NEW DELHI: Gautam Adani-owned Adani Group, and specifically it flagship firm Adani Enterprises hold massive amount of debt and is overleveraged, valuation guru Aswath Damodar said in a blog post as the group as a whole reels under pressure in the aftermath of the Hindenburg report.

However, he noted that carrying so much debt is not a con but just a bad business practice.

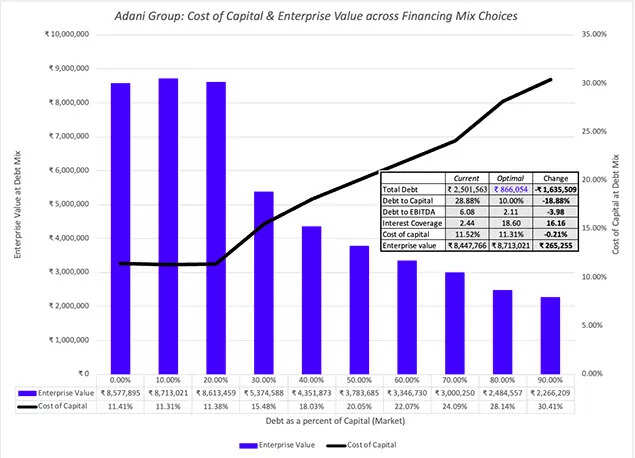

"The Adani Group collectively carries about three times as much debt as it should, confirming that the group is over levered as well, but note that this is bad business practice, not a con," Damodaran said.

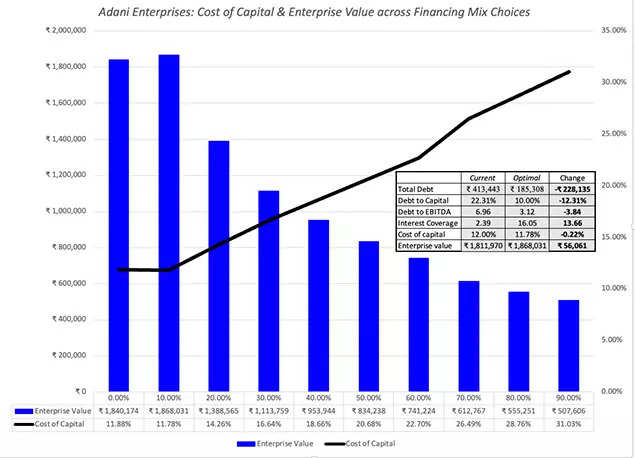

The New York University professor also noted that in particular, Adani Enterprises carries too much debt and reducing it will not just lower the risk of failure but also bring down the cost of capital.

Damodaran studied the flagship company of Adani Group, Adani Enterprises and estimated its cost of capital and value at different debt ratios.

He found that, in particular, Adani Enterprise carries too much debt, with actual debt of 413,443 million more than double its optimal debt of 185,309 million.

"This company is part of a family group, where higher debt at one of the Adani companies may be offset by less debt at another," he wrote.

Referring to the chart above, Damodaran wrote that there is little, if any, benefit in terms of value added to Adani from using debt, and significant downside risk, unless the debt is being subsidized by someone (government, sloppy bankers, green bondholders).

'Dysfunctional choices'

In his posts on Adani Group, Damodaran had noted in their zeal for control, insiders, founders and families sometimes make dysfunctional choices, and one of those is on borrowing.

A growing firm needs capital to fund its growth, and that capital has to come from equity issuances or new borrowing, he said.

"When control becoming the dominant prerogative for those running the firm, they may choose to borrow money, even if it pushes up the cost of funding and increases truncation risk, rather than issue shares to the the public (and risk dilution)," Damodaran wrote.

How much is too much

There will always be that have too much debt, given their capacity to borrow, just as there will be firms at the other end of the spectrum that refuse to borrow.

"The bottom line is that since firms borrow based upon their own past histories and their peer group policies on borrowing, there will always be firms that have too much debt, given their capacity to borrow, just as there will be firms at the other end of the spectrum that refuse to borrow, even though they can, because they have never borrowed money or because they operate in industry groupings, where no one borrows," Damodaran said.

'Share price has 40% more downside'

In a separate blog post earlier this month, Damodaran had said Adani Enterprises yielded a value of Rs 945 per share even before “factoring any of the Hindenburg accusations of fraud and malfeasance.”

“I still think the company is priced too high, given its fundamentals (cash flows, growth and risk),” he added.

The so-called price-to-earnings ratio for the stock has surged from 15 times earnings in the five years to 2021 to 214 times in the last two years, the professor wrote, adding that “irrational exuberance” has “little play” for companies operating in the infrastructure sector. Operating income is barely higher than the interest expenses of the debt-laden business, according to Damodaran.

Hindenburg saga continues

Meanwhile, shares of eight of the ten listed firms of the Adani Group ended with gains on Tuesday after taking a beating in recent sessions.

Since January 24 when the US short seller Hindenburg Research came out with its report on the group, all the ten firms have lost Rs 12,07,848.69 crore in market valuation. At current exchange rate, this translates to around $147 billion.

Till Monday, these companies' cumulative market capitalisation had eroded by Rs 12,37,891.56 crore.

The group has dismissed the charges as lies, saying it complies with all laws and disclosure requirements.

Meanwhile, Adani Group plans to prepay or repay share-backed loans worth $690 million to $790 million by March-end, two people with knowledge of the matter told Reuters.

Adani Green Energy Ltd also plans to refinance its 2024 bonds via an $800 million, three-year credit line, said the people, who declined to be identified as they were not authorised to speak with media.

In addition, a proxy advisory firm SES said in a report that Adani Group needs a third-party audit of accounts to allay fears of shareholders even though the concern over group debt may be "overstated".

(With inputs from agencies)