns about dividend sustainability. Altria’s forward payout ratio of 72.9% is relatively high. While it is manageable for the time being, investors are concerned that if cash flows deteriorate, this dividend will become increasingly vulnerable. Furthermore, it limits the ability to reinvest in the business or reduce debt.

Despite its strengths, Altria’s dividend is not risk-free. Although Altria can temporarily increase prices to compensate for the volume decline, there is a natural limit to how much consumers will tolerate before switching to cheaper alternatives or quitting entirely. As volumes continue to decline, the company may face a revenue gap that is too large to bridge with price increases alone.

One bright spot for Altria in dealing with this is ON!, its oral nicotine pouch brand. The product has emerged as a key growth driver, offsetting cigarette volume declines. In Q2, ON! shipment volume increased 26.5% to 52.1 million cans, increasing its retail share of the total oral tobacco category to 8.7%. What is even more impressive is that, unlike many next-generation nicotine products, which often struggle with thin margins, ON! is making a significant contribution to segment profit growth. That means Altria is not just acquiring new customers, it is doing so in a way that helps the financial engine required to sustain its dividend.

Altria’s Q2 results demonstrated the company’s remarkable ability to continue generating cash and expanding margins even as cigarette volumes declined. Price realization, disciplined portfolio management, and the growth of ON! are all helping to mitigate industry headwinds.

Is Altria Stock a Buy, Hold, or Sell on Wall Street?

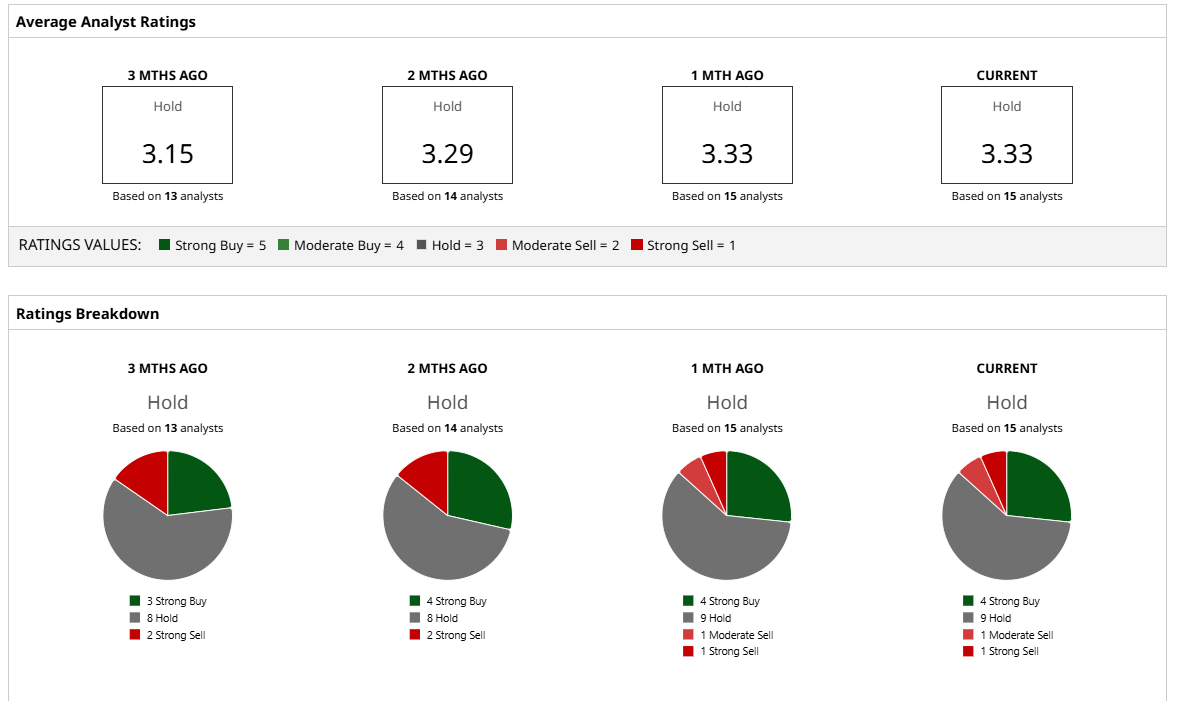

Overall, on Wall Street, Altria stock is a “Hold.” Of the 15 analysts covering the stock, four rate it a “Strong Buy,” nine rate it a “Hold,” one says it is a “Moderate Sell,” and one rates it a “Strong Sell.” Altria has surpassed its average target price of $60.09 and its high price target of $65.

The Bottom Line on Altria Stock

Altria’s dividend is currently supported by strong cash flows and prudent financial management, making it an attractive option for income investors. However, the question remains whether its next-generation products can eventually take over the mantle once cigarettes fade away.

We will have to wait and see if Altria can keep up with its massive dividend payouts. Until then, Altria remains a top dividend stock for income investors.